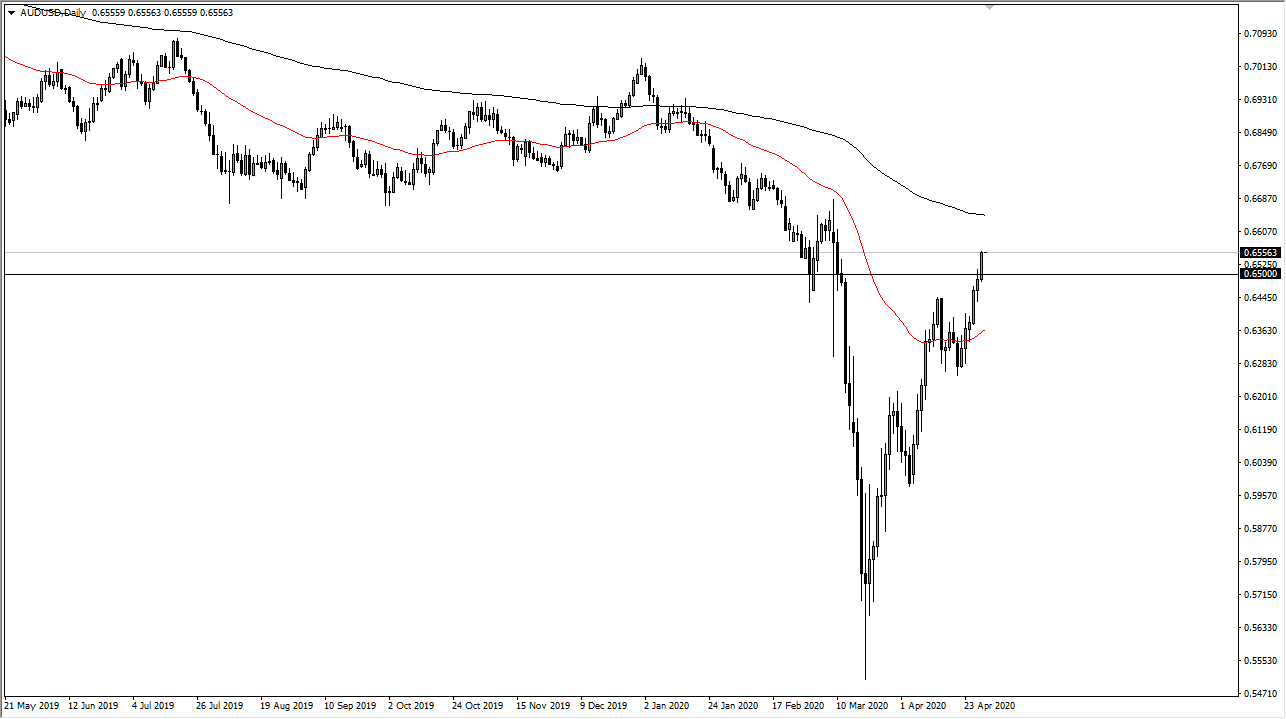

The Australian dollar has rallied significantly during the trading session on Wednesday, slicing through the 0.65 level like it was not even there. That being said, the market is facing a significant pressure in this general vicinity, so signs of exhaustion will more than likely come into play. The 200 day EMA above also offers a lot of resistance, and I think that the top of the range is close to the 0.67 handle. If we break above there, then the downtrend is over, and this market will continue to go much higher. That being said though, I suspect that signs of exhaustion will be jumped upon as the Australian dollar has gotten far too ahead of itself.

The size of the candlestick is something to pay attention to, and it does suggest that perhaps we have further to go. The 0.65 level being broken to the downside would be rather negative and could send this market much lower. Ultimately, this is a market that is anticipating the lot of stimulus and therefore the potential of a rebound as traders continue to look at the possibility of Gilead at being a drug fixing the coronavirus. Granted, that is a big stretch from here so at this point I think that perhaps we are probably looking at a scenario where we will continue to see the Australian dollar show bullish pressure, but it is only a matter of time before we see this market break down from here. If that is going to be the case, then it is possible that we could drop all the way down to the 0.63 level, possibly even lower than that. The US dollar of course is getting crushed by the Federal Reserve but quite frankly if there is some type of “risk off” type of scenario, then you have a scenario where you could have a lot of problems.

If we were to break above the 200 day EMA, it is highly likely that the market is going to go to the 0.70 level. To the downside, if we break down significantly, then it could be rather brutal and rapid, as we have seen so much in the way of noise as of late. I do not like buying the Aussie at this high level, but quite frankly there is no reason to sell it here either based upon the reaction that we have seen during the day on Wednesday.