Bitcoin enjoyed the relative calm in global financial markets over the past three weeks, offering yet more evidence that the cryptocurrency market is connected to the existing system. The initial wave of selling related to the global Covid-19 pandemic crashed price action across cryptocurrencies, forcing smaller mining operations to shut down due to the lack of profitability. After a price dip below the 4,000 level, the BTC/USD rallied over 90%, and into its short-term resistance zone. The loss in bullish momentum is anticipated to spark a profit-taking sell-off.

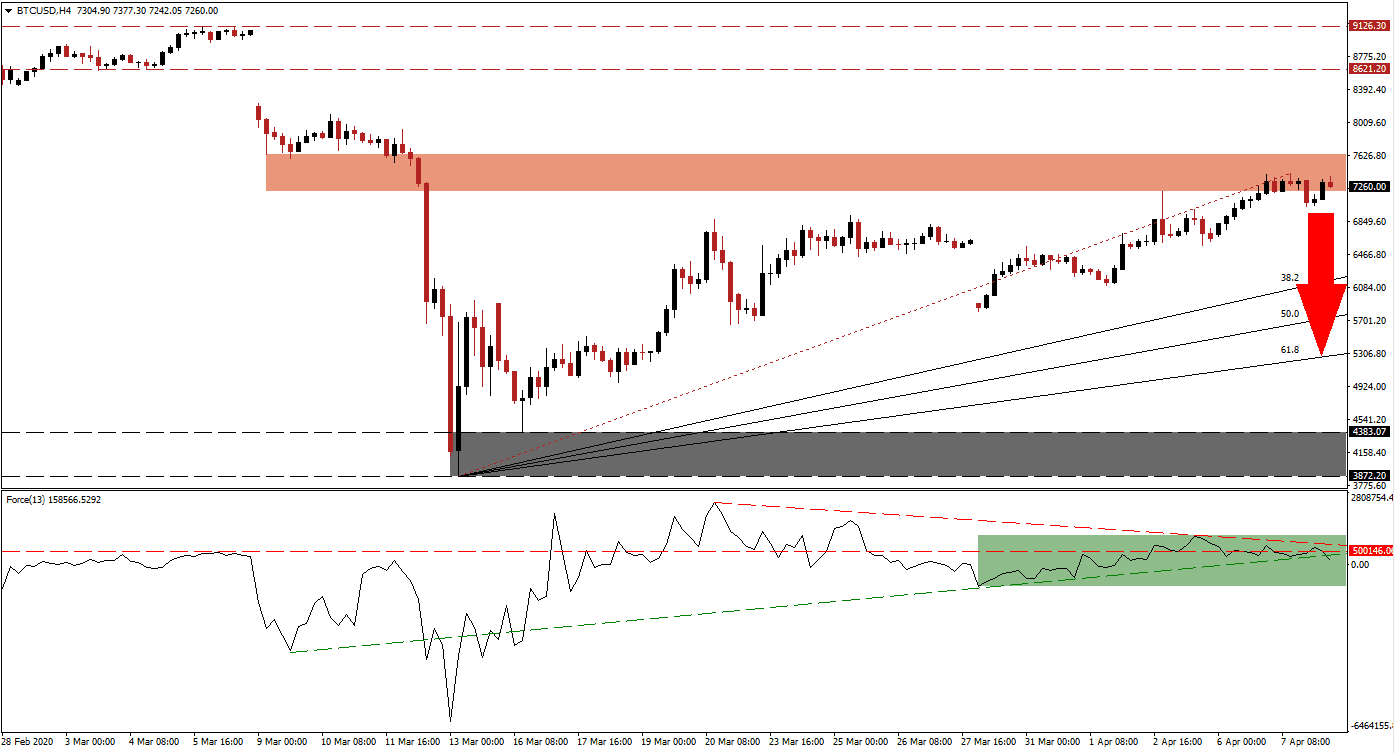

The Force Index, a next-generation technical indicator, features a negative divergence, as this cryptocurrency pair advanced while the Force Index corrected. Its descending resistance level pressured a conversion of the horizontal resistance level into support, marked by the green rectangle. Adding to bearish momentum is the breakdown in this technical indicator below its ascending support level. More downside is favored with bears positioned to take control of the BTC/USD following a crossover below the 0 center-line.

Retail demand based on hope next month’s halving event will accelerate price action to new all-time highs, as evident in the previous two, assisted the BTC/USD in its price action reversal. The third having event is well-positioned to disappoint consensus expectations and may result in a continued contraction of the hash rate in this cryptocurrency pair. With institutional demand fading, the short-term resistance zone located between 7,202.60 and 7,636.61, as marked by the red rectangle, is likely to initiate the next corrective phase.

After a breakdown, the BTC/USD is on track to close the gap to its ascending 38.2 Fibonacci Retracement Fan Support Level. The downside potential remains dependent on fluent Covid-19 developments, government reactions to it, and developing future global system. Fundamental conditions directly related to cryptocurrencies will take a secondary role until the peak of the pandemic. While the intermediate support is provided by the 61.8 Fibonacci Retracement Fan Support Level, a renewed breakdown into its support zone cannot be excluded. This support zone is located between 3,872.20 and 4,383.07, as identified by the grey rectangle.

BTC/USD Technical Trading Set-Up - Breakdown Scenario

- Short Entry @ 7,275.00

- Take Profit @ 5,335.00

- Stop Loss @ 7,835.00

- Downside Potential: 194,000 pips

- Upside Risk: 56,000 pips

- Risk/Reward Ratio: 3.46

In the event of a breakout in the Force Index above its descending resistance level, the BTC/USD is expected to extend its advance. A short-term spike is possible, on the back of the pending having event, but the upside remains limited to its resistance zone located between 8,621.20 and 9,126.30. Volatility is favored to increase over the next few weeks, but the risk remains to the downside, lead by a contraction in the hash rate post-having.

BTC/USD Technical Trading Set-Up - Limited Breakout Scenario

- Long Entry @ 8,100.00

- Take Profit @ 9,100.00

- Stop Loss @ 7,600.00

- Upside Potential: 100,000 pips

- Downside Risk: 50,000 pips

- Risk/Reward Ratio: 2.00