The Euro has fallen a bit during the trading session on Tuesday but turned around to bounce and regain about half of the losses. By doing so, the market looks as if it is simply trying to find its way and I think this is probably one of the most difficult pairs right now to trade. This being the case, the market should be approached with a very small position if you feel the need to get involved.

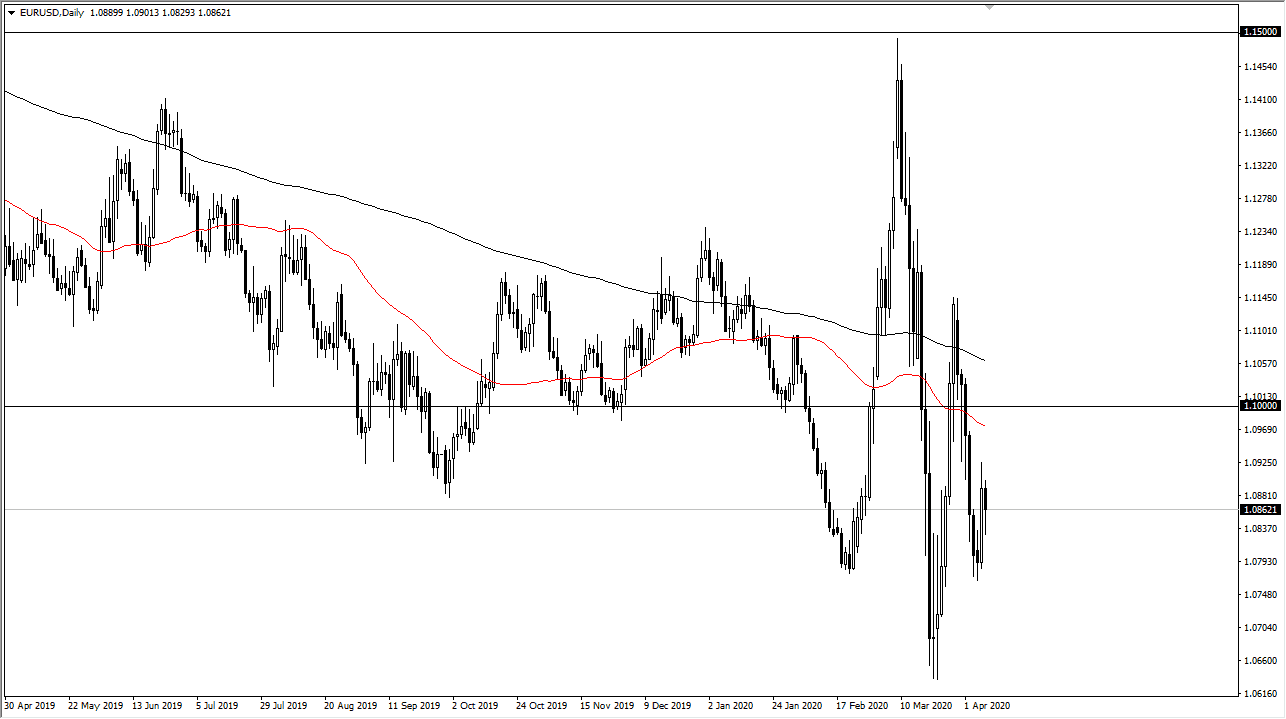

Historically, the Euro moves very little against the US dollar, simply chopping back and forth with an overall attitude. Over the last couple of years, we have seen this market to chop back and forth with a general downward pressure, but the noise causes all kinds of issues. Ultimately, the Euro should cause a lot of back and forth momentum near the 1.10 level, as it is an area that will cause a lot of noise. The large, round, psychologically significant bit of that level should cause quite a bit of attention to be paid to the market, and at this point I think what we are looking at is a market that is trying to decide whether or not it is going to continue chopping around wildly, or if it’s going to calm down.

The fact that the highs and lows continue to tighten, it’s very likely that the range compressing. That is a good sign though, because it means that the market is starting to calm down. In that sense, we could get right back to the usual choppiness that we see in this pair, perhaps with some slight directionality. In the short term, I believe that the 1.10 level will be the target but if we were to break down below the 1.0775 level, the market will more than likely go down to the 1.06 handle, perhaps even the 1.05 level. Ultimately, I am a bit skeptical about the outlook for the Euro, but the range that we have seen over the last several weeks it certainly widened, so it’s difficult to jump into this pair with a significant amount of position size right away. The main use I have for this pair right now is a proxy for the US Dollar Index, as it is one of the largest parts of that market. In other words, the US dollar strengthening then I know what to do with it against other currencies, on the whole.