British Prime Minister Johnson was hospitalized due to persistent symptoms of Covid-19 after contracting the virus over ten days ago. He remained in self-isolation but was now admitted to an undisclosed hospital on the advice of his doctor. His office noted it was not an emergency, and that the PM remains in full control of the government. The UK announced a war-time economic stimulus worth approximately 15% of GDP, more than any other economy. Panic selling in the British Pound ebbed, and the EUR/GBP is amid a corrective phase following the breakdown below its resistance zone.

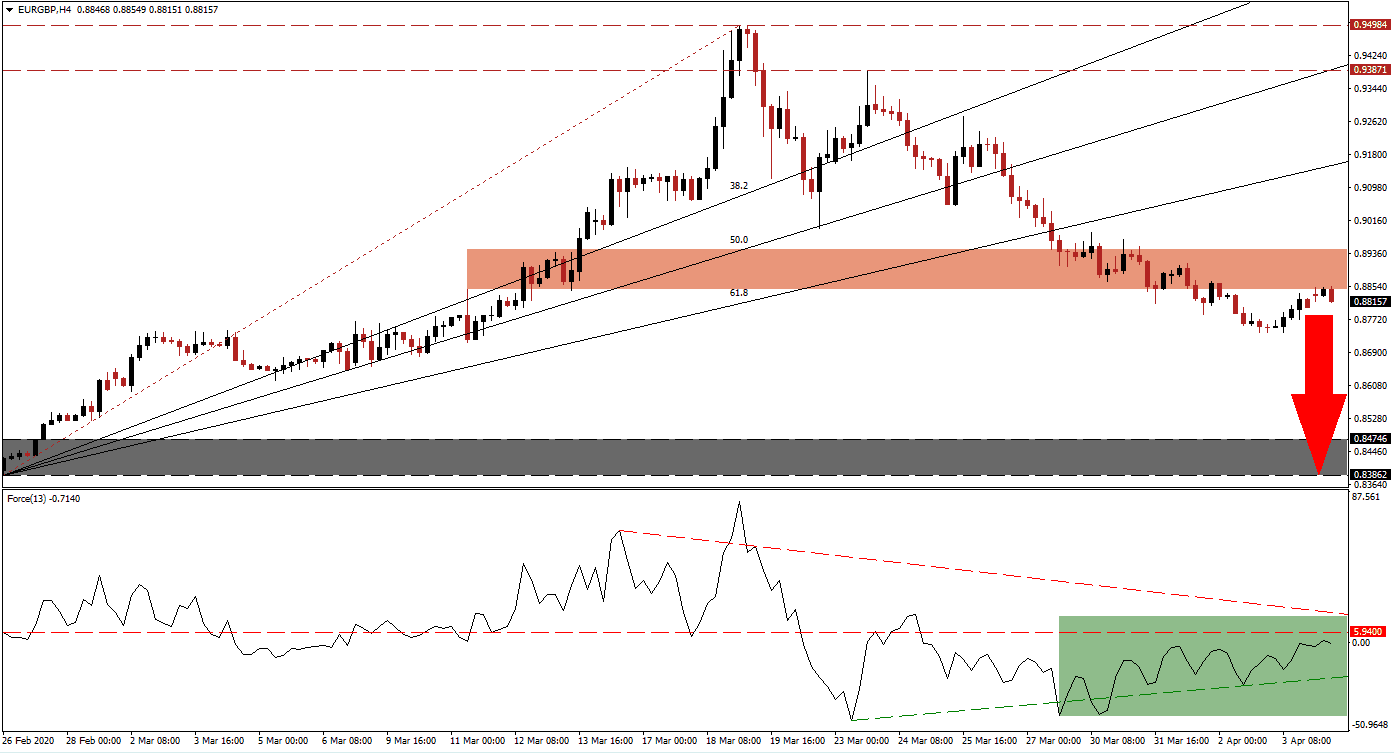

The Force Index, a next-generation technical indicator, recovered from a multi-week low. It remains below its horizontal resistance level, as marked by the green rectangle. The descending resistance level enforces downside pressures. A move below its horizontal resistance level is anticipated to collapse the Force Index below its ascending support level. Bears remain in control of price action in the EUR/GBP with this technical indicator positioned below the 0 center-line.

This currency pair converted its horizontal support level into resistance and confirmed the conversion by the rejection of the subsequent price action reversal. The zone is located between 0.88464 and 0.89458, as identified by the red rectangle. A breakdown extension below the intra-day low of 0.87394, the low of the current correction, will result in the redrawing of the Fibonacci Retracement Fan sequence. The EUR/GBP received a distinct bearish catalyst from the collapse below the ascending 61.8 Fibonacci Retracement Fan Support Level.

Economic data out of the Eurozone has been dismal, as evident in March PMI readings. While UK data has confirmed the disruptions caused by the global pandemic, the kingdom is well-positioned to bridge the period to economic recovery with a unified response. The EU continues to struggle with internal rifts, a scattered response, and a lack of unity. Before the virus, the Eurozone struggled with the global slowdown, now expected to mature into a recession, while the UK was on solid ground. The EUR/GBP is favored to accelerate into its support zone located between 0.83862 and 0.84746, as marked by the grey rectangle. A breakdown extension is likely to follow and lead to a new 2020 low.

EUR/GBP Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 0.88150

Take Profit @ 0.83850

Stop Loss @ 0.89450

Downside Potential: 430 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 3.31

Should the Force Index push through its descending resistance level, the EUR/GBP will come under breakout pressure. Any price spike from current levels will represent an outstanding short-selling opportunity for Forex traders to consider. The long-term outlook for this currency pair carries a distinct bearish bias. Upside potential for price action is limited to its ascending 61.8 Fibonacci Retracement Fan Support Level.

EUR/GBP Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 0.90150

Take Profit @ 0.91700

Stop Loss @ 0.89450

Upside Potential: 155 pips

Downside Risk: 70 pips

Risk/Reward Ratio: 2.21