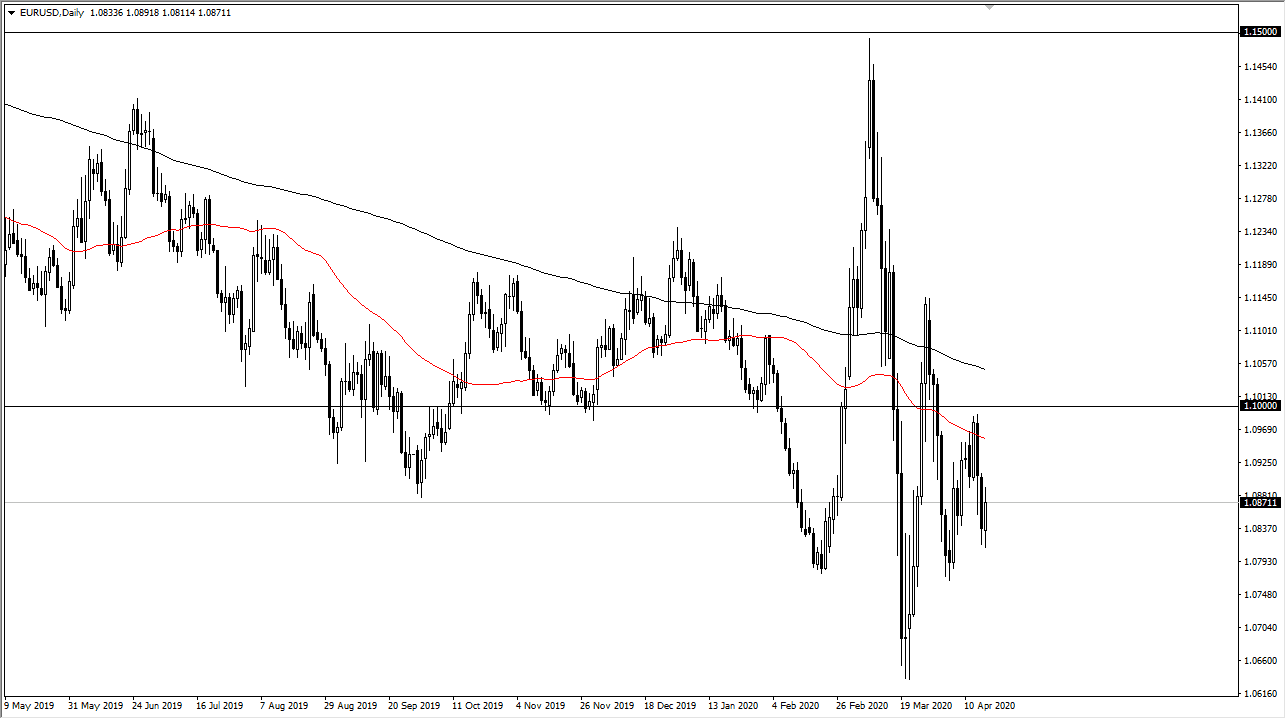

The Euro initially fell a bit during the trading session on Friday but then turned around to rally as the market reached towards the 1.09 level. The market has pulled back from there and now although we have a bullish candlestick, the market still looks very susceptible to rolling over as we have given up quite a bit of the gains. With that being the case, the fact that we have gone back and forth in a relatively tight range doesn’t do a lot of favors for the Euro.

Ultimately, this is a market that you should also be looking at through the prism of the US Treasury markets, due to the fact that the yields have not risen at all, showing signs that there is still a lot of demand for US paper. This drives up demand for the greenback, and this will show itself in this market. In fact, the Euro I believe inset rolling over relatively soon and reaching towards the bottom of the larger range. The Friday candlestick needed to be a lot more impressive to continue the triangle like behavior that we had been dealing with. Ultimately, I think that this market does break down below the Thursday and the Friday lows, reaching towards the 1.07 level underneath, before we then break down to the 1.06 level, followed by the psychologically important 1.05 level.

Remember, this pair tends to move very little so don’t be surprised if it’s more or less a grind lower, not some type of huge move in one direction or the other. Ultimately, this is a market that I believe has a “hard ceiling” at the 1.10 level, and therefore I’m looking for selling opportunities on rally still, but again, the candlestick for Friday was less than impressive. I may not get a rally towards that area to start selling in this set of circumstances. I would not be interested in buying this currency pair, because if the US dollar does selloff, I think you have a much better chance of making money in a currency that has been outperforming its peers as of late, namely the British pound. I can also make an argument for a few other currencies, but without a doubt the Euro is one of the biggest laggards out there and has a whole mess of issues attached to it that I want nothing to do with.