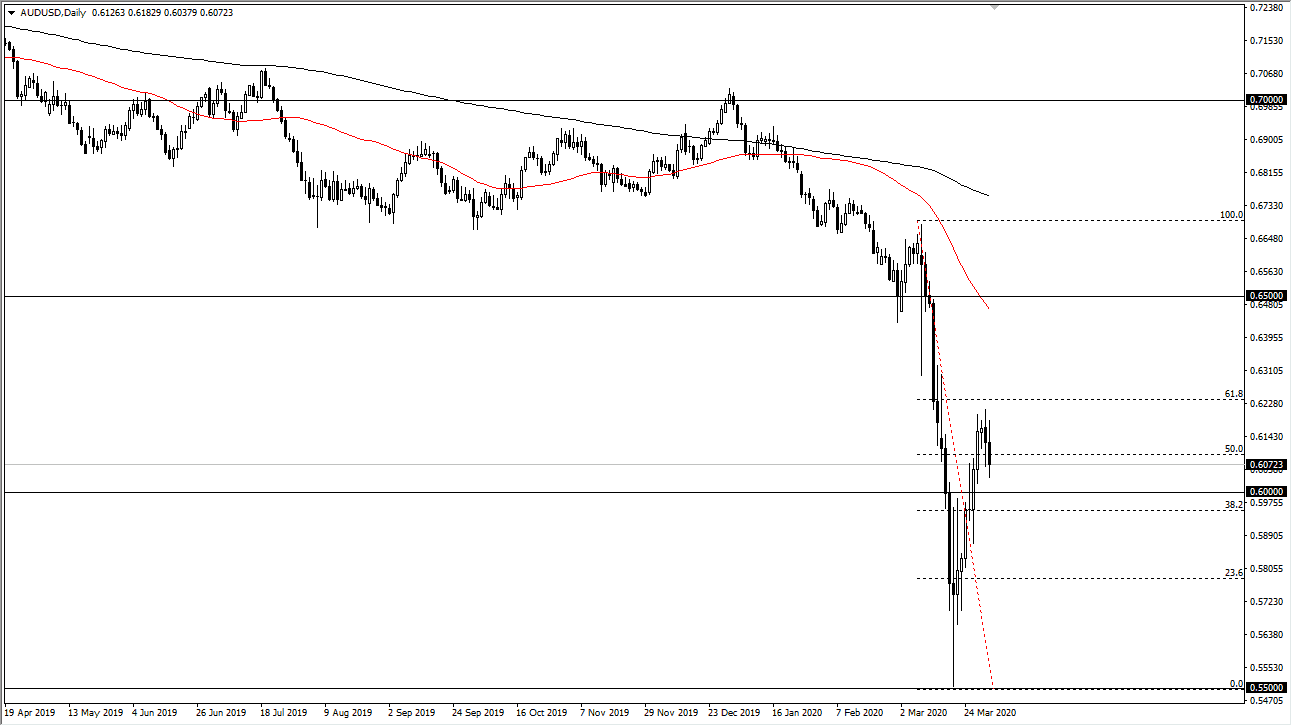

The Australian dollar initially tried to rally during the trading session on Wednesday but gave back the gains to reach towards the 0.6050 level. This is a currency that is highly sensitive to the overall risk appetite and global supply chain situation around the world. After all, Australia is one of the biggest drivers of commodities and global growth due to its wealth of copper, aluminum, iron, and the like. At this point, the market is likely to continue to reach towards the 0.60 level, and possibly lower than that. If we break down below the 0.60 level, then it’s likely that the market could even drop down to the 0.50 level underneath.

With the jobs number coming out on Friday, it will be interesting to see how that affects this market. The US job situation is murky at best and a horrific reading is anticipated. This could have a huge effect on the overall risk appetite. Looking at the close of the candle, we have certainly seen a bit of negativity but given enough time it’s likely that the fear really start to catch hold. After all, gains in risk appetite seems to be fleeting at best.

Another thing to pay attention to is the fact that the market has pulled back from the 61.8% Fibonacci retracement level which also offers a significant amount of resistance and there was a gap in the highs that we just made previously. With that being the case, I think it’s only a matter of time before the sellers would take over and therefore it makes sense that we fall like this. That being said, the market was to turn around a break above the 0.65 zero level it’s likely that the Australian dollar could then go towards the 0.65 handle or at least the 50 day EMA which is just below there right now.

At the very least, I believe that the Australian dollar needs to make a run towards lower levels so that it can try to find some type of stability and perhaps make a “higher low”, which is the first sign that we will be trying to turn things around and stabilize a bit pair we are at extraordinarily low levels, so I do think that given enough time we should see some type of bottom. We aren’t there yet, at least not with the last couple of candlesticks that we have seen.