The Canadian dollar has been a bit of an enigma as of late, as it has held up rather well considering just how drastic the selloff in crude oil has been. Remember, Canada is typically used as a proxy for the crude oil market, which of course has seen a massive amount of selling pressure due to oversupply. The question now is whether or not this will continue?

Looking at the Canadian dollar against the Japanese yen, you can see there was a massive selloff, but the month of April was actually quite calm. That is pretty impressive considering just how negative the oil market has been. What is particularly interesting about this pair is the fact that it features Canada which is an oil exporter, and Japan which imports 100% of its petroleum. In other words, this is an almost perfect way to play the crude oil market via Forex. The theory goes of course that if crude oil falls and price the way it has, then the Canadian dollar should be in much less demand coming out of Japan.

Obviously, the exact opposite is possible as well, but it is highly likely that as we close out the June contract, which will be later in May, crude oil could very well end up going negative again. If it does, I suspect that this pair could get crushed. Remember, the May contract closed recently, and reached as low as $-37. This is because we are literally running out of places to store crude oil, and some grades of crude oil have even gone negative before that happened, this is especially true at lower grades of crude.

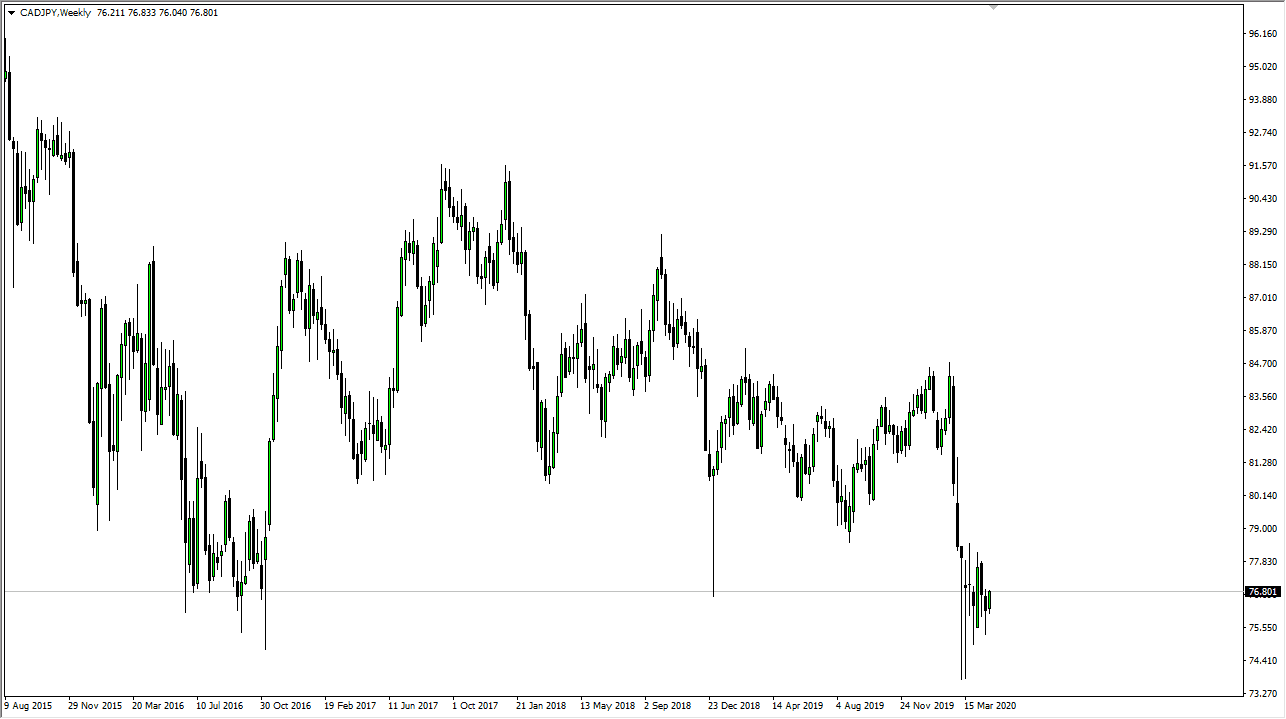

Currently, it looks as if the ¥79 level should offer a bit of resistance, while the ¥75 level underneath should offer a significant amount of support. I anticipate that we will probably trade back and forth in that range with more of a negative tilt. That being said, we have formed a couple of very stubborn hammers on the weekly chart, so this does suggest that at least the market is looking to go higher, even if it does not get the fundamental reason to pick up that momentum. If we break above the ¥79 level, then it is likely that this pair would go looking towards ¥84 over the next several months. The biggest problem for this pair though is that there simply is not much in the way of demand for crude oil.