The Australian dollar rallied a bit during the trading session on Friday, as the world celebrated the announcement from Donald Trump that the United States may open up much sooner than anticipated. Having said that though, it seems as if there is plenty of concern out there still, and the Australian dollar has no business rallying the way it has. Granted, the Chinese have gone back to work to a point, but at the end of the day there is no demand for the goods that they are trying to produce. Furthermore, Australia is about to enter its first recession in over 30 years, and the Reserve Bank of Australia is almost certainly going to do more quantitative easing or some type of monetary policy in the short term.

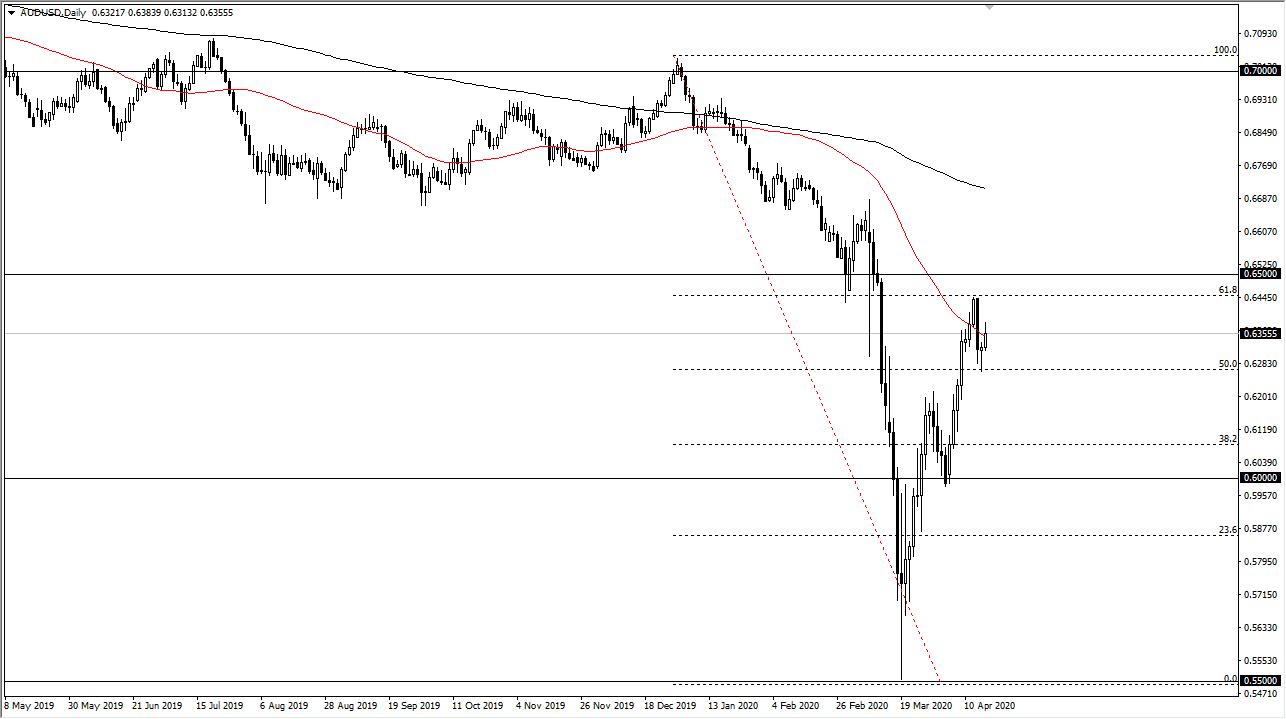

As the market approach the 50 day EMA, you can see we have pulled back from there to show signs of exhaustion. The 0.6450 level above continues offer a significant amount of resistance that extends to at least the 0.65 handle, if not the 0.66 level. In other words, there is an absolute ton of resistance above that will continue to cause major issues. Furthermore, what’s worth noting as we rallied during the trading session on Friday, treasury yields didn’t fall much, citing demand for US denominated paper. This will drive up the value of the US dollar on the whole.

If we break down below the hammer from the session on Thursday, then I think the Australian dollar is free to drop towards the 0.62 level. At this point, I still prefer to sell short-term rallies that show signs of exhaustion, and don’t have any interest in buying this pair until we get a daily close above the 0.66 handle. If that happens, then it’s very likely that the market goes looking towards the 200 day EMA, and then the 0.70 level after that. Ultimately though, I think it’s much easier to fall from here than it is to rise, so therefore I am only keeping the idea of buying this pair in the back my head, and at this point don’t see any reason to be involved to the upside. Obviously, things change so the 0.66 level is my “line in the sand” when it comes to any selling. Longer-term, I would not be surprised at all to see this market go looking towards the 0.60 level given a few bad headlines.