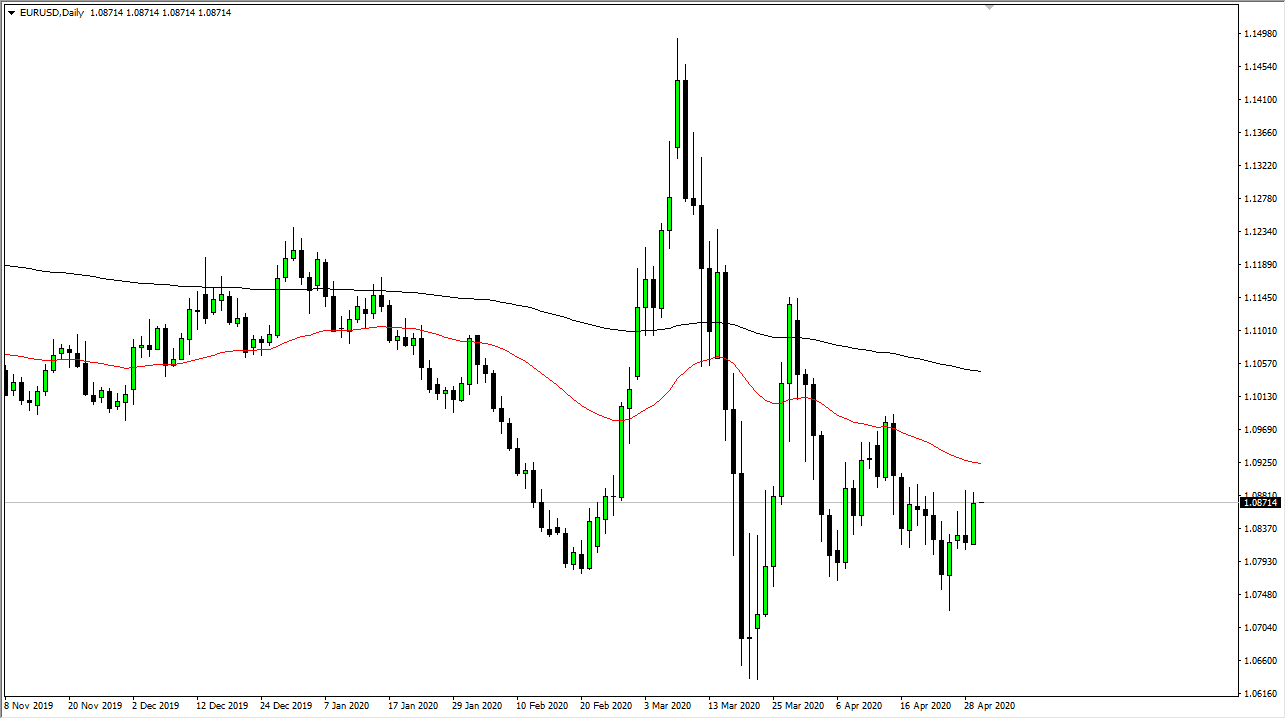

The Euro rallied significantly during the trading session on Wednesday, reaching towards the top of the candlestick from the previous session, and at this point it looks like we are going to continue to see a lot of noise. Quite frankly I think that this is a market that is trying to figure out where to go next and after the Federal Reserve basically stated that it was willing to stay loose for in perpetuity, this of course was extremely negative for the US dollar. The question now is what is the ECB going to do today?

One would have to think that the European Central Bank is more than likely going to go out of its way to try to sound as soft as the Federal Reserve is, so I think we will continue to see a lot of noise in this pair and I believe that it is probably going to be a scenario where we turn around and wipe out the gains heading into the meeting. At this point, it is not entirely clear with the ECB can do about whatever it is going to do it is going to be rather massive as quantitative easing is a big deal.

At this point, the market has continued to see a lot of volatility but quite frankly the Euro against the US dollar is that choppy is market that you can probably get your hands on. In other words, a pullback from here would not be a huge surprise anyway. I like the idea of fading this rally, as we have seen so much in the way of resistance just above where the market closed. With that in mind, it is highly likely that we will continue to see the Euro on the back foot, because quite frankly the European Union has a whole host of issues that the United States does not have to deal with when it comes to aligning various governments. Because of this, I like the idea of taking advantage of what looks to be an overbought euro in the meantime. To the downside I anticipate that the market may go looking towards 1.08 handle, perhaps even down to the 1.0750 level if the ECB is loose enough. After all, we are essentially in a currency war, and that will only continue going forward. With that being the case, I think that this is a pair that has an extremely limited upside.