Eurozone sentiment data was reported below already depressed expectations, presenting the latest sign the economy is in significantly worse shape than forecast. Financial markets have dismissed the threats to the global economy and recovered massively from their 2020 lows, led by retail demand. It added to the breakout sequence in the EUR/CHF due to reduced demand for the safe-haven Swiss Franc. Risks of a second infection wave are increasing, as evident in Germany, after it eased lockdown measures. It resulted in a rise in confirmed Covid-19 cases and the absence of economic activity. This currency pair is well-positioned to reverse its advance, initiated by an increase in bearish pressures inside of its short-term resistance zone.

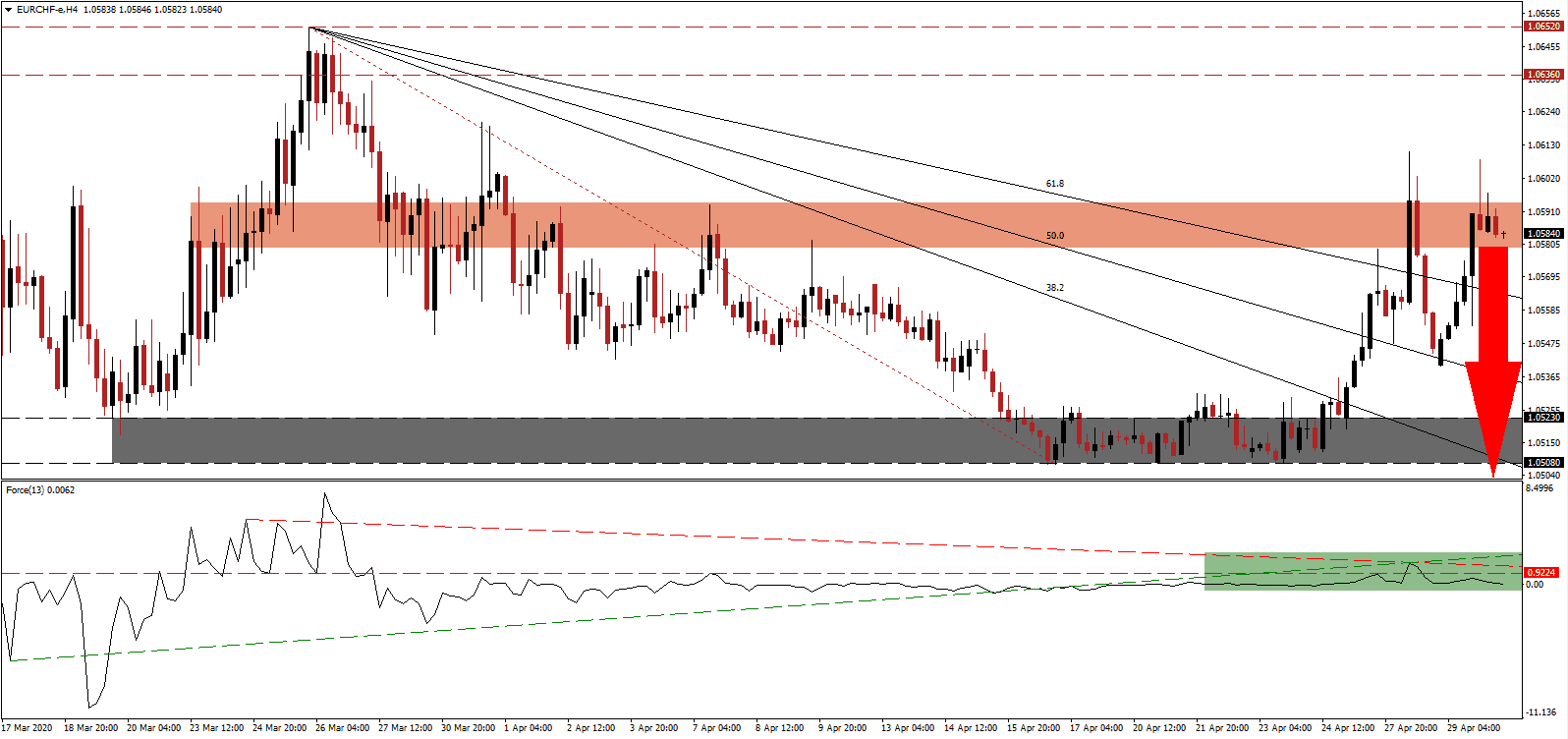

The Force Index, a next-generation technical indicator, was rejected by its descending resistance level, which led to a breakdown below its horizontal support level. This currency pair is detaching further from its ascending support level, converted into resistance, as marked by the green rectangle. Bears await a crossover below the 0 center-line to regain full control of the EUR/CHF, likely to lead a correction in this currency pair. You can learn more about the Force Index here.

After the European Central Bank eased monetary conditions, markets anticipate another round of capital injections. Central banks in developed economies have ignored fiscal responsibility and interfered on various occasions, essentially manipulating free markets. The costs have been brushed aside, global debt exploded, and each crisis is treated with the same mistakes. Instability across the Eurozone is expanding beneath the surface, adding a long-term bearish fundamental catalyst to the EUR/CHF. The rise in bearish momentum is favored to result in a breakdown below the short-term resistance zone located between 1.0579 and 1.0594, as marked by the red rectangle.

Forex traders are advised to monitor this currency pair for a collapse below the descending 61.8 Fibonacci Retracement Fan Support Level. It will convert it into resistance and lead to a spike in selling pressure. The 38.2 Fibonacci Retracement Fan Support Level contracted below its support zone located between 1.0508 and 1.0523, as identified by the grey rectangle, suggesting a new 2020 in the EUR/CHF cannot be ruled out. With unaddressed risk accumulating, a return of risk-off sentiment will add to pending breakdown pressures.

EUR/CHF Technical Trading Set-Up - Price Action Reversal Scenario

- Short Entry @ 1.0585

- Take Profit @ 1.0500

- Stop Loss @ 1.0605

- Downside Potential: 85 pips

- Upside Risk: 20 pips

- Risk/Reward Ratio: 4.25

Should the Force Index reclaim its ascending support level, presently serving as resistance, the EUR/CHF is likely to attempt an extension of its advance. The upside potential is reduced to its next resistance zone located between 1.0636 and 1.0652. Forex traders are recommended to consider and price spike from current levels as an excellent long-term selling opportunity in this currency pair.

EUR/CHF Technical Trading Set-Up - Limited Breakout Scenario

- Long Entry @ 1.0620

- Take Profit @ 1.0650

- Stop Loss @ 1.0605

- Upside Potential: 30 pips

- Downside Risk: 15 pips

- Risk/Reward Ratio: 2.00