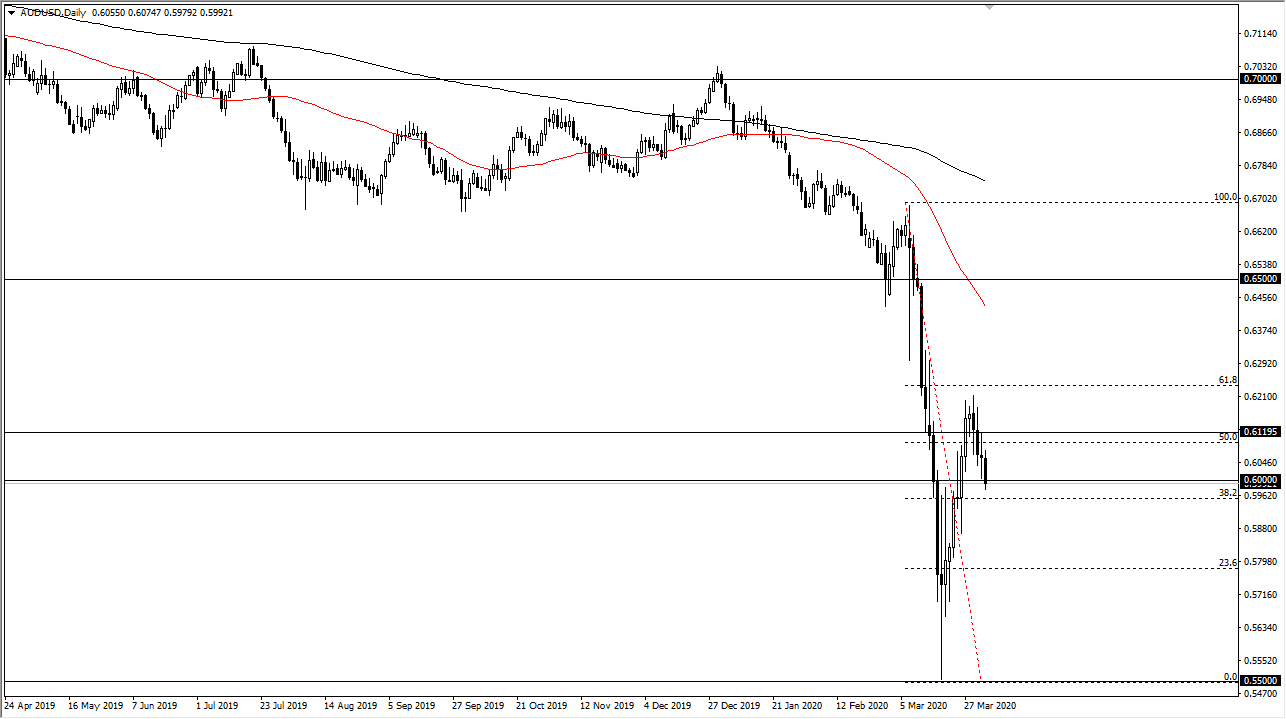

The Australian dollar fell during the trading session on Friday, drifting below the 0.60 level, an area that of course is a psychologically significant figure. That being said though, the market has broken down significantly from the high, but it has been somewhat orderly. Because of this I believe that the market is going to continue to go lower but it may not be some type of massive break down like we had seen previously. When you look at the most recent break down in this pair, you can see that we have had a bit of a dead cat bounce so it would make quite a bit of sense that we have rallied as hard as we have and then it’s likely that we are going to go towards the bottom again as it is the bottom of the overall move. The 0.55 level of course is represented by this low.

The Australian dollar is highly sensitive to the global supply chain situation, and as the Chinese are the biggest consumer of Australian raw materials, it will come down to whether or not the Chinese even need those raw materials. As long as the West is extraordinarily locked down the way it has been, it’s difficult to imagine that the Chinese economic machine will be kicking along the way it was before. This certainly will have a negative effect on the Australian dollar and the Australian economy on the whole.

Furthermore, a lot of money is flowing into US treasuries and that helps the greenback. At this point, I do think that we need to at least retest the lower levels, in order to find some type of floor or basing pattern for this currency pair. After these type of precipitous falls, you don’t just turn around and wipe them out very often, at least not without some type of major catalyst. Right now, we don’t have that as so much of the world is locked down and simply not transacting anywhere near as much business as they had been. For example, air traffic in the United States is down 95%. That is not a scenario that looks good for global growth, so with that in mind it’s likely to still be difficult for the Aussie but the question now is whether or not the bottom holds and if we can form a base to change the trend longer-term from?