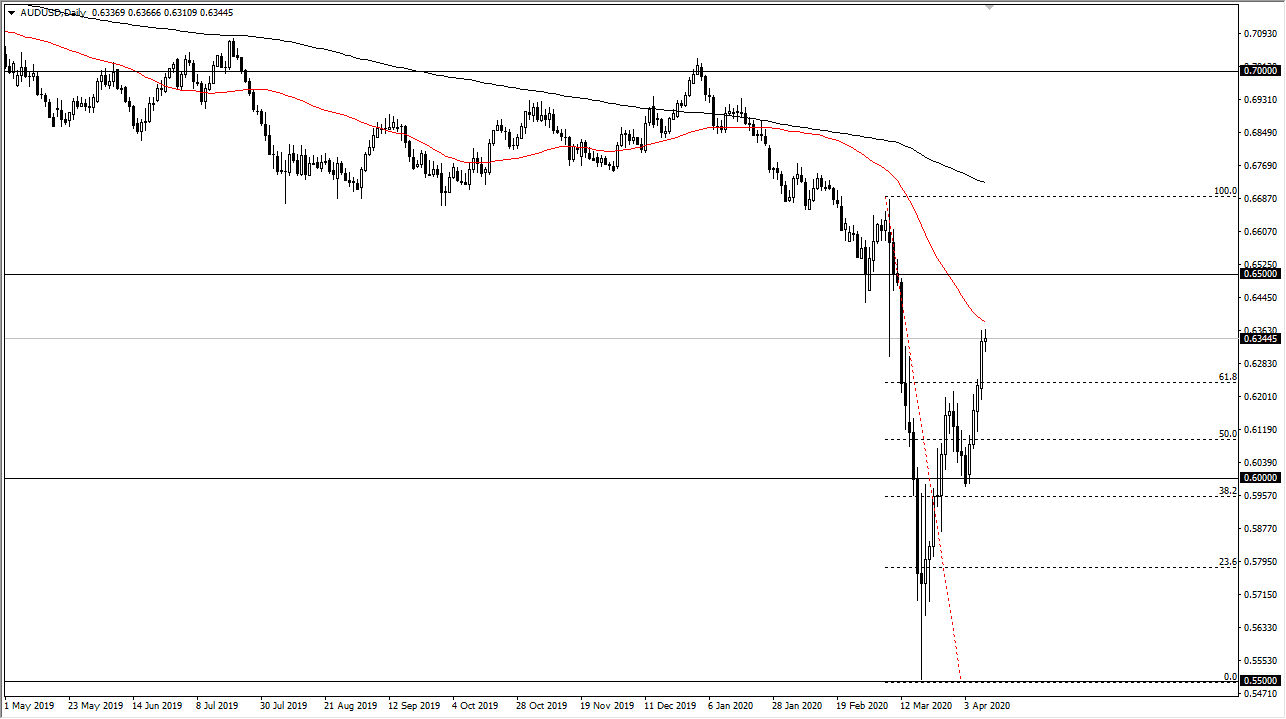

The Australian dollar went back and forth during the trading session on Friday as you would expect, with that being Good Friday and most banks closed around the world. That being said, when we look at the Thursday session you can see that we had taken out to the upside and held most of the gains. That of course is impressive, as the market slice through major resistance previously. In fact, a couple of weeks ago the market had formed large tales at the top of shooting stars in that area and the fact that we are broken through it is another positive sign.

Keep in mind that the Federal Reserve has introduced another $2 trillion worth of stimulus into the marketplace, and that should continue to work against the value of the greenback. The Australian dollar certainly has taken advantage of that, and as a result we have seen a lot of momentum to the upside. What’s interesting is that not all currencies have faired the same. The Australian dollar is currently one of the most resilient and perhaps the strongest currency that I follow, so that’s worth paying attention to. I believe that pullback should continue to have plenty of buyers underneath, especially near the 0.62 handle. To the upside I would anticipate that the 0.65 level would be the ceiling in the market currently.

Pay attention to the 50 day EMA which is just above, as it could offer a little bit of resistance but at the end of the day, I think that’s only a minor blip on the radar one way or the other. I don’t have any interest in shorting the Aussie anymore, but I don’t necessarily think you should be paying for it all the way up here either, because it has extended so far in the last several sessions. A bit of a pullback offers you value in a market that is clearly turning things around and it looks very strong. I would not read too much into the candlestick on Friday other than the fact that nobody was rushing to cover their short positions. The weekend of course will bring a new slew of headlines that could affect risk appetite, so we should see a gap on Monday, which could get his move in rather quickly. It’s not until we break down below the 0.60 level that I would consider shorting this pair.