Canada’s economy is faced with increasing pressures from the sell-off across the oil market. Oil extended its sell-off, after a strong recovery from an abnormal negative price in the now-expired May contract. Persistent weakness may lead to job losses in the energy sector, adding to millions of lost jobs due to the Covid-19 pandemic. While the Eurozone economy is in a dire position with a worsening outlook, the short-term focus remains on crumbling oil prices and the negative impact on economies depending on the energy sector. The EUR/CAD is anticipated to enter a minor short-covering rally, which will position this currency pair for a more significant sell-off.

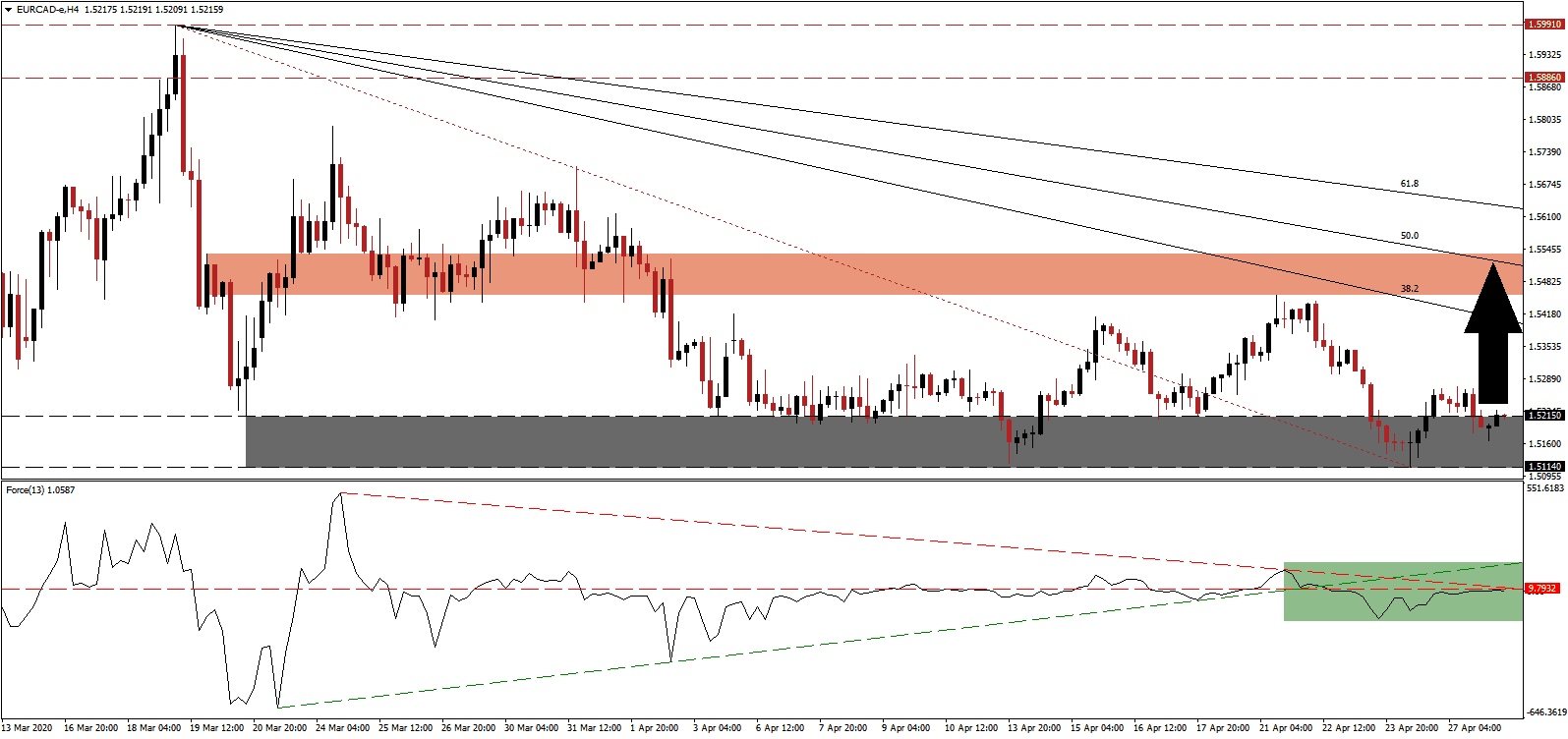

The Force Index, a next-generation technical indicator, maintains its position below the horizontal resistance level, as marked by the green rectangle. Bearish momentum expanded following the conversion of the ascending support level into resistance. Adding to downside pressure is the descending resistance level, expected to push the Force Index below the 0 center-line. Bears will regain complete control of the EUR/CAD after this technical indicator contracts into negative territory.

Minor anti-lockdown protests have flared up, but regional governments urge extreme caution as measures are lifted slowly. One of the most dominant risks to the global economy persists in a potential second wave of infections due to a rush by sovereign governments to reopen their markets and lift social distancing measures. It will risk a collapse of the healthcare system globally, while Germany provided an example that shoppers remain absent after stores were opened. The EUR/CAD is favored to eclipse its support zone located between 1.5114 and 1.5215, as identified by the grey rectangle.

Long-term bearish pressures, on the back of a deteriorating Eurozone outlook, limit the breakout potential in this currency pair. The descending Fibonacci Retracement Fan sequence enforces the downtrend with the 50.0 Fibonacci Retracement Fan Resistance Level passing through the short-term resistance zone. This zone is located between 1.5454 and 1.5536, as marked by the red rectangle. A breakout extension in the EUR/CAD is unlikely given the present fundamental scenario.

EUR/CAD Technical Trading Set-Up - Short-Covering Scenario

- Long Entry @ 1.5215

- Take Profit @ 1.5500

- Stop Loss @ 1.5135

- Upside Potential: 285 pips

- Downside Risk: 80 pips

- Risk/Reward Ratio: 3.56

Should the descending resistance level pressure the Force Index into a collapse below the 0 center-line, the EUR/CAD is favored to resume its long-term corrective phase. The Eurozone is home to four of the top five infected countries, with the US at the top of the group, but the response capabilities have been severely disappointing due to lack of unity. This currency pair will face its next support zone between 1.4721 and 1.4793.

EUR/CAD Technical Trading Set-Up - Breakdown Scenario

- Short Entry @ 1.5025

- Take Profit @ 1.4740

- Stop Loss @ 1.5125

- Downside Potential: 285 pips

- Upside Risk: 100 pips

- Risk/Reward Ratio: 2.85