The EUR/USD gains face a threat despite the recent optimism from the decline in coronavirus infection and death numbers in Europe, the most active center of the disease since it crossed the Chinese borders, which pushed the EUR/USD pair towards the 1.0925 resistance before settling around 1.0841 at the time of writing. The economically damaging effects of the virus longevity increase the pressure on the European economy, which has not yet recovered from the consequences of the global trade war before this disease appeared. The gains of Tuesday's trading session reversed losses of 6 bearish trading sessions, which pushed it towards the 1.0768 support at the beginning of this week’s trading.

For economic news. Data from the German statistics agency, Destatis, revealed that German industrial production grew unexpectedly in February, as the coronavirus had no noticeable impact on the industry. Industrial production saw a 0.3 percent growth on a monthly basis in February, which raised alarming expectations for a -0.9 percent decrease. However, the pace of growth was eased from a 3.2 percent rise in January.

On an annual basis, industrial production fell by - 1.2 percent after falling - 0.9 percent in January. Excluding energy and construction, industrial production rose 0.4 percent in February. Energy production increased 2.7 percent, while construction production fell 1.0 percent.

The German Ministry of Economy said that industrial production will decrease in March. The building output will also suffer from noticeable losses temporarily due to the sudden drop in the workforce.

Carsten Brzezsky, economist at ING, said that with the recent production cessation, closing procedures and a sharp drop in production forecasts in March, February's numbers are nothing more than remnants from the past, which seem far farther than they really are.

In this regard, the IFO Institute said that industrial production is expected to collapse in the next three months. The Research Center said that the production expectations index fell to -20.8 in March from +2.0 the previous period. This was the most severe recession since the survey began in 1991.

At the beginning of this week, factory orders were expected to decrease by -1.4 percent on a monthly basis in February, after increasing by 4.8 percent in January. The BDI Industrial Group predicted that the German economy could shrink 3-6 percent this year.

In Europe, the death rate from the epidemic rose in Spain for the first time in five days, with 743 new deaths recorded, a disappointing result, after expecting that the worst was over for countries with the largest number of cases in Europe. In the United Kingdom, Prime Minister Boris Johnson remained in the intensive care unit that he was admitted to late on Monday after his symptoms worsened. The UK recorded 768 new deaths, the highest toll in a single day.

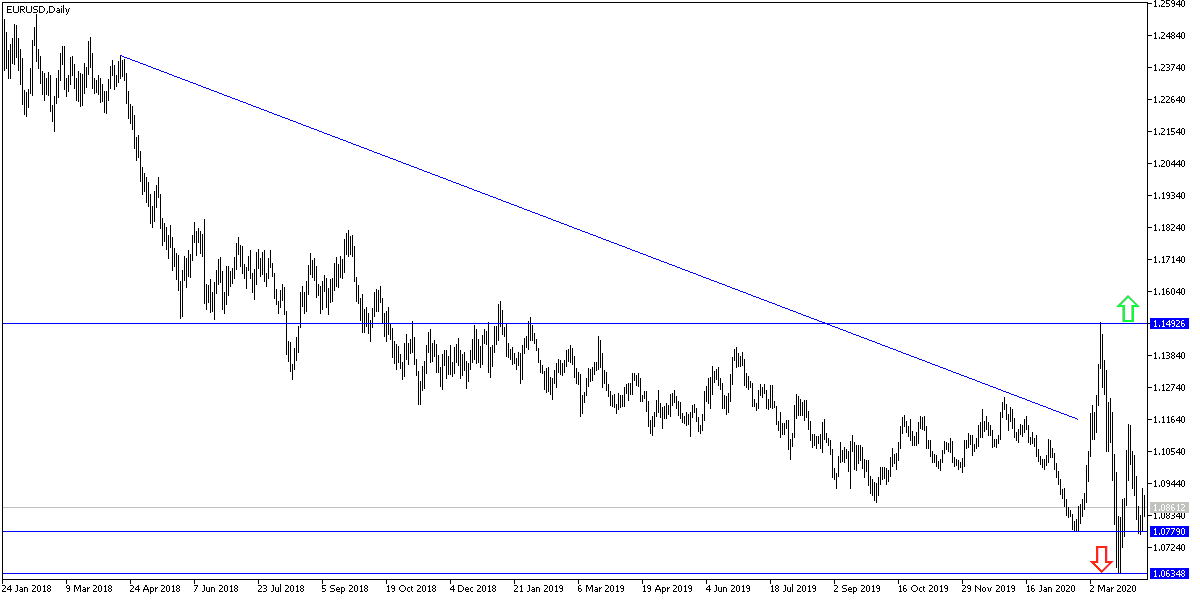

According to the technical analysis: There is still more effort for the bulls to succeed in reversing the general trend of the EUR/USD, which is still bearish so far. Their closest opportunity may be to break the 110.00 psychological resistance. A return to move around and below the 1.0800 psychological support will confirm that the bears are able to perform and the pair will sell again.

As for the economic calendar data today: There are no significant economic releases from the Eurozone. From the United States, the focus will be on the content of the US Federal Reserve’s last meeting minutes.