For those of you who are diehard Bitcoin holders, this has to be one of the strangest markets to deal with right now. After all, the market is basically hanging around the $7000 area, an area that it has been in for a couple of weeks now. While the rest of the world is essentially on fire, Bitcoin has done extraordinarily little. On one hand, you can make an argument for stability, something that Bitcoin is not necessarily known for. In fact, it is been more stable than just about anything I can think of off the top of my head, including gold. However, there is a problem in the sense that the Bitcoin market has not done much. In other words, in this environment when we should be seeing a lot of buying of Bitcoin, nobody is out there doing that.

It has almost as if the market is simply paused and try to figure out what to do. I think one of the biggest problems that Bitcoin has right now is that most of the people who will have bought into the narrative probably already have. Institutions need to come in in order to build up the volume, despite the fact that it is originally thought to be a way around all of that manipulation. At this point, institutions have a world of problems and other markets, especially when you start talking about the energy sector. The last thing you want to be as a hedge fund that is start taking delivery of crude oil right now.

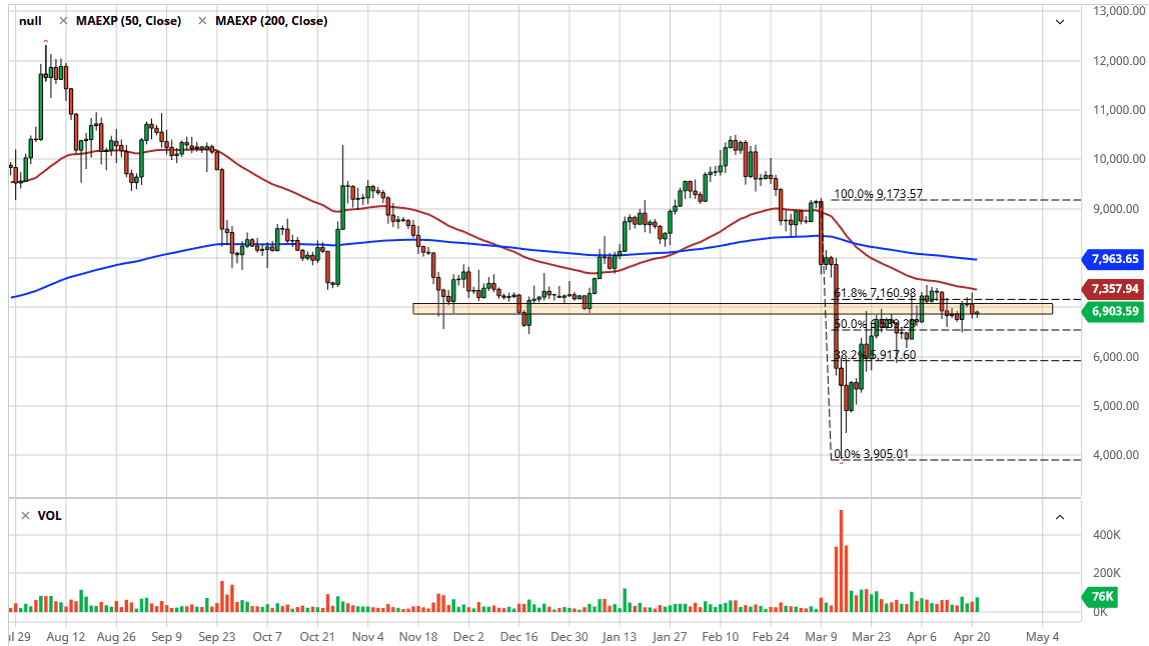

At this point, it is difficult to imagine a scenario that would be more bullish for some type of alternative currency, but there is nobody out there buying it. So, at this point, I suspect that Bitcoin will eventually rollover because people are going to need to raise liquidity to cover losses in other places. I’m not necessarily overly bearish of Bitcoin, I just recognize that we are in a scenario where you’re going to see “rolling bear markets”, meaning that even places where markets have been okay, they get pounded eventually because traders will have to cover other things like losses in the stock market. If you take a look at the volume at the bottom of the chart, it is simply sitting sideways at exceptionally low levels. The 50 day EMA above will cause a significant amount of resistance, but if we break down below the 6500 level, it is highly likely that this market will break down further.