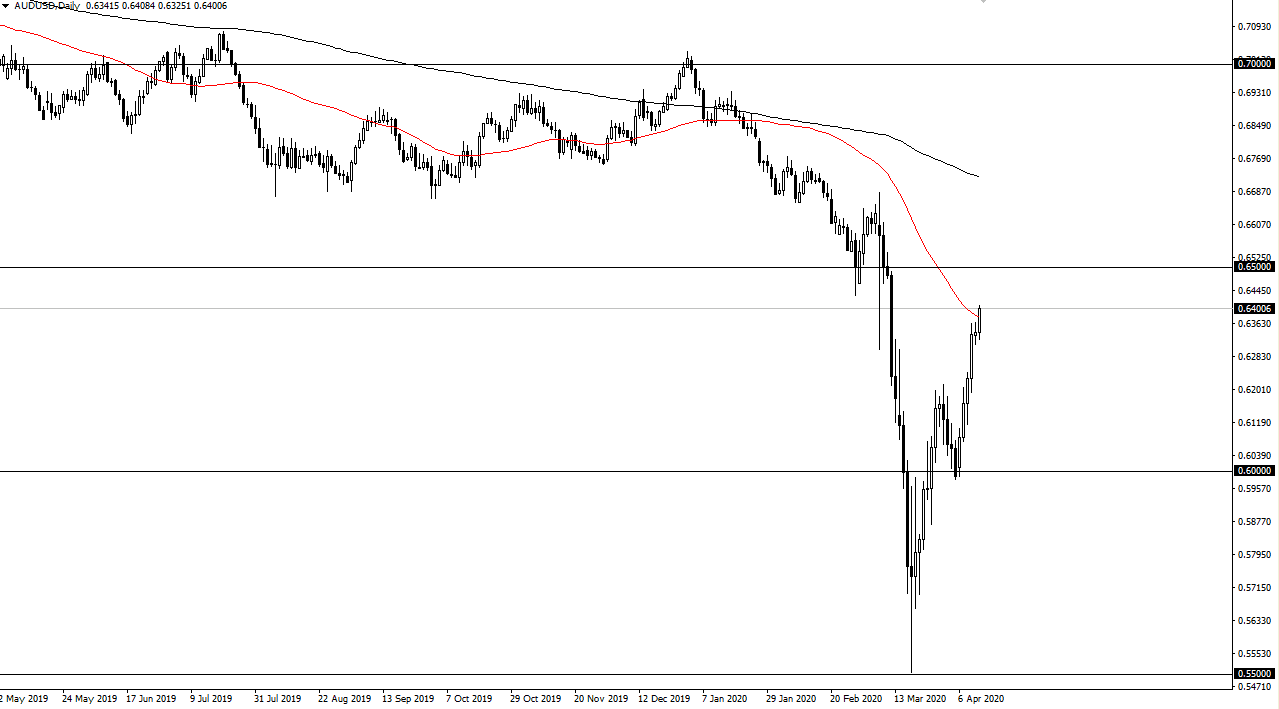

The Australian dollar has rallied a bit during the trading session on Monday to pierce the 50 day EMA. Having said that, the market is likely to continue to be very noisy, and therefore we will get the occasional pullback. However, we have seen the Australian dollar grind its way much higher, and it certainly looks as if it is ready to continue reaching towards the next major resistance barrier ahead, at the 0.65 handle. That is not only a psychologically important figure, but it is also a structurally important figure to pay attention to as well.

On the other hand, if we were to turn around a break down below the Friday candle of last week, that could lead to a pullback towards the 0.62 handle, maybe even the 0.60 level after that. That being said, keep in mind that the Australian dollar has done quite well against the US dollar, mainly due to the concerns about the Federal Reserve throwing a ton of currency out there. Ultimately though, the Australian dollar is also highly sensitive to the global risk equation, and the Chinese economy. That’s two signs of the same coin, because most of the global supply chain goes through China at one point or another. Australia is a major provider of commodities for that supply chain, so we need to see some type of good news in order to continue this uptrend.

I anticipate at this point we are simply looking at a market that is starting to finally face significant resistance, so I think the next couple of days could be a bit difficult. If we can get above the 0.65 level on a daily close though, that could finally send the Australian dollar much higher. That being said I see a lot of noise just above there, so my best case scenario is that we still see a bit of a fade in the short term. After all, we have gone straight up in the air so it wouldn’t be a huge surprise to see a little bit of a pullback, even if you are bullish. After all, no market can go in one direction forever, so I believe that we are a little bit overdone but may have a little higher to go before finding true selling. I think we make a little higher initially, only to start selling again as we had been doing previously.