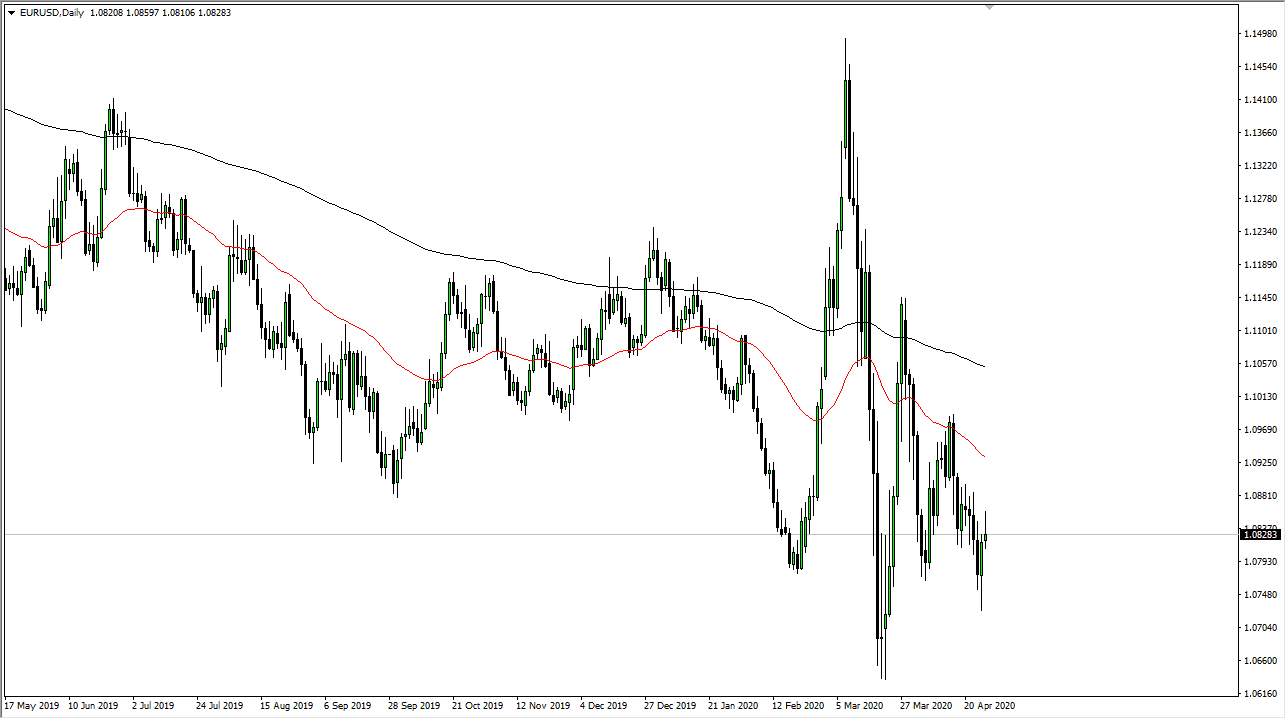

The Euro rallied a bit during the trading session on Monday but then turned right back around to form a bit of a shooting star against the greenback. At this point, it looks as if the market is ready to rollover, so we break down below the lows of the trading session on Monday, I anticipate that we go looking towards the 1.0750 level. Beyond that, it opens up the door down to the 1.0650 level.

The Euro is negative from a longer-term perspective, and quite frankly with the business confidence numbers last week showing just how shot things were in Germany, and of course the plethora of European issues, I think it is very likely that the Euro continues to fall in general, not just against the US dollar. On the other side of the equation, you have the US dollar that has the US Treasury market lifting it as well, so I think that we will continue to see the Euro get sold into on short-term rallies. The market has recently just made a “lower low”, and that of course is something to pay attention to.

The shape of the candlestick is a shooting star so that does not exactly inspire confidence either, it is worth noting that the 1.09 level continues offer selling. I think that short-term trading will continue to favor fading the rally, as it occurs on a short-term chart. The 50 day EMA is sloping negative, and it is starting to reach towards the market itself as it is just 100 pips above. If we can break down below the bottom of the candlestick for the trading session on Monday, then it is likely to kick off a lot of selling pressure, and at that point I anticipate that more people will be in the market and shorting.

Keep in mind that this pair is extraordinarily choppy under most circumstances, and I do not think that will change in the short term. Nonetheless, I do favor the downside as the US dollar is extraordinarily strong although we have seen a bit of greenback selling. This has been a brief rebound, but as you can see, even with all of the volatility over the last couple of months, the Euro could not pick itself up from the lows and that in and of itself is a signal as to what the market is trying to do.