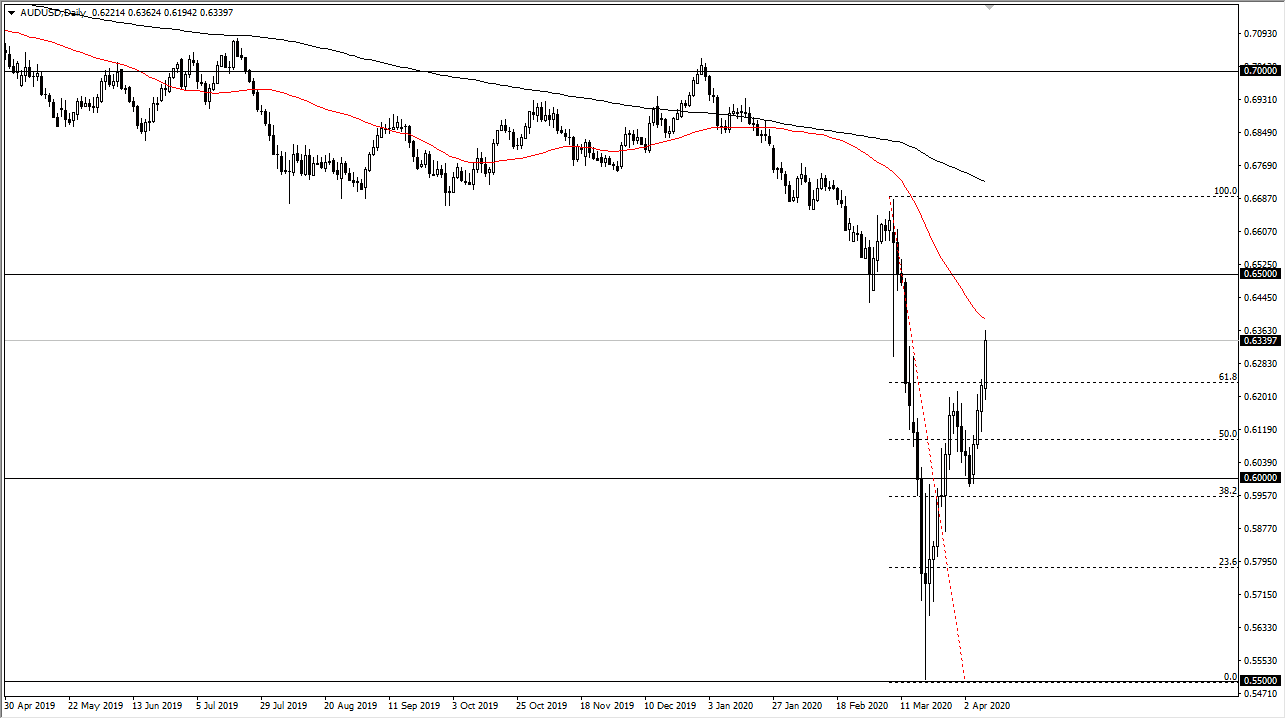

The Australian dollar has rallied significantly during the trading session on Thursday, breaking above the 0.63 handle during the day. Ultimately, this is a market that has been extraordinarily bullish over the last couple of days as we continue to see a lot of US dollar weakness due to the Federal Reserve issuing another $2 trillion worth of stimulus.

At this point, I believe that the 50 day EMA above could offer a bit of resistance but it’s very likely that we will continue to see buyers on dips. The 0.62 level underneath could offer a significant amount of support, as it was significant resistance. Furthermore, we are above the 61.8% Fibonacci retracement level and quite often that will attract a certain amount of movement to the upside again. At this point, this is a market that seems to be celebrating the idea of liquidity out there, and perhaps the idea of China getting back to work. Unfortunately, I think there are a lot of moving pieces here that we need to take care of and pay attention to, because the global situation continues to be extraordinary at the moment, and of course the global supply chain is in pieces. Because of this, it’s possible that we are starting to see the Australian dollar get a little ahead of itself.

Nonetheless, you have to respect the price action which shows so much in the way of positivity. In fact, I have no interest in shorting this pair anytime soon, and I do think that we are trying to put the bottom in. That being said, I do believe from what I’m reading everywhere that people are trying to price in the idea of just a month or two of disruption, which remains to be seen. Ultimately, if the disruption lasts much longer, then it’s hard to imagine a scenario where this pair continues to go higher for much longer. I believe that the 0.65 level above will prove to be rather problematic for the buyers, so ultimately that is the longer-term upside target. If we were to turn around a break down below the 0.62 handle, then it’s likely that we could go down to the 0.60 level. A breakdown below that level turn things around completely in order to continue the overall downtrend. Having said that, the buyers seem to be most certainly in control of the market as we speak.