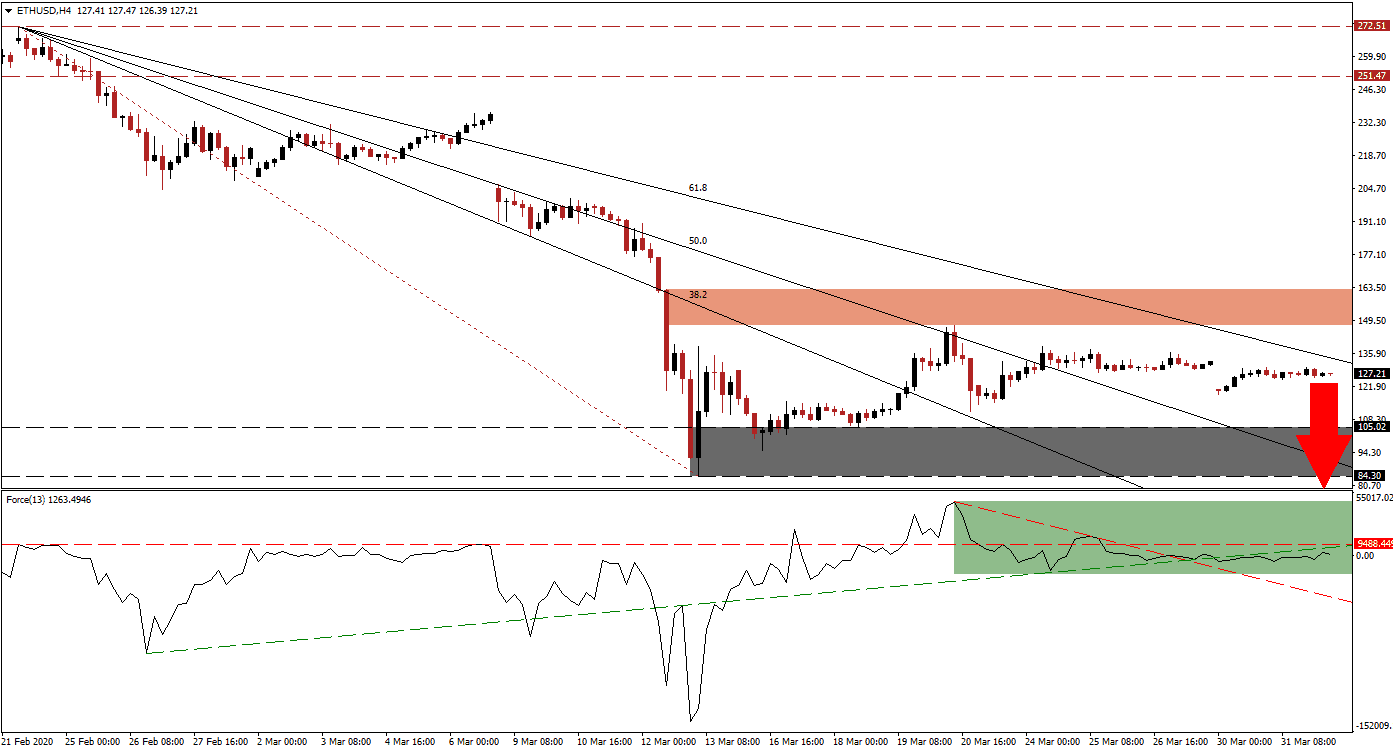

Ethereum collapsed below the psychologically significant $100 support level before recovering in unison with Bitcoin. Selling pressure from institutional clients to meet margin calls ignited the massive sell-off. After partially retracing the move to the downside, this cryptocurrency pair is exposed to an aggregation of bearish forces. Ethereum’s futures volume is declining across major exchanges, while open interest is on the rise. The fragile technical condition suggests the next move in the ETH/USD will be a breakdown challenging its existing 2020 low at 84.30.

The Force Index, a next-generation technical indicator, contracted together with price action and confirmed the sell-off. A quick rebound was followed by a renewed push to the downside, converting its horizontal support level into resistance. The Force Index now entered a sideways drift below its ascending support level, as marked by the green rectangle. Bears are favored to regain control of the ETH/USD after this technical indicator contract below the 0 center-line, guided lower by its descending resistance level acting as support.

After the ETH/USD was rejected by the bottom range of its short-term resistance zone, and its descending 50.0 Fibonacci Retracement Fan Resistance Level, bearish pressures spiked. This zone is located between 147.58 and 162.68, as identified by the red rectangle. Additional downside pressure is provided by its 61.8 Fibonacci Retracement Fan Resistance Level, with the 38.2 Fibonacci Retracement Fan Resistance Level already below the support zone. More selling across financial markets is anticipated, granting a bearish fundamental catalyst to this cryptocurrency pair.

While a collapse in price action into its support zone located between 84.30 and 105.02, as marked by the grey rectangle, is expected, more downside cannot be ruled out. The Ethereum hashrate is likely to follow the 45% plunge in the Bitcoin hashrate, as more miners are forced to shutter operations. It makes the network less secure, increases transaction times, and makes it vulnerable to 51%-attacks. Underlying conditions may extend a plunge in the ETH/USD into its next support zone, located between 41.73 and 53.60.

ETH/USD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 127.25

Take Profit @ 84.25

Stop Loss @ 139.00

Downside Potential: 4,300 pips

Upside Risk: 1,175 pips

Risk/Reward Ratio: 3.66

In the event of a breakout in the Force Index above its ascending support level, the ETH/USD is anticipated to accelerate into its short-term resistance zone. An extension of the advance is highly unlikely on the back of distinct bearish developments. Traders are advised to take advantage of short-term price spikes with new net short-positions amid a rapid deterioration in fundamental conditions.

ETH/USD Technical Trading Set-Up - Limited Reversal Scenario

Long Entry @ 150.00

Take Profit @ 163.00

Stop Loss @ 144.50

Upside Potential: 1,300 pips

Downside Risk: 550 pips

Risk/Reward Ratio: 2.36