Divisions across the European Union and the Eurozone are laid bare, as the global Covid-19 pandemic is shining a light on the core of economies. Deep divisions across member countries are set to widen, and the lack of solidarity and unity is evident. Eurozone finance ministers continue to struggle on a path forward, with Germany and the Netherlands refusing to back corona bonds. It prompted the reopening of canceled Nazi war debts. Italy noted Germany would have never been able to repay its debt unless Europe partially voided it. Now Germany remains unwilling to offer financial assistance. The delayed response and absence of urgency provide a long-term bearish fundamental catalyst to the Euro, placing new breakdown pressures on the EUR/CHF.

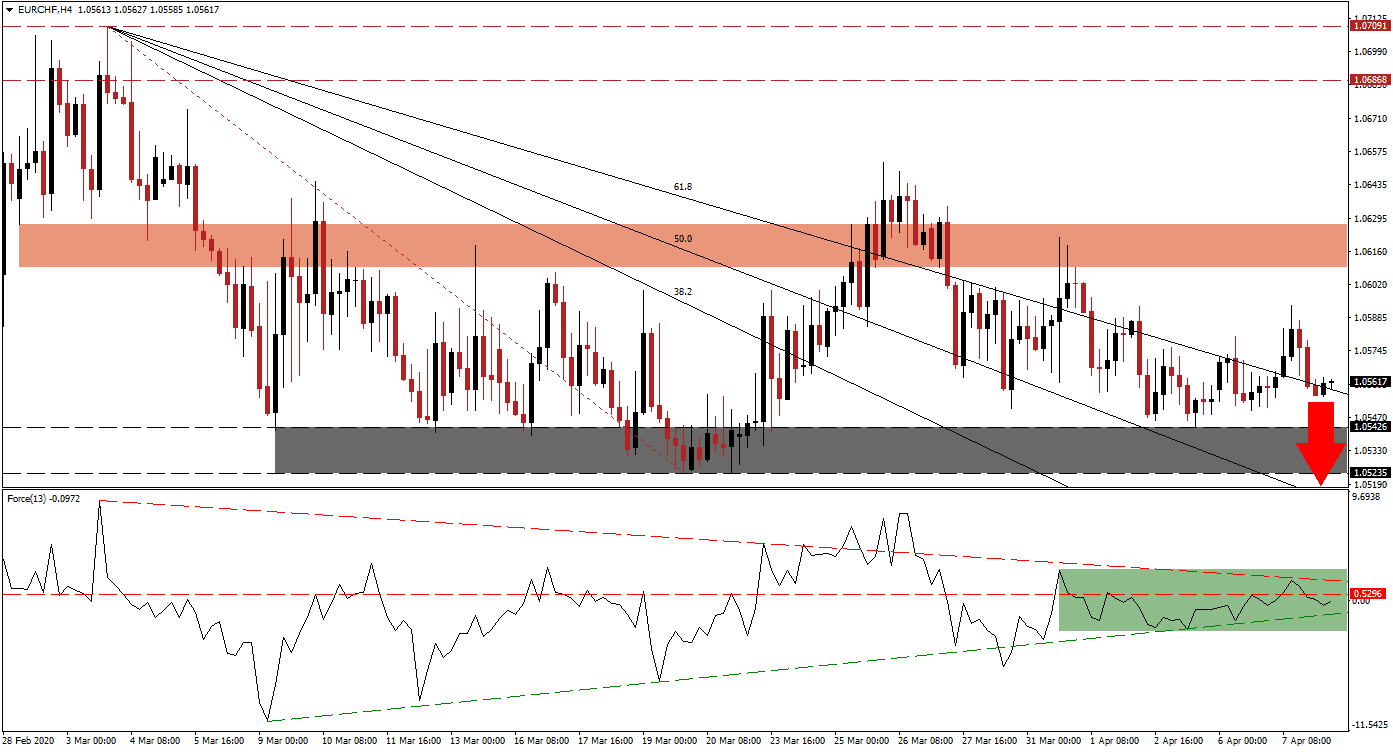

The Force Index, a next-generation technical indicator, points towards the loss in bullish momentum. After the descending resistance level pressured the Force Index below its horizontal support level, converting it into resistance, more downside is favored. The ascending support level is closing in, as marked by the green rectangle, and this technical indicator is expected to push below it, farther into negative territory. The EUR/CHF remains under the control of bears.

Switzerland is leading global efforts in the area of financing to small and medium-sized businesses, which form the backbone of developed economies, accounting for the majority of job creation. The Swiss Franc is considered a safe-haven currency. While the Swiss National Bank, active in market manipulation, prefers a weaker currency to support its export sector, it may be unable to prevent further strengthening. Following the breakdown in the EUR/CHF below its short-term resistance zone located between 1.06092 and 1.06271, as marked by the red rectangle, a bearish chart pattern was confirmed.

Three lower highs provide sufficient downside pressure on this currency pair. The descending Fibonacci Retracement Fan sequence is anticipated to guide the EUR/CHF into an extended breakdown, with a push below its 61.8 Fibonacci Retracement Fan Resistance Level. With the remainder below the support zone located between 1.05235 and 1.05426, as identified by the grey rectangle, the sell-off is well-positioned to extend. The next support zone awaits price action between 1.02784 and 1.03118, dating back to May 2015.

EUR/CHF Technical Trading Set-Up - Breakdown Scenario

- Short Entry @ 1.05600

- Take Profit @ 1.03000

- Stop Loss @ 1.06400

- Downside Potential: 260 pips

- Upside Risk: 80 pips

- Risk/Reward Ratio: 3.25

A sustained breakout in the Forced Index above its descending resistance level may spark a short-term reversal in the EUR/CHF. Forex traders are advised to take advantage of any price spike above its short-term resistance zone with new net short positions. The outlook for this currency pair carries a distinct bearish bias. Price action will face its next resistance zone between 1.06868 and 1.07091.

EUR/CHF Technical Trading Set-Up - Limited Breakout Scenario

- Long Entry @ 1.06600

- Take Profit @ 1.07000

- Stop Loss @ 1.06400

- Upside Potential: 40 pips

- Downside Risk: 20 pips

- Risk/Reward Ratio: 2.00