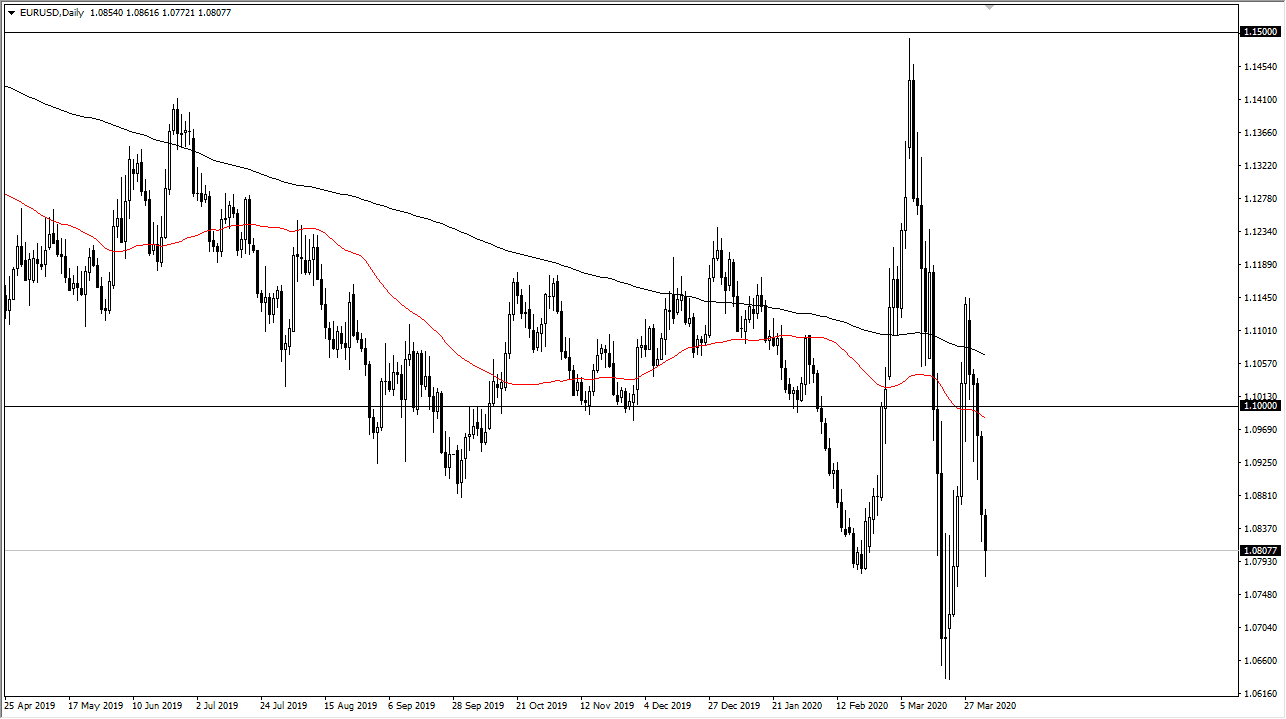

The Euro bounced a bit from a major support level just below the 1.08 handle, an area that I had been calling for a couple of the past videos now. Now that we reach that and it looks like we are trying to recover a bit, it’s likely that we could try to bounce from here. That being said, I do not trust the European Union and its economy, although you also have to keep in mind that it’s possible this would have been highly influenced by the Friday session short covering before people went home.

The jobs number was absently horrible in the United States, losing over 700,000 jobs for the month of March. While that is a bit of a shock, the reality is that some pundits are now starting to call for the European Union to enter a bit of a technical depression. Europe is still one of the hotspots for coronavirus infections, and as a result it’s very likely that we will continue to see the European Union struggle. We also will have to get through the Brexit situation, which is still waiting for this virus nonsense the knock itself off. All things being equal, I do think that we could get a little bit of a bounce from here, but the 1.10 level could very well be resistive and therefore I like the idea of fading rallies on signs of exhaustion above. The longer-term trend is still to the downside and it should be noted that the most recent high was a “lower high”, suggesting that we are going to continue the overall downtrend. However, if we bounce from here than the most recent low is a “higher low”, showing that more and more volatility is entering this pair.

This is the domain of high-frequency traders, so it should not be a surprised at all to see this market undulate back and forth the way it has. The 1.10 level continues to be a bit of a magnet for price, so having said that it’s very likely that the market will continue to go back and forth towards that area. We may have gotten a little too far from that area now, so it’s likely we may have to have a little bit of a bounce from here. Ultimately though, if we break down below the lows of the Friday session, I think we will go crashing towards the 1.06 level rather quickly.