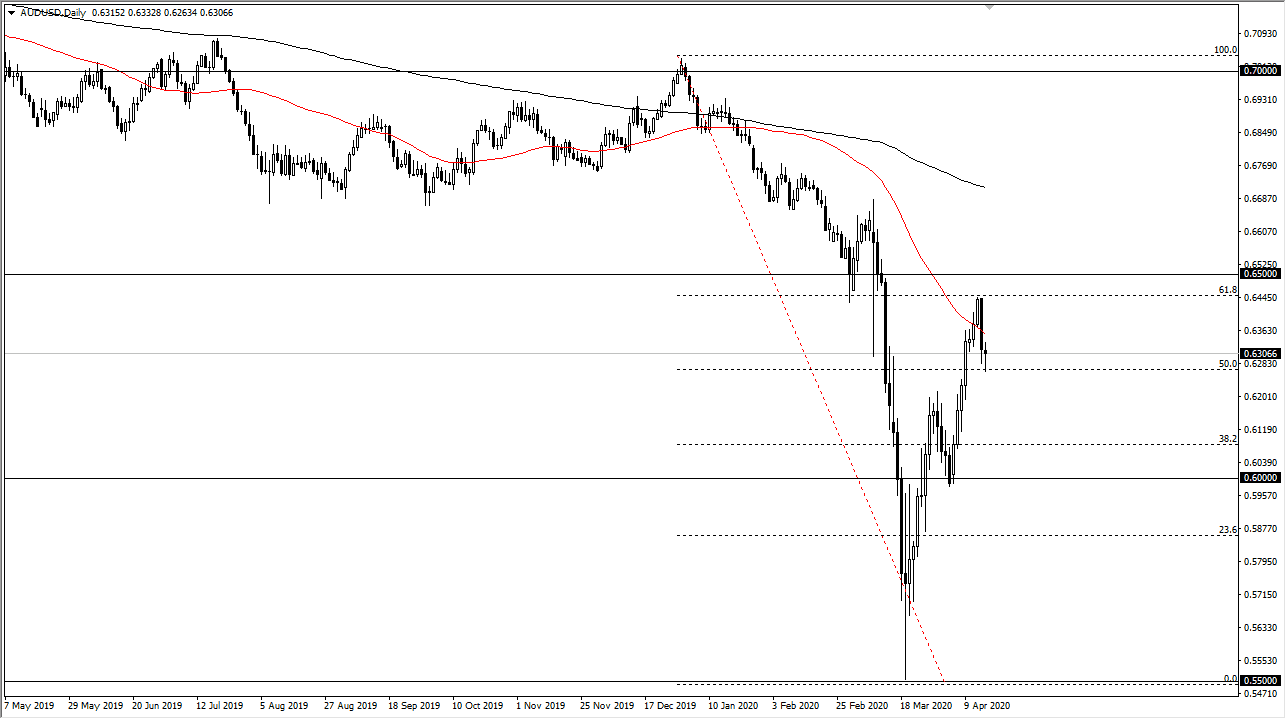

The Australian dollar has pulled back a bit during the trading session on Thursday but have recovered quite nicely to turn things around and form a bit of a hammer. This is obviously a very bullish sign but I think the Australian dollar showed its true colors during the trading session on Wednesday as we have completely broken down through three candles during that session alone. Rallies at this point look like nice selling opportunities to me, because I believe that the 0.65 level above is an area that should attract a certain amount of attention.

To the downside, if we were to break down below the candlestick for the trading session on Thursday, I think that the market goes down to the 0.62 level next. That was an area that had been previous resistance and it should now be support based upon “market memory.” On the other hand, if we break above the top of the candlestick for the trading session on Thursday, then I’m going to be looking towards shorting this market near the 0.6450 level. In that general vicinity, I think some type of exhaustion will show itself that I can take advantage of.

Remember, the Australian dollar is highly levered to the Chinese economy and the Chinese situation, as Australia supplies so much of the raw materials necessary for the Chinese industrial machine. The Chinese are getting back to work and that of course is part of the reason we have seen the Australian dollar rallied a bit, and of course the fact that the employment figures that came out early during the trading session on Thursday, although better than the expected headline figures, were mainly made up of part-time jobs, not something that necessarily brings a lot of confidence in when it comes to the economy the currency represents. In other words, it’s only a matter of time before this market breaks down because although the Chinese are working, nobody else is and therefore nobody else is buying those goods. If your customer doesn’t come to the store, you’re not making sales. China is about to find itself in that position, as Australia enters a recession for the first time in almost 40 years. All things being equal, I don’t have any interest in buying the Australian dollar in the short term as I think there is far too much in the way of trouble out there.