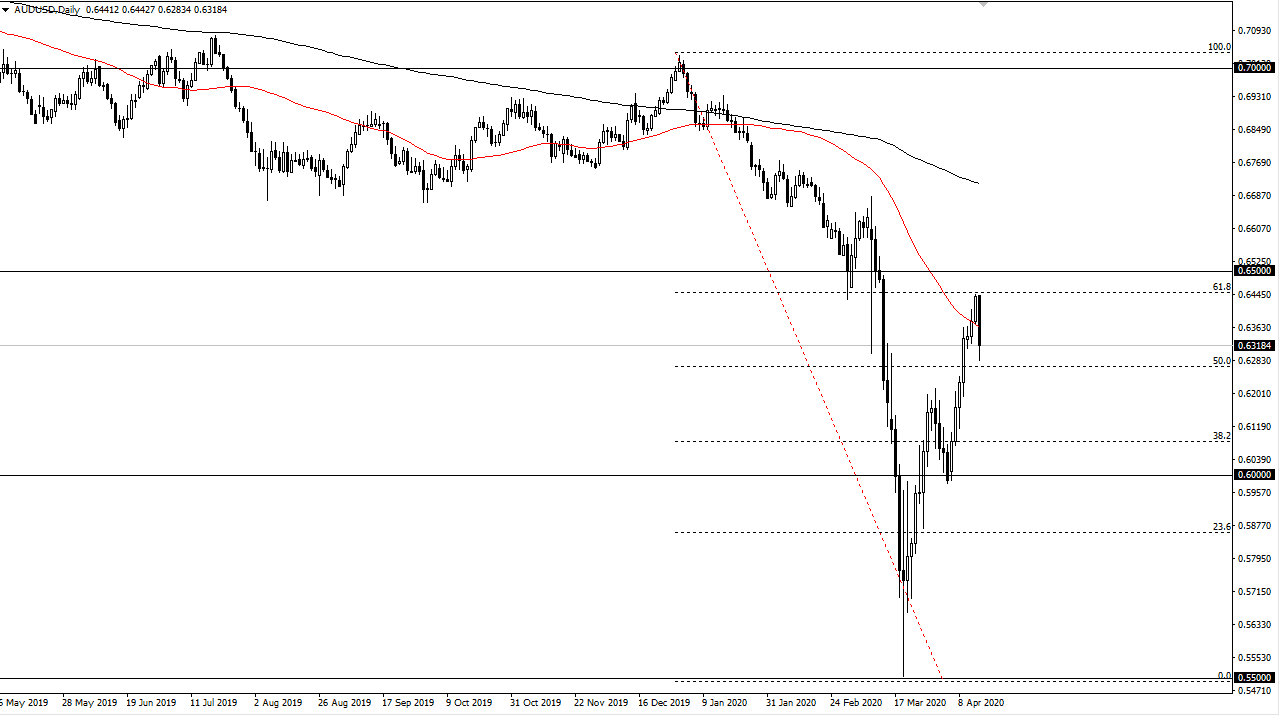

The Australian dollar formed a very negative candlestick during the trading session on Wednesday, and now looks likely to break down from the 61.8% Fibonacci retracement level. This is a currency that has no business rallying the way it has, due to the fact that the global economy has shut down. Remember, Australia is highly levered to the Chinese situation, and even though China has gone back to work to a point, the reality is that there aren’t that many customers out there. In other words, there is going to be much less of the demand for the Australian dollar.

Australia is entering its first recession in 30 years. Furthermore, this is a “double high, low close” formation, which typically leads to more selling. There is a bit of a “brick wall above, and it’s likely that I think if we do rally towards this area it’s likely that the market will probably continue to find plenty of sellers. Treasury markets remain well bid, so it makes sense that the US dollar continues to offer an attractive place to be, although I recognize we may get the occasional short-term rally. I am still looking to fade those rallies until we close well above the .65 level, possibly even the 0.66 handle.

To the downside, the 0.62 level will be targeted, as it is an area where people had been willing to get involved. Beyond that, it’s very likely that we go to the 0.60 level, which is even more crucial. While we are at extremely low levels in comparison of the last couple of decades, the reality is that we are in a situation where the financial system is under extreme amounts of stress. With various countries around the world shut down due to the coronavirus epidemic, it’s difficult to imagine a scenario where people want to take on a ton of risk at this point. The Australian stock market will probably get hit as there are a lot of major suppliers to the Chinese economy in the index, and therefore money will be flowing out of Australia. That will drive the Australian dollar lower as people leave that economy. I’m not necessarily calling for the end of the world, but clearly this is not an environment where we should be seeing a lot of growth. With the lack of growth, there’s no need to think that the Australian dollar is anywhere near being a currency you want to be involved in for the longer term.