Structural weakness across the Eurozone and the European Union is highlighted by the Covid-19 pandemic, which is forcing the global economy into a recession. A virtual meeting of EU leaders ended in a disaster, displaying a lack of unity and solidarity often touted by Brussels. Failure of wealthy nations to support those in need at a time of extraordinary crisis will cast a shadow over the Euro. It may initiate the future collapse of the currency union. The EUR/JPY is expected to extend farther to the downside with a fresh breakdown sequence.

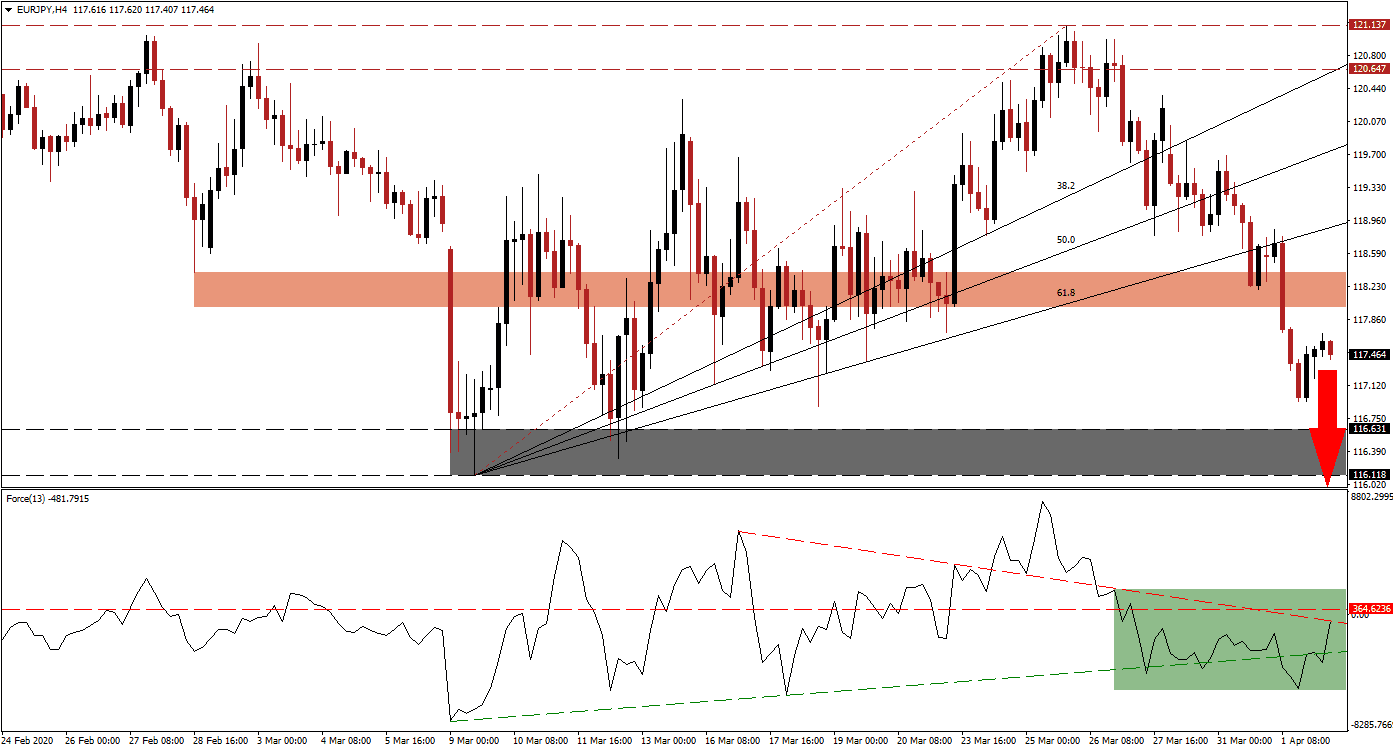

The Force Index, a next-generation technical indicator, contracted from a new 2020 high and converted its horizontal support level into resistance. Bearish momentum sufficed for a brief drop below its ascending support level. The Force Index has now reversed but is faced with its descending resistance level, as marked by the green rectangle. This technical indicator, located in negative territory with bears in control of the EUR/JPY, is anticipated to be denied and lead price action to a continued corrective phase.

After this currency pair was rejected by its ascending 61.8 Fibonacci Retracement Fan Resistance Level, it plunged below its short-term support zone, turning it into resistance. This zone is located between 117.990 and 118.379, as marked by the red rectangle. While the EUR/JPY may challenge the bottom range of it, a resumption of the contraction is favored on the back of intensifying bearish pressures on the Euro. You can learn more about the Fibonacci Retracement Fan here.

Deep divisions by Eurozone members are evident in the failure to agree on corona bonds or the now-lifted export ban of medical supplies by France and Germany to other members like Italy and France, which will add to long-term bearish fundamental factors. The EUR/JPY is well-positioned to correct into its support zone located between 116.118 and 116.631, as identified by the grey rectangle. More downside cannot be excluded, with the next support zone located between 112.559 and 113.709, dating back to October 2016.

EUR/JPY Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 117.450

Take Profit @ 113.000

Stop Loss @ 118.700

Downside Potential: 445 pips

Upside Risk: 125 pips

Risk/Reward Ratio: 3.56

In case the Force Index sustains a breakout above its descending resistance level into positive territory, the EUR/JPY is likely to attempt a recovery. The upside potential is limited to its 38.2 Fibonacci Retracement Fan Resistance Level. It entered the resistance zone located between 120.647 and 121.137. Forex traders are advised to view any price spike as an outstanding short selling opportunity.

EUR/JPY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 119.700

Take Profit @ 121.000

Stop Loss @ 119.100

Upside Potential: 130 pips

Downside Risk: 60 pips

Risk/Reward Ratio: 2.17