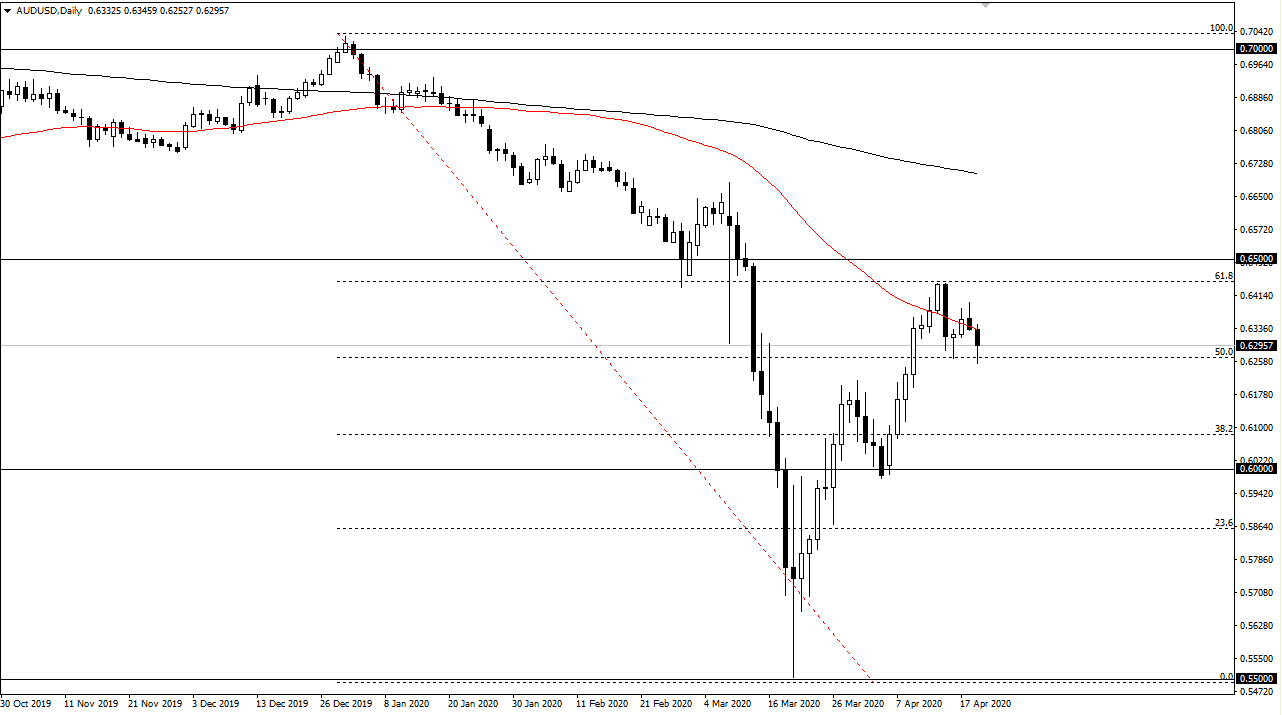

The Australian dollar fell significantly during the trading session on Tuesday, reaching down towards the 0.6250 level and then promptly bounced from there. At this point, it looks like the Australian dollar is going to put up a bit of a fight, but it is obvious out there that there is a lot of negativity. At this point, the market is trying to price in whether or not there is going to be any economic growth. At this juncture, it seems very unlikely and as a result people have been selling the Australian dollar retirement rallies. The 50 day EMA certainly has sliced through a lot of the recent price and it suggests that we are going to continue to struggle.

However, the Australian dollar has been extraordinarily stubborn, and therefore it is not a huge surprise to see that later in the day we had seen the market rallied a bit. If we can break down below the candlestick for the trading session on Tuesday, that would be an extremely negative sign to me and I think that the market probably goes looking towards the 0.62 level, perhaps even down towards the 0.60 level underneath. On the other hand, if the market was to break above the top of the candlestick for the trading session on Tuesday, then we could go looking towards the highs again which are closer to the 0.6450 level.

I believe that area is an extension to the 0.65 handle which I think is a massive resistance barrier. The Chinese economy is starting to work again but there are very many buyers of Chinese goods out there. In other words, the demand for the Australian dollar will continue to be a bit skewed, due to the fact that copper and other base metals simply are not needed. Australia has just entered a recession for the first time in over three decades, so that is something to pay attention to as well. Ultimately, I believe that this pair probably is a “sell the rally” type of situation as demand for US Treasuries will continue. This is a market that will continue to move with the latest coronavirus headlines as well, but I do believe that the absolute lockdown of the global economy continues to be the only game in town, and it is pointless to try to fight this. Buying the Australian dollar makes absolutely no sense at this point.