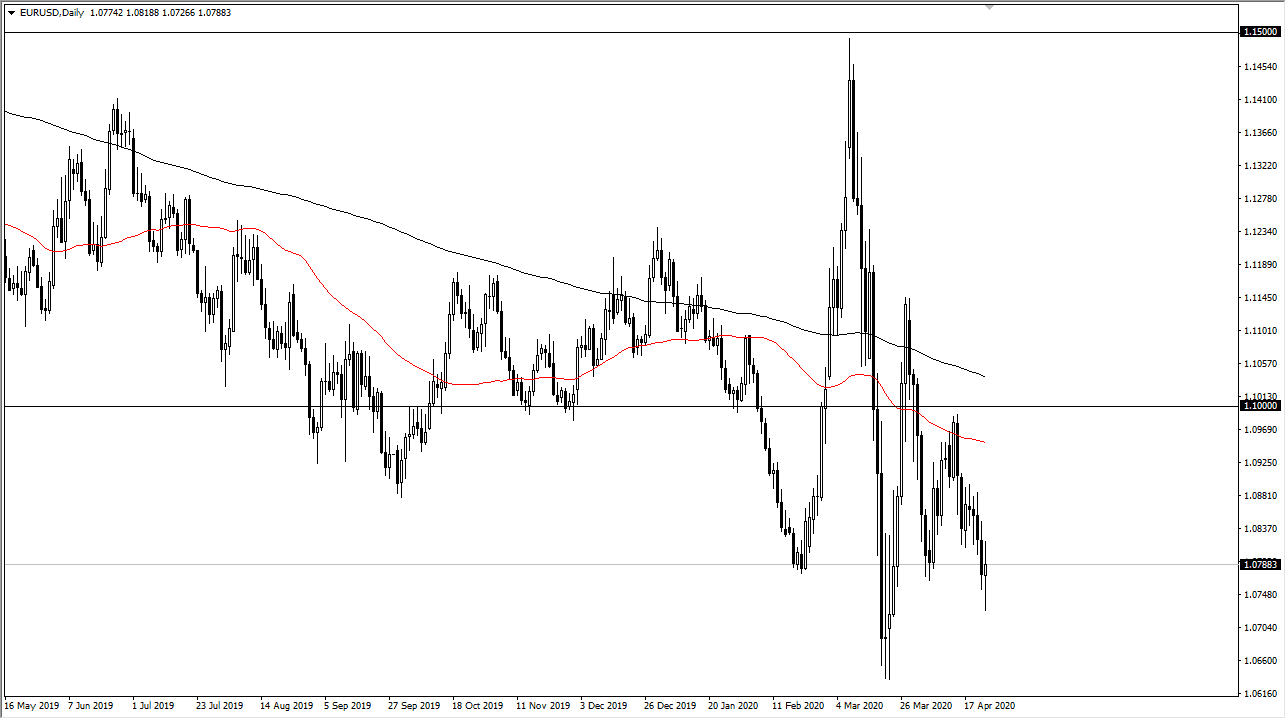

The Euro went back and forth during the trading session on Friday, showing a bit of a neutral candlestick. At this point, it looks as if the 1.08 level should continue to cause a bit of noise, as it was previous support and now should offer a bit of resistance. What is interesting is that we made a fresh new low before recovering.

Because of this, when I look at the candlestick, I recognize that this is a bit of neutrality, but I also recognize that the market had made a lower low, and it suggests that we could continue to go much lower. The 1.0650 level would be a target over the longer term but as usual this pair is going to be very noisy and exceedingly difficult to hang onto. Short-term traders will continue to fade short-term rallies that show signs of exhaustion. I do not have any interest in trying to hang onto a trade for a bigger move, because quite frankly this pair very rarely offers that opportunity. Yes, we have recently seen rather large candlesticks, but that was the first time in a couple of years.

To the upside, the 1.10 level is the absolute ceiling in the market, and I believe that the market is not going to be anywhere near being able to break above that. In fact, I can make an argument for the fact that the ceiling has move down to the 1.09 level. To the downside, I believe that the 1.0650 level will be difficult to break down through, but if we do manage do slice through it, the Euro is more than likely going to go down to the $1.05 level next.

You will probably need to trade this from the 15 minute charts or something like that to make any money, because as you can see the market simply grind back and forth although it does have a downward proclivity. This is why the Euro is favored by high-frequency traders because it has a tight spread and you can get in and out of the trade in a few minutes. The US dollar continues to be favored against most currencies, and with the nasty German business Ifo numbers coming out during the day, it shows that Germany is a long way from recovering, which of course drives most of what we see in the European Union.