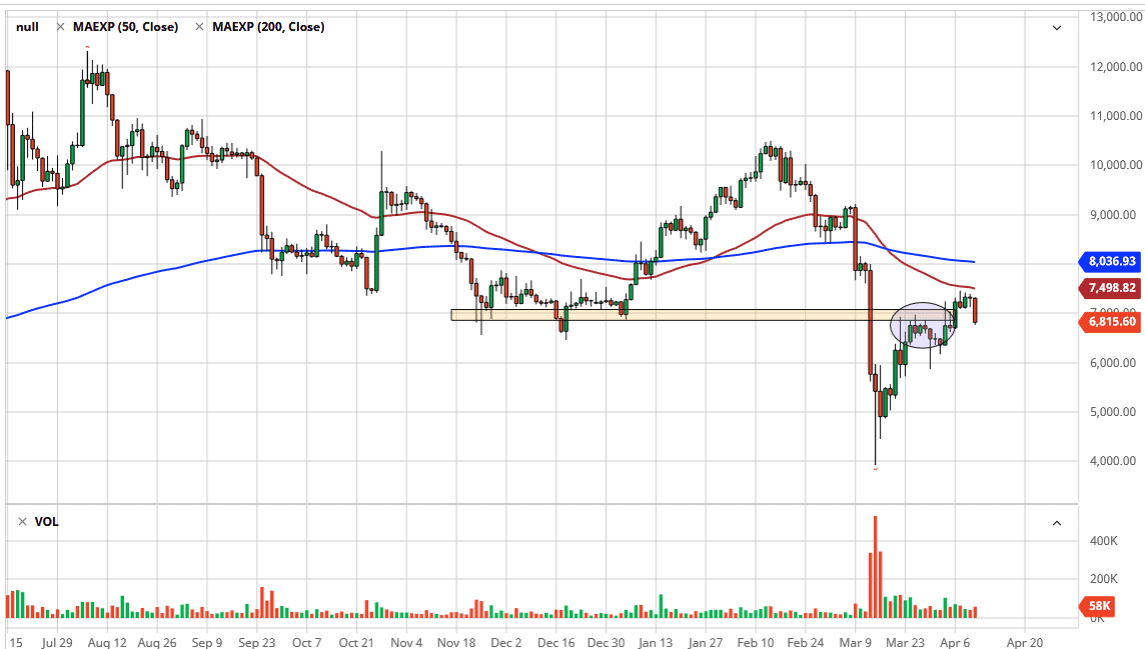

The coin markets rolled over during the trading session on Good Friday as there would have been a serious lack of volume. That being said, the market then broke down below the $7000 level, showing a bit of weakness as we failed at the 50 day EMA. If that is a sign of things to come, Bitcoin will more than likely go looking towards the bottom of the previous consolidation, which sends it down to $6500.

After that, the $6000 level is the next target, and then breaking down below that could really start to send this market much lower. I will say this though, Bitcoin has not acted well over the last couple of days. It failed at the 50 day EMA, forming a shooting star. Granted, it would sideways for a couple of days after that but the candlestick during the Friday session certainly shows that there is still a lack of belief in this market. I think at this point the fact that the greenback has given back so much strength against so many other currencies and Bitcoin can’t rally against it probably speaks volumes.

That also sets up an interesting scenario that the market could turn around a break back above the red 50 day EMA. If it does, then the market will break above the $7500 level it more than likely go looking towards the $8000 level where we had seen a significant amount of selling previously, and the 200 day EMA sits at. I think that Bitcoin is going to continue to be choppy to say the least, and that it’s very likely that we will eventually see sellers come in and push to the downside. However, I do keep both sides of the equation laid out, knowing that are wrong you need to have an area where you admit it. For me, it’s the 50 day EMA.

At this point, Bitcoin has underperformed considering how other risk appetite based market tab. I think this shows a real weakness in this sector still, and as a result unless you are a long term holder, the best thing you can do is fade rallies or breakdowns below the support levels underneath. If we do break down below the $6000 level, I expect this market to start falling rather rapidly as the momentum will build upon itself. Remember, Bitcoin is very thinly traded so algorithms will come in and start throwing things around if we see hints of momentum.