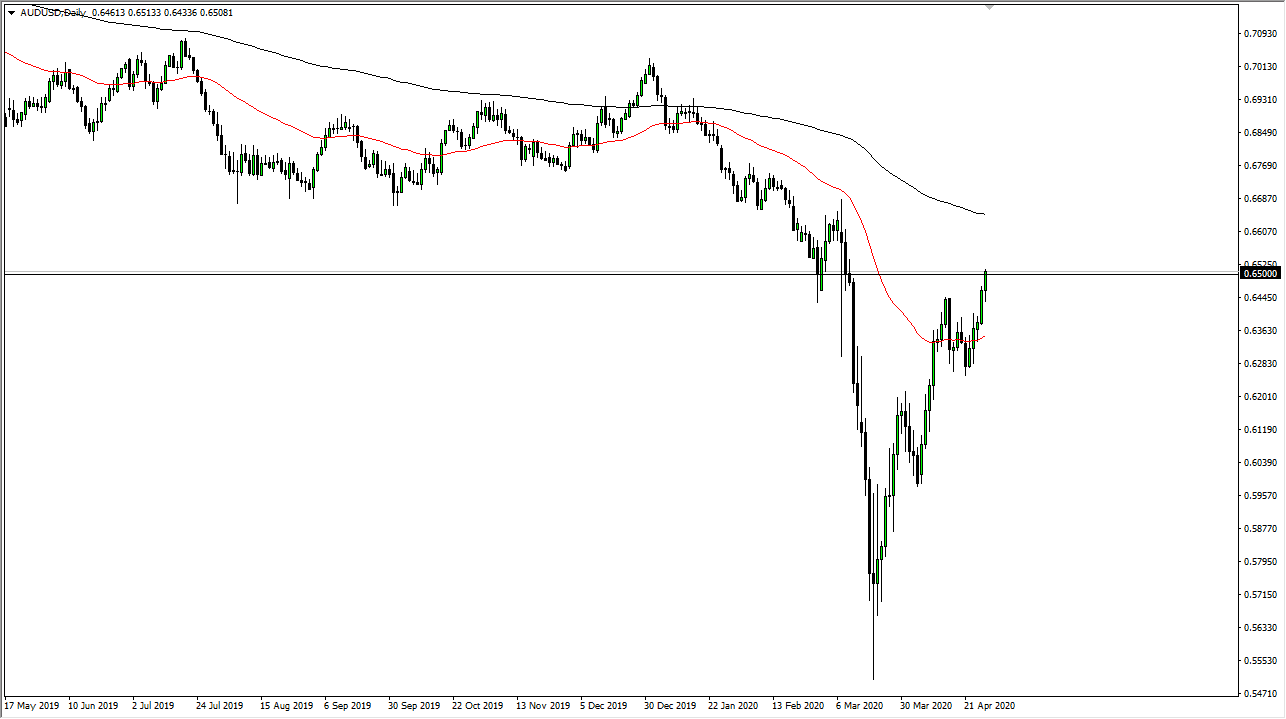

The Australian dollar initially pulled back during the trading session on Tuesday but then turned around to reach towards the 0.65 level, an area that should bring in a fresh wave of selling. That being said, it is obvious that the Australian dollar has been on an absolute tear lately, and it looks as if it is going to do everything you can to find the resistance just above in the major zone. I believe that zone extends to the 0.67 level, or we also see the 200 day EMA.

Looking at this candlestick for the day, it is obviously bullish, but we also have the Federal Reserve coming out with a statement late on Wednesday, and that of course can cause a lot of issues. Overall, I believe that this market will continue to see the longer-term trend reassert itself, because it is basically implausible that the trend changes like it has and continues to go much higher without some type of major shift in the global supply chain and demand in general.

At this point, the economy around the world continues to slow down so that does not bode well for the Aussie dollar as it is extremely sensitive to China and the demand that the market may or may not show around the world for Chinese goods. Austria supplies China with most of its raw materials when it comes to hard metals, and that of course is a way to link Australia and China. In fact, as the Chinese Yuan does not freely trade, a lot of traders will use the Aussie as some type of proxy. At this point, the market is likely to see a bit of exhaustion come into the marketplace, especially after the Federal Reserve makes its announcement. The question is whether or not we have peaked when it comes to US dollar weakness? If you start to see the US dollar strength in late during the day on Wednesday, it is highly likely that the Australian dollar will be one of the first places you choose to express that opinion, as this market is extraordinarily overbought. This is a market that will continue to be extremely sensitive to the global demand scenario, and even though economies around the world are starting to talk about waking up, the reality is that there has been serious demand destruction out there, something that will be cured overnight.