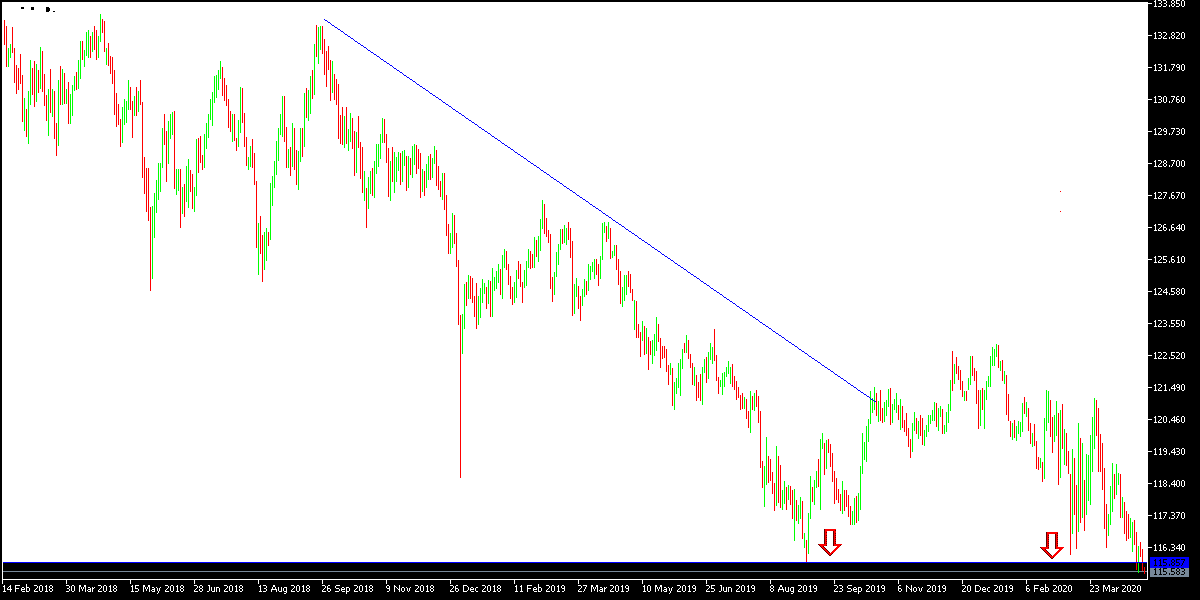

The strength of the Japanese yen and the lack of momentum for the Euro to stop the collapse, pushed the EUR/JPY to retreat to the 115.52 support, its lowest in three years, where it is stable around at the time of writing. Despite calls from European countries to reopen the exhausted economy, there are still fears of a violent wave of cases and deaths with Covid-19 epidemic, which has turned Europe into a hotbed of the outbreak. The absence of unity among the EU countries in intensifying efforts to face the economic shock of the Coronavirus was a valid reason for the continued weakness of the Euro, despite the recent optimism that prevailed in the global financial markets.

The European Commission has yet to see a clear way to fund the reconstruction of Europe after the economic disaster caused by Corona. However, they do find other ways to support banks and companies. Reports indicate that they are considering easing more regulatory measures that would facilitate the calculation of the leverage ratio. This would supposedly free up more capital for banks in the hope that it would keep lending activities. There are other measures that can be taken by the European Commission, such as considering software costs an investment and excluding reserves held in the European Central Bank from measures of assets that require capital reserves.

The Swedish Central Bank kept its monetary policy unchanged. The main interest rate was kept at zero, and the central bank confirmed its plans to continue buying assets until the end of September, and they certainly kept their options open for further policy amendment. However, the possibility of resorting to negative interest rates is high, and it appears that buying new assets is more likely than negative interest rates. Sweden also took a somewhat different approach to Covid 19, with a less severe approach. The results so far look slightly worse than other countries in the region, but they are better than the UK and Italy. Although the economic blow is severe, it may be less than anywhere else. And retail sales were announced for March at - 1.7%. The median forecast in the Bloomberg Survey was a decrease of - 3%.

Employment data in Japan is stalled. As the unemployment rate rose to 2.5% from 2.4%. Japan had a narrow job market in the era of crisis. The decline is often seen as a job cut for applicants. The number narrowed to 1.39 jobs per applicant, compared to 1.45 in February. This percentage is the lowest since August 2016. It reached 1.62 in March 2019.

According to technical analysis of the pair: the EUR/JPY reached strong oversold areas, and therefore, support levels at 115.20, 114.45, and 113.80, may be best suited to buy the pair currently and gain chances of rebounding higher. The pair will have an opportunity to reverse the currently pessimistic outlook if it breaches the highest resistance level 117.75. The Euro will wait for the German consumer price index announcement and the extent of investor risk appetite.