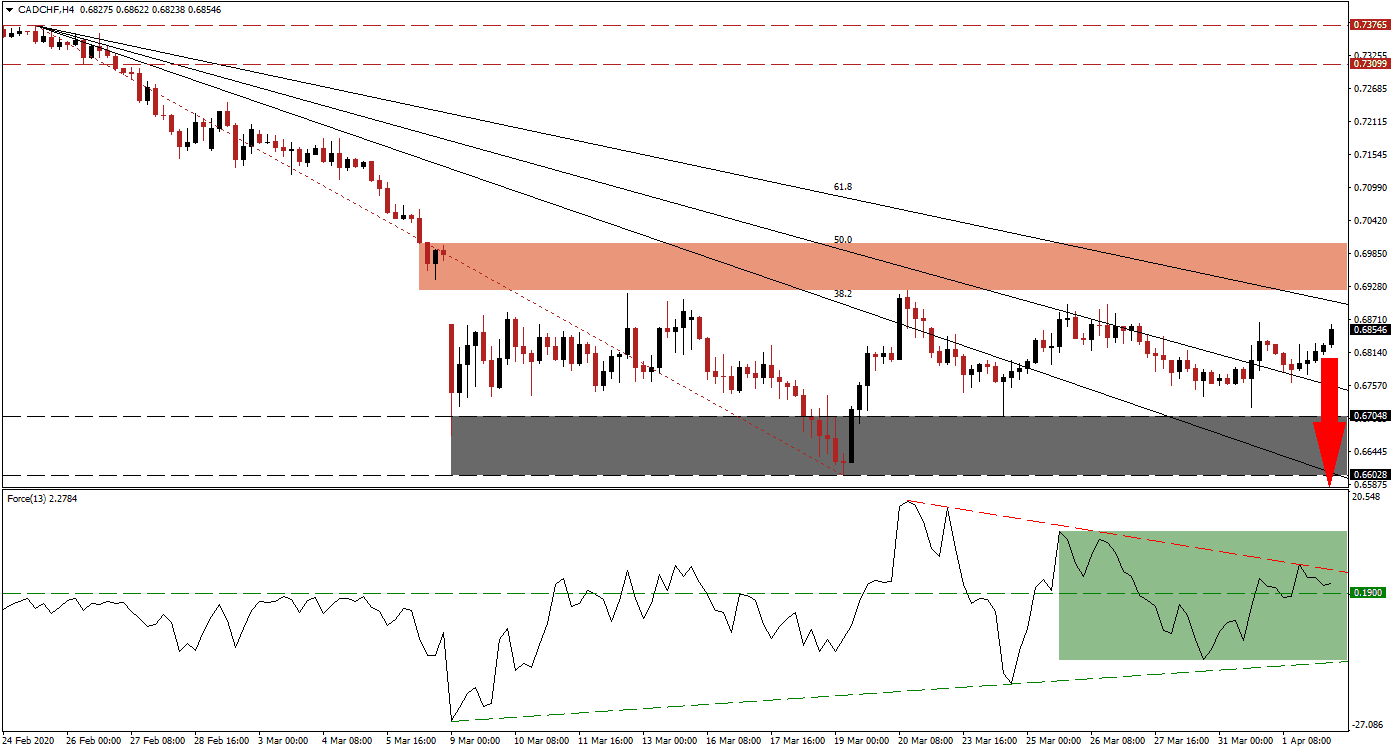

Canada’s economy was in dire shape to start the year, with GDP expanding a dismal 0.1%. The transportation sector, the oil and gas industry, and the retail sector posted contraction. While manufacturing and finance posted gains, the fundamental weakness before the Covid-19 pandemic is evident. Railroad blockades by indigenous groups in protest of projects energy projects on their soil impacted over 25% of companies. The government additionally houses a weak fiscal position, adding to long-term bearish pressures in the CAD/CHF. Price action is anticipated to be rejected by its descending 61.8 Fibonacci Retracement Fan Resistance Level.

The Force Index, a next-generation technical indicator, established a series of higher lows, allowing for the emergence of an ascending support level. It pushed the Force Index above its horizontal resistance level, turning it into support. It is now under breakdown pressure provided by its descending resistance level created through a sequence of lower highs, as marked by the green rectangle. This technical indicator is favored to cede control of the CAD/CHF to bears with a collapse into negative territory.

With the 61.8 Fibonacci Retracement Fan Resistance Level below its short-term resistance zone located between 0.69219 and 0.70025, as identified by the red rectangle, the CAD/CHF is exposed to more selling. Canada boosted its stimulus to C$202 billion after initial jobless claims spiked by a record-breaking 929,000 last week. The Bank of Canada announced an unprecedented bond-buying program of a minimum C$5 billion per week, while interest rates were slashed to 0.25%. Breakdown momentum in this currency pair remains elevated due to the increase in debt mixed with a weak economic outlook.

Switzerland increased its stimulus to approximately 6% of GDP after unlocking a further CHF 32 billion. The country reported a budget surplus last year of CHF3.1 billion, which can support the economy from a sound fiscal position and is well-positioned to return to growth ahead of many European countries. The CAD/CHF is anticipated to correct into its support zone located between 0.66028 and 0.67048, as marked by the grey rectangle. More downside is expected with the 38.2 Fibonacci Retracement Fan Support Level below this zone. You can learn more about a support zone here.

CAD/CHF Technical Trading Set-Up - Price Action Reversal Scenario

Short Entry @ 0.68550

Take Profit @ 0.66000

Stop Loss @ 0.69150

Downside Potential: 255 pips

Upside Risk: 60 pips

Risk/Reward Ratio: 4.25

Should the Force Index accelerate above its descending resistance level, the CAD/CHF may attempt a breakout. Due to the dismal economic outlook for Canada, long-term bearish pressures remain dominant. Any spike above its short-term resistance zone is unlikely to be sustained but will offer Forex traders and excellent short-selling opportunity. Price action is conditioned to challenge its all-time low of 0.62020, created in January 2015.

CAD/CHF Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 0.69400

Take Profit @ 0.70000

Stop Loss @ 0.69150

Upside Potential: 60 pips

Downside Risk: 25 pips

Risk/Reward Ratio: 2.40