Oil prices may have reached a bottom after OPEC+ announced an unprecedented supply cut of 9.7 million barrels per day, but they are far from being in a position to recover. Canada’s economy is heavily dependent on oil production in several states, and a persistent weak oil price will eventually force job losses. The March employment report showed 1.010 million lost jobs, over twice the most pessimistic forecast. With the global Covid-19 pandemic battering the fragile Canadian economy, the fallout is anticipated to have a long-lasting impact, forcing changes to essential sectors. The CAD/CHF is positioned to extend its breakdown sequence until it can confront its next support zone.

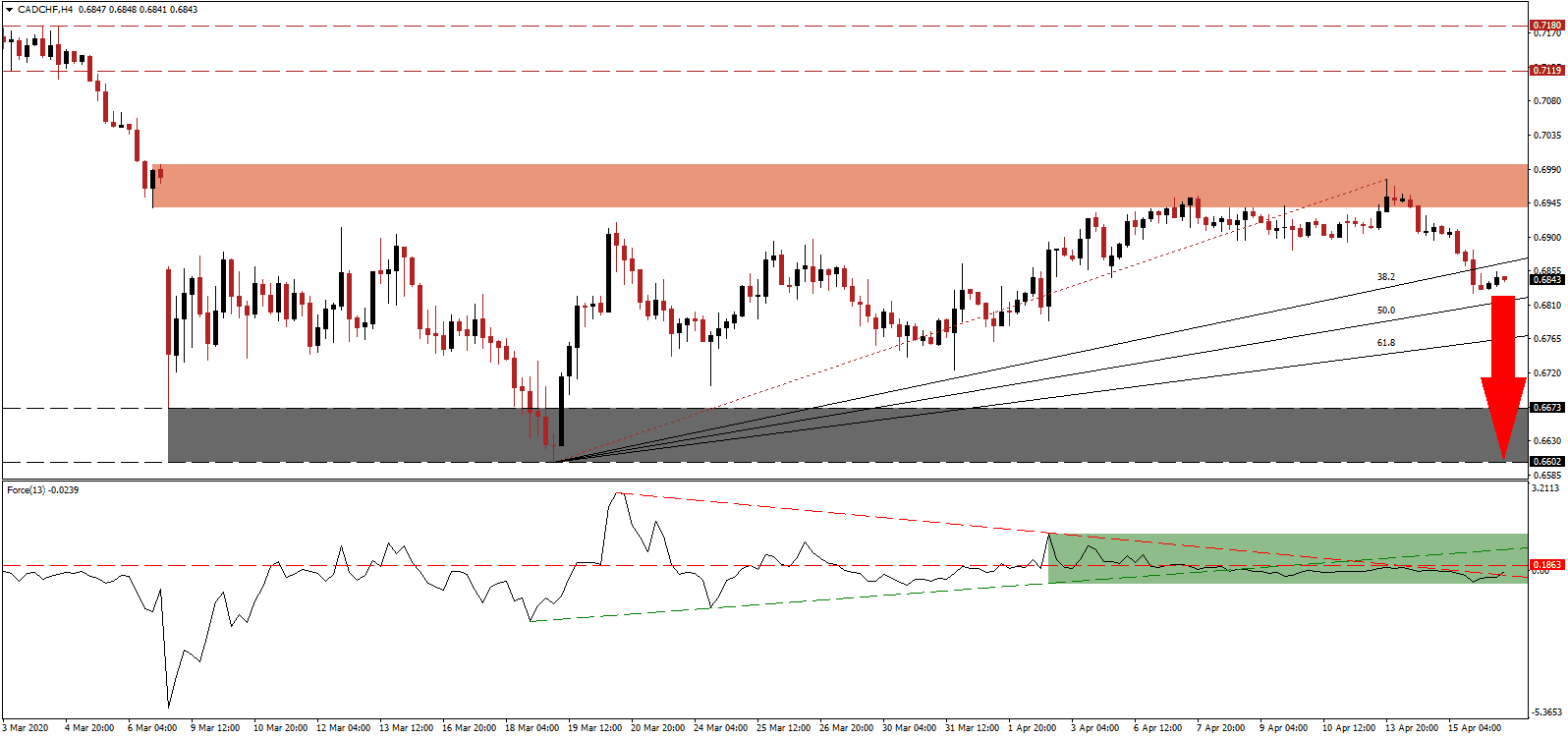

The Force Index, a next-generation technical indicator, points towards the dominance of bearish pressures after contracting below its horizontal support level, converting it into resistance, followed by a move below its ascending support level. While the Force Index pierced its descending resistance level to the upside, as marked by the green rectangle, bears remain in control of the CAD/CHF with this technical indicator in negative territory. You can learn more about the Force Index here.

Bearish pressures expanded after price action was rejected by its short-term resistance zone located between 0.6938 and 0.6996, as identified by the red rectangle. The breakdown below its ascending 38.2 Fibonacci Retracement Fan Support Level, which now serves as resistance, additionally enhanced them. Switzerland managed the 2008 global financial crisis more superior than most other economies, despite a destructive blow to one of its essential pillars, and is now once again positioned to bridge the pandemic ahead of the curve. The Swiss Franc, a safe-haven and commodity currency, is expected to remain dominant, pressuring the CAD/CHF farther to the downside.

Forex traders are advised to monitor this currency pair for a breakdown below its 50.0 Fibonacci Retracement Fan Support Level, favored to attract the next wave of net sell orders in the CAD/CHF. It will provide the necessary volume to force an accelerated sell-off into its support zone located between 0.6602 and 0.6673, as marked by the grey rectangle. The 0.6600 level represents an essential support level, but more downside cannot be excluded on the back of the ongoing global economic hibernation due to the pandemic

CAD/CHF Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 0.6840

Take Profit @ 0.6620

Stop Loss @ 0.6900

Downside Potential: 220 pips

Upside Risk: 60 pips

Risk/Reward Ratio: 3.67

Should the Force Index elevate above its ascending support level, acting as current resistance, the CAD/CHF is likely to challenge its short-term resistance zone. It may close a previous price gap to the downside, but fundamental circumstances make a sustained breakout unlikely. Forex traders are recommended to consider any advance from current levels as an outstanding short-selling opportunity.

CAD/CHF Technical Trading Set-Up - Limited Reversal Scenario

Long Entry @ 0.6920

Take Profit @ 0.6990

Stop Loss @ 0.6885

Upside Potential: 70 pips

Downside Risk: 35 pips

Risk/Reward Ratio: 2.00