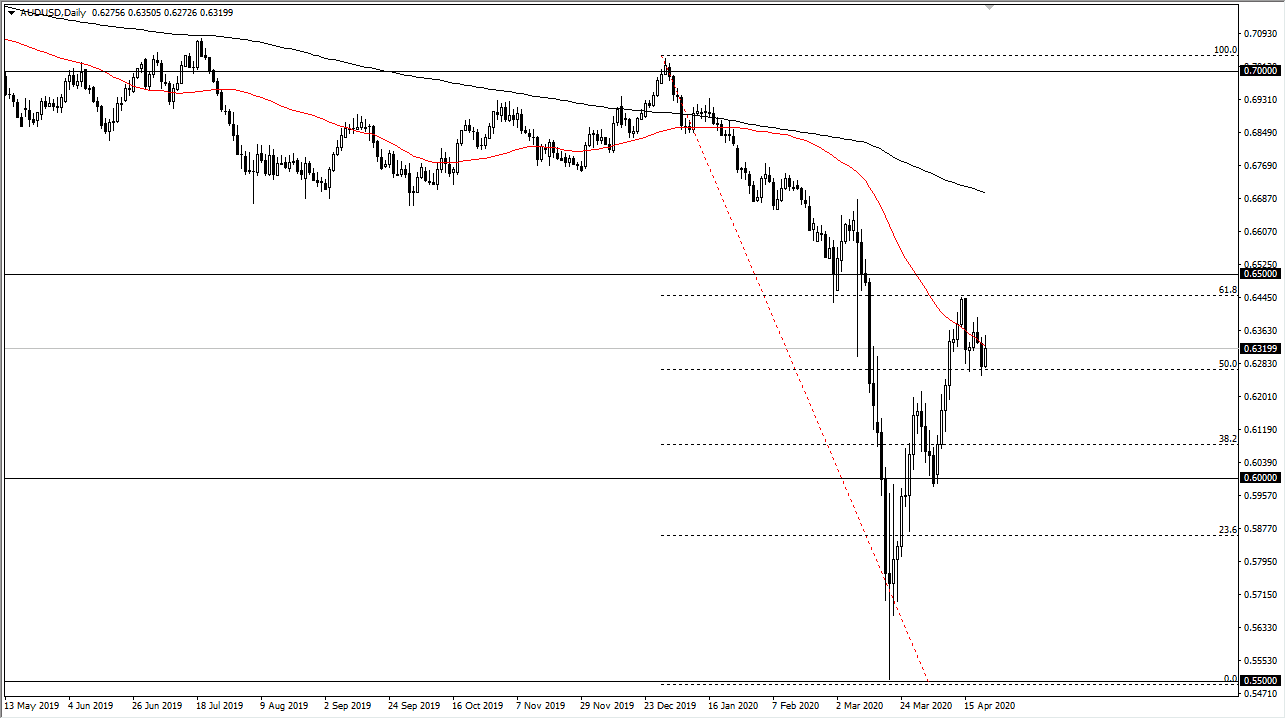

The Australian dollar rallied a bit during the trading session on Wednesday, reaching towards the 50 day EMA where there has been selling pressure. At this point, the market has rolled over just a bit and it looks to me as if the market is trying to rollover a bit. We are just above the 0.63 level, but at this point I think we are more than likely going to see sellers come in and punish the Australian dollar as there is no real demand out there when it comes to the global economy so it’s difficult to imagine that this will be sustainable. Granted, the Aussie had been in a nice uptrend, but it certainly seems as if this continues to be a “fade the rally” type of set up.

I believe that the 0.65 level above offers a major ceiling for this market, and it is not until we break above there that I would be overly excited about this market. Looking at this market, I do believe that we will eventually go looking towards the 0.62 level underneath which is a major swing higher from before, but I think we break down below there and go closer to the 0.60 level. It is one of those scenarios where we simply need a little bit of a push to rollover from what I can see.

The US dollar will continue to be one of the better performers out there, as there is a lot of demand for safety. Granted, that was not necessarily the case during the Wednesday session but in general you can see that the interest rates in the United States continue to drop, meaning that there has been a lot of buying pressure. This of course is a major driver of US dollar strength and should continue to be. The market has rallied all the way to the 61.8% Fibonacci retracement level, and then rolled over and what would be a classic move. I think that is the first serious sign of trouble, and it’s only a matter of time before we get some type of negativity when it comes to the global economy that should send the Aussie lower as it is so highly levered to the Chinese export economy as it is a supplier of so many raw materials. With this, I continue to short this market on small rallies that show signs of exhaustion on short-term charts.