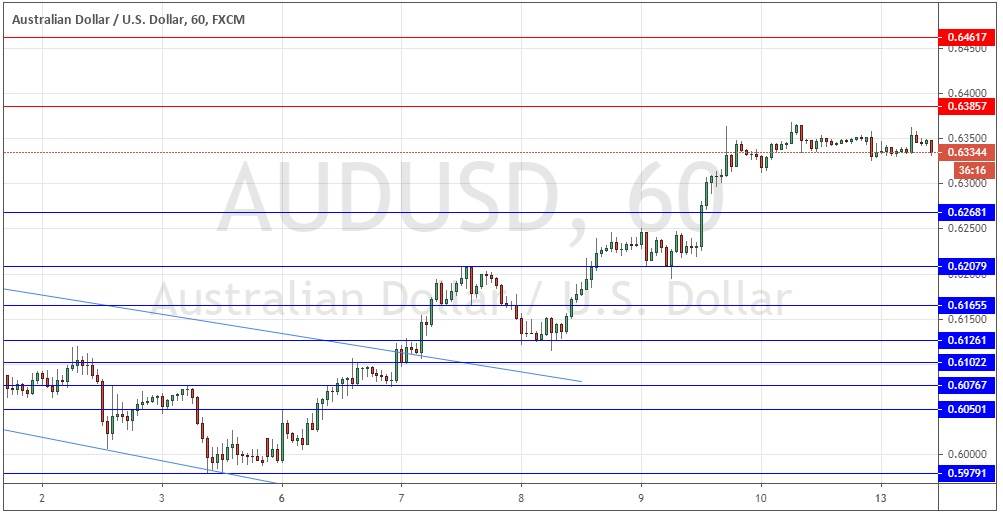

AUD/USD: Normal bearish retracement underway

Last Thursday’s signals were not triggered, as there was no bearish price action when 0.6268 was first reached.

Today’s AUD/USD Signals

Risk 0.75%.

Trades must be taken from 8am New York time Monday to 5pm Tokyo time Tuesday.

Short Trade Ideas

Short entry following bearish price action on the H1 time frame immediately upon the next touch of 0.6386 or 0.6462.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

Long entry following bullish price action on the H1 time frame immediately upon the next touch of 0.6268 or 0.6208.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

I wrote yesterday that as long as stock markets remained bullish, the AUD was likely to continue rising against the USD, so I remained bullish above 0.6208 and would take a long trade from a bullish bounce there if it had set up. This was a good call and I also mentioned I would be even more bullish above 0.6268 which was easily broken later that same day.

The picture is still essentially bullish technically, but there is a serious pause in the medium-term bullish trend, with the price now consolidating at about 0.6350 for a lengthy time. It looks likely that we will see a natural bearish retracement now, maybe to 0.6268 as a logical nearby support or the round number at 0.6300, where we can expect a bullish bounce and a resumption of the bullish move to be the most likely outcome. There is nothing of high importance due today concerning either the AUD or the USD.

There is nothing of high importance due today concerning either the AUD or the USD.