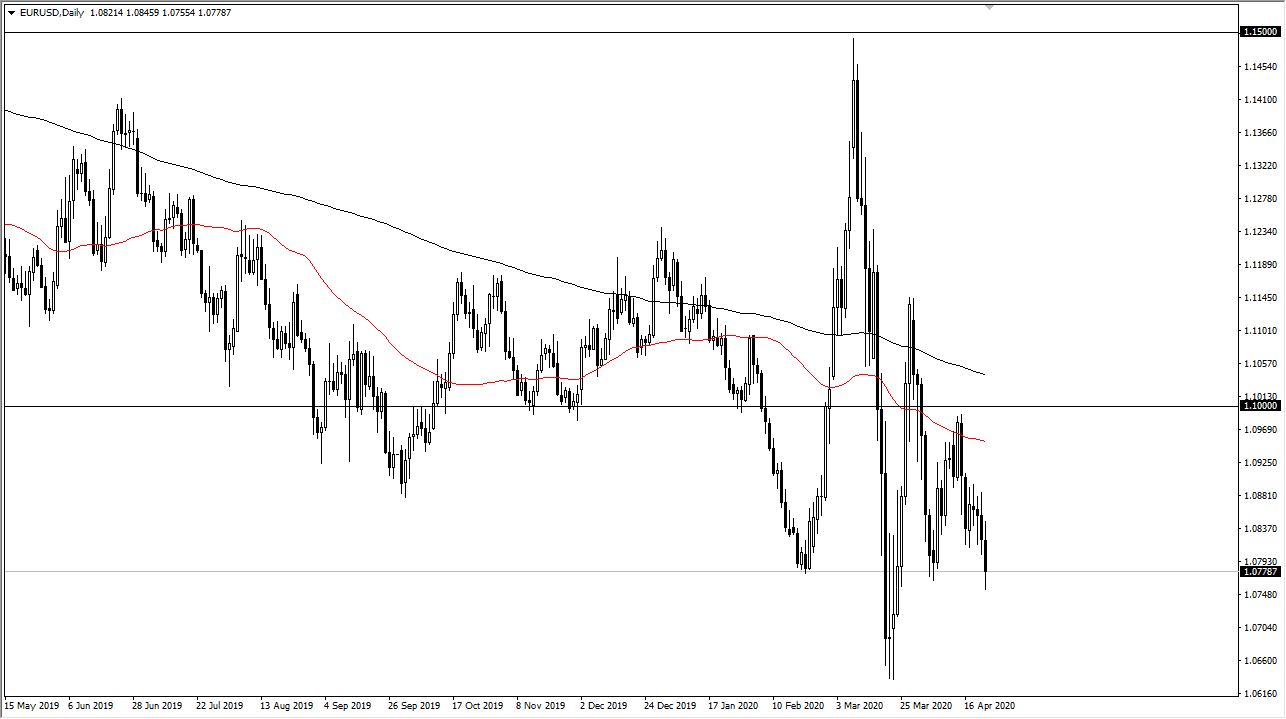

The Euro initially tried to rally during the trading session on Thursday but gave back quite a bit of the gains as the market reached towards the 1.0850 level. By doing so, the market looks as if it is ready to reach below the one point to write handle, and in fact did during the day. We bounced slightly towards the end of the session, but it looks as if we are ready to continue to go much lower. Short-term rally should continue to offer plenty of selling opportunities and I do think that it is only a matter of time before the Euro is likely to continue to go down to the 1.0650 level. The market is currently sitting on a lot of support underneath, so I think it is only a matter of time before we get down to that area and then have to take a serious heart look at this region.

Rallies at this point will continue to see a lot of resistance near the 1.09 level, which at one point during the day look like it was going to be seriously threatened. However, as Wall Street closed out for the day, we started to see a lot of weakness out there, meaning that people were throwing money towards the US Treasury markets which yields of course fell. That is a very bullish sign for the US dollar as people continue to worry about almost everything under the sun, and that of course has a major ramification.

To the upside, it is not until we break above the 1.09 level that I think that we could pick up any serious momentum, and even then, I think the 50 day EMA above would be a massive resistance. Signs of exhaustion there of course would be nice selling opportunities, as the 1.10 level above is massive resistance and essentially the “ceiling” in the market. If we break down below the 1.06 level underneath, that is likely a sign that we are going to go to the 1.05 level, perhaps even parity over the longer term. At this point, it has difficult to see whether or not we see some type of recovery in the European Union, because quite frankly we are about to see Italy and Spain get reduced to junk status as far as creditors are concerned with the S&P 500 rating agency. The pair will continue to be very sideways and choppy, as it normally is.