South Africa faced severe economic challenges before the global Covid-19 pandemic and is now exposed to three distinct disruptions. A drop in exports combines with a halt in domestic demand due to lockdown measures, while foreign direct investment is likely to grind to a standstill. The short-term disruptions may lead to a cut in the corporate tax rates, creating an investor-friendly environment. South Africa lacks the financial strength to announce cash payments to citizens but can lower the income and value-added taxes, potentially implementing long-term positive measures. The Eurozone represents an arguably more challenging situation than South Africa and lacks unity to act, positioning the EUR/ZAR to extend its breakdown sequence.

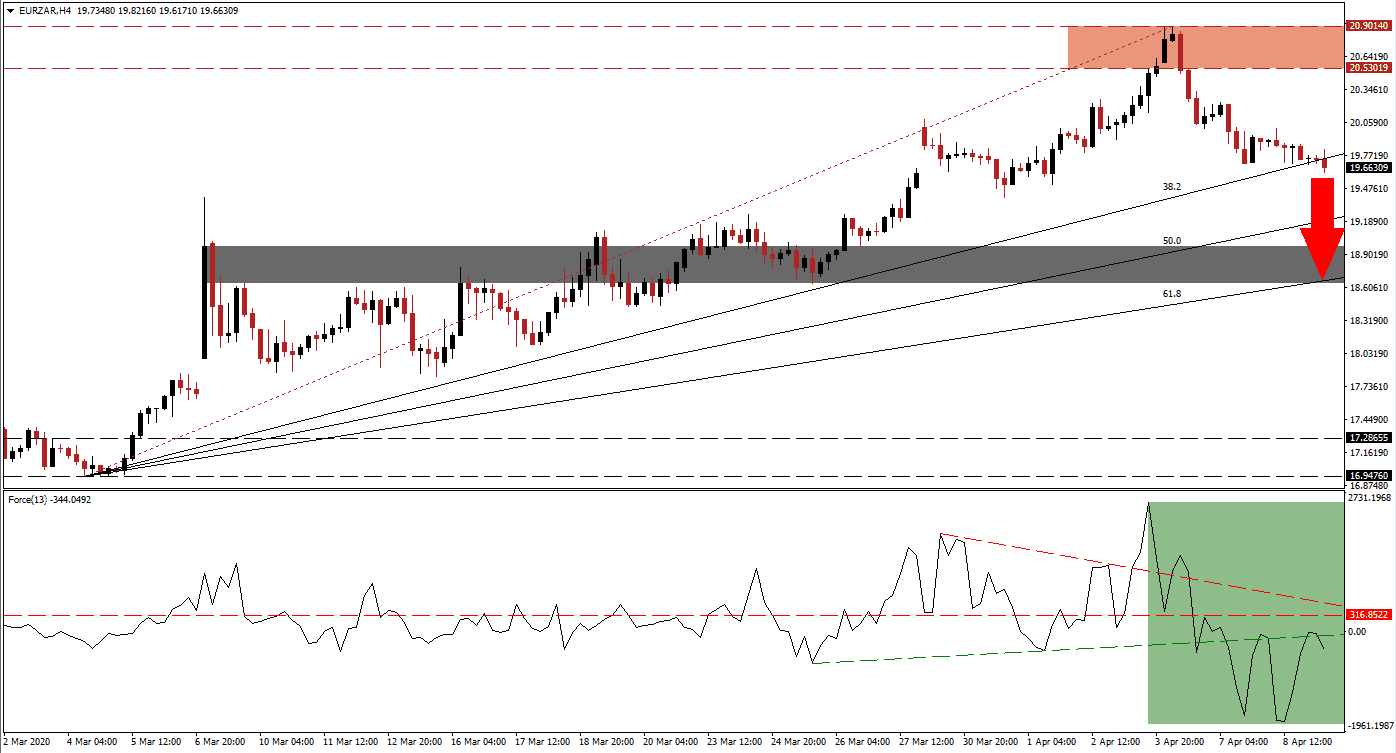

The Force Index, a next-generation technical indicator, initially spiked to a new 2020 peak before collapsing below its descending resistance level. It then converted its horizontal support level into resistance, as marked by the green rectangle. The Force Index reversed the breakdown below its ascending support level, which led to a 2020 low, but failed to sustain the advance. Bears remain in control of the EUR/ZAR with this technical indicator in negative territory.

Following the breakdown in the EUR/ZAR below its resistance zone located between 20.53019 and 20.90140, as marked by the red rectangle, breakdown pressures increased. Eurozone finance minister met for sixteen hours without reaching an agreement on how to adequately support the economy, prompting Italy to refer to the partial cancellation of Nazi debt post-WWII. Similar to the South African economy, the Eurozone was amid a severe economic slowdown led by Germany. Divisions within member countries across the monetary union add a distinct bearish bias to this currency pair.

Selling pressure intensified after price action turned its ascending 38.2 Fibonacci Retracement Fan Support Level into resistance. An accelerated sell-off in the EUR/ZAR into its short-term support zone located between 18.64836 and 18.96850, as identified by the grey rectangle, is pending a new set of economic data out of South Africa. German export data released this morning showed an upside surprise for February, failing to lift the Euro. The 61.8 Fibonacci Retracement Fan Support Level enforces the bottom range of its support zone, but an extension of the corrective phase cannot be excluded.

EUR/ZAR Technical Trading Set-Up - Breakdown Extension Scenario

- Short Entry @ 19.66000

- Take Profit @ 18.66000

- Stop Loss @ 19.91000

- Downside Potential: 10,000 pips

- Upside Risk: 2,500 pips

- Risk/Reward Ratio: 4.00

In the event the Force Index spikes above its descending resistance level, the EUR/ZAR is likely to attempt a reversal. Volatility is favored to remain elevated, dominated by news flow out of the Eurozone. Due to developing fundamental conditions, coupled with the long-term recovery potential, the upside in this currency pair remains limited to its resistance zone from where the breakdown initiated. It will offer Forex traders a second selling opportunity.

EUR/ZAR Technical Trading Set-Up - Limited Reversal Scenario

- Long Entry @ 20.30000

- Take Profit @ 20.85000

- Stop Loss @ 20.05000

- Upside Potential: 5,500 pips

- Downside Risk: 2,500 pips

- Risk/Reward Ratio: 2.20