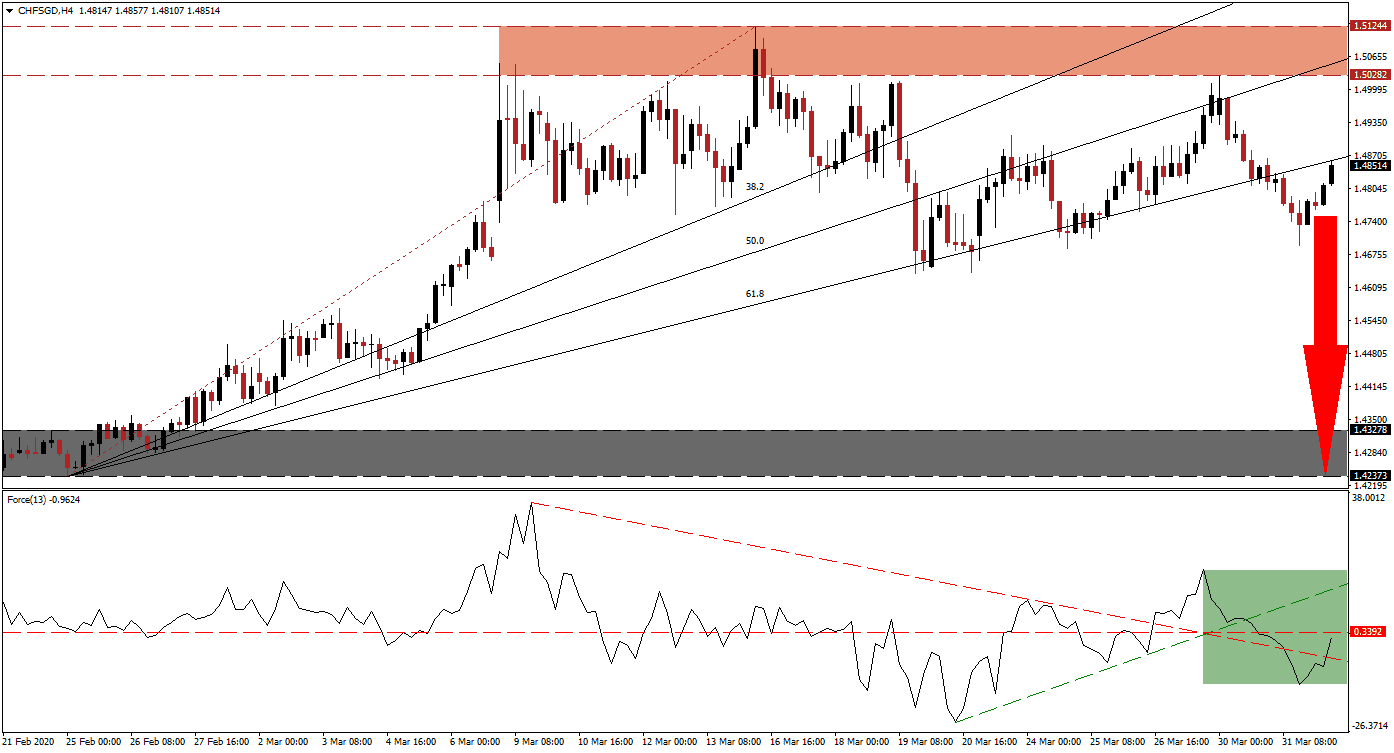

Singapore’s central bank, the Monetary Authority of Singapore (MAS), eased monetary policy as expected. It adjusted the currency's annualized rate of appreciation to zero percent against a basket of currencies, lowering the mid-point of its policy band. Unlike most central banks, MAS adjusts monetary policy through the Singapore Dollar Nominal Effective Exchange Rate (S$NEER). The CHF/SGD extended its breakdown sequence after being rejected by the bottom range of its resistance zone. It has recovered from a reaction low, but the correction is favored to extend.

The Force Index, a next-generation technical indicator, points towards the presence of bearish momentum. It converted its horizontal support level into resistance following a contraction from a lower high. The Force Index slid below its ascending support level, currently acting as resistance, but pushed above its descending resistance level, as marked by the green rectangle. Bears remain in control of the CHF/SGD, and this technical indicator is anticipated to move deeper into negative territory. You can learn more about the Force Index here.

Price action ended its bullish move with the initial breakdown below its resistance zone located between 1.50282 and 1.51244, as marked by the red rectangle. While Singapore may face its most massive economic contraction in history, it is well-prepared to bridge this period. After the first stimulus worth S$6.4 billion, the island-nation passed an unprecedented S$48 billion addition. The Swiss KOF Economic Barometer plunged to a five-year low, indicating more stress ahead for the export-oriented economy, increasing downside pressure on the CHF/SGD on the back of Swiss Franc weakness.

Following the breakdown in this currency pair below its ascending 61.8 Fibonacci Retracement Fan Support Level, converting it into resistance, the CHF/SGD retraced the move to confirm its validity. Forex traders are recommended to monitor the intra-day low of 1.46372, the low of the breakdown sequence initiated by its resistance zone. A push lower is likely to result in the addition of new net short orders, providing the required volume to force price action into its support zone. This zone awaits between 1.42373 and 1.43278, as identified by the grey rectangle.

CHF/SGD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 1.48500

Take Profit @ 1.42500

Stop Loss @ 1.50000

Downside Potential: 600 pips

Upside Risk: 150 pips

Risk/Reward Ratio: 4.00

Should the Force Index spike above its ascending support level and maintain that position, the CHF/SGD is likely to challenge the top range of its resistance zone. Given the dominant fundamental conditions, supported by short-term technical developments, this currency pair carries a bearish bias. A sustained breakout is not expected to emerge, and Forex traders may view any advance from current levels as a sound selling opportunity.

CHF/SGD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.50300

Take Profit @ 1.51250

Stop Loss @ 1.49900

Upside Potential: 95 pips

Downside Risk: 40 pips

Risk/Reward Ratio: 2.38