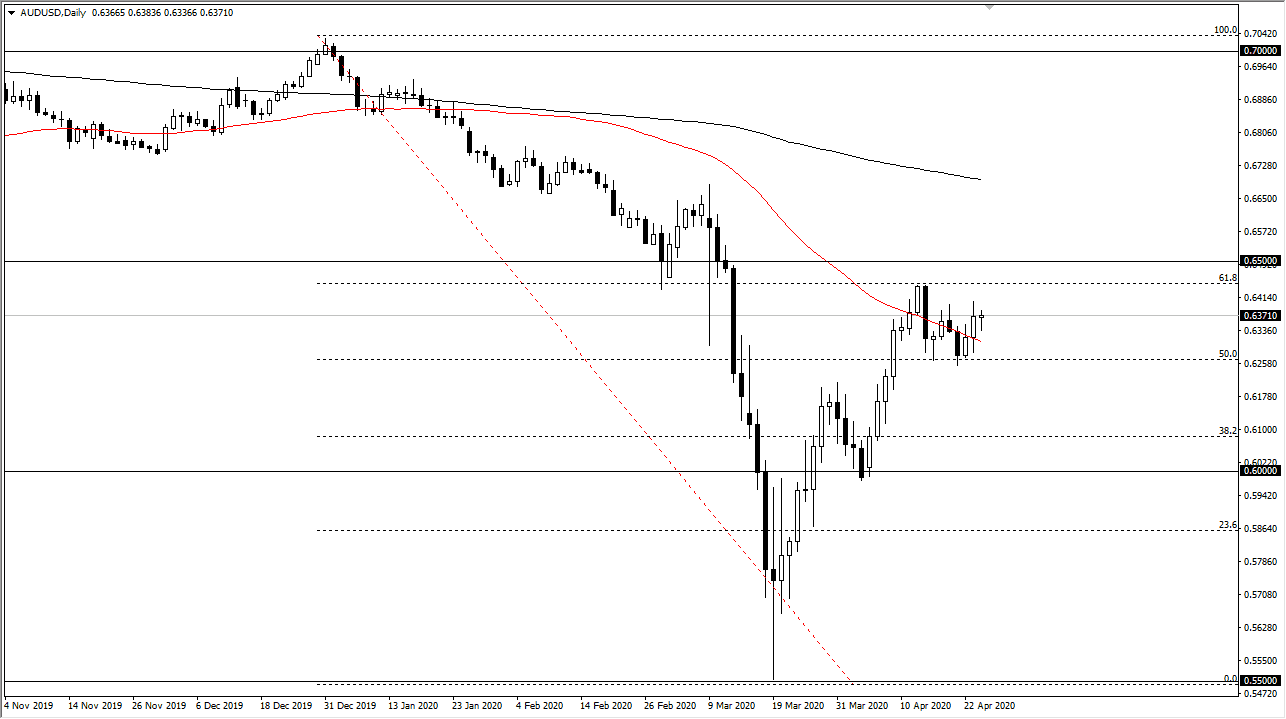

The Australian dollar went back and forth during the trading session on Friday, as we are drifting into the weekend, more of a limp than anything else. The Aussie continues to try to rally, but at this point it looks like there is a significant amount of resistance above that will continue to cause problems. After all, the market has sold off at the 0.64 level several times, but it should be noted that at least it did not selloff as much on Friday. I believe that we have a lot of problems out there that will continue to weigh upon the idea of risk related assets such as the Australian dollar.

After all, the Australian dollar is highly levered to the Chinese economy, and that will have quite a few questions to ask about that economy. After all, it is overly sensitive to global demand and at this point there has been an extraordinarily large amount of damage done to global demand. Even when the economies around the world reopen, there are going to be a lot people that will be buying things like they used to. There will be a lot of businesses that are not going to reopen, and this will most certainly have a huge effect on all of the Chinese goods that are bought.

The market does look as if it has trying to form a bullish flag, so that is clearly a good sign. However, I also see the 0.65 level has been exceedingly difficult to get above, so I believe the next couple of sessions will probably give us much more clarity as to where the Aussie is going to go. A break down below the 0.6250 level I would be a seller of the Australian dollar, because quite frankly it would be a complete failure of the pattern. If we broke above the 0.65 handle, then it would be a very bullish sign and could open up the door to the 200 day EMA. However, one thinks that it is only a matter of time before we get some type of negativity that has people running back towards the greenback. That being said, I think the one thing you can probably count on over the next couple weeks will be a lot of choppiness. We will eventually get some type of impulsive candlestick that could lead to the next move, which I believe will make itself known rather soon.