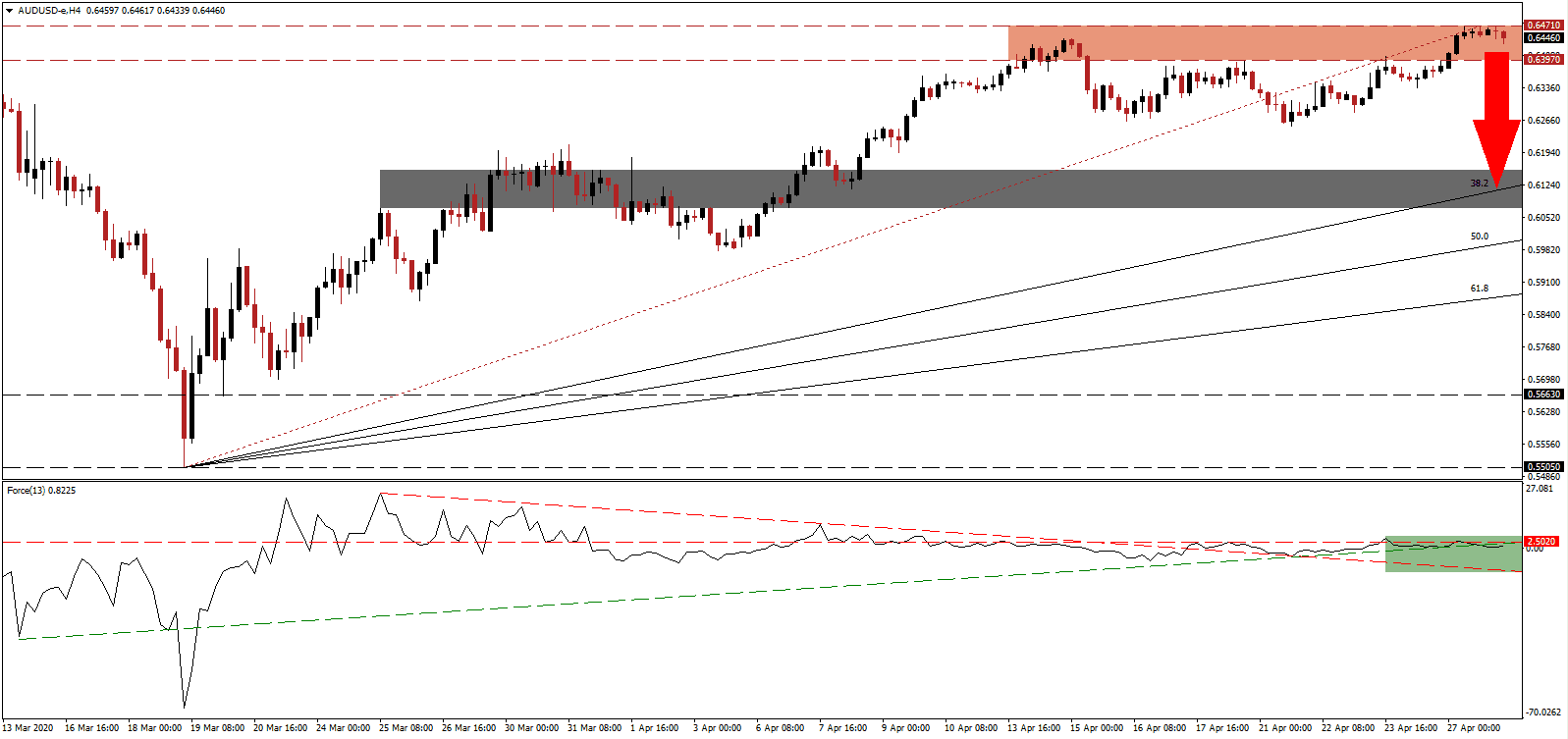

Upon the return of the Australian government on May 12th, an unprecedented statement will be made regarding the Covid-19 pandemic. Nationwide lockdown measures are likely to be relaxed, but the Morris government is additionally anticipated to present a more realistic assessment of the recovery prospects. Frydenberg, the Treasurer of Australia, and Cormann, the Minister of Finance, will use the opportunity to present the budget to the House of Representatives and to the Senate, respectively, to warn the recovery will not be swift. Financial markets remain in a state of hope for a V-shape bounce-back. The AUD/USD advanced into its resistance zone with a long-term bullish outlook, but short-term development suggests a minor correction before the start of a new breakout sequence.

The Force Index, a next-generation technical indicator, drifter lower while this currency pair advanced, resulting in the formation of a negative divergence. After it moved above its descending resistance level, converting it into temporary support, the Force Index contracted below its ascending support level. It remains below its horizontal resistance level in positive territory, as marked by the green rectangle. This technical indicator is favored to collapse below the 0 center-line, ceding control of the AUD/USD to bears.

With numerous governments moving away from unrealistic recovery assessments, markets will begin to evaluate the financial costs and spike in debt loads relating to implemented stimuli. The primary response was to implement nationwide lockdowns and flush domestic markets with debt-induced capital. It was meant as a short-term bridge until economic activity can resume, but it added to the long-term problem. With Australia in a more stable condition than the US, following a breakdown in the AUD/USD below its resistance zone located between 0.6397 and 0.6471, as marked by the green rectangle, more upside should follow.

Any corrective phase is expected to remain limited to the short-term support zone located between 0.6073 and 0.6156, as identified by the grey rectangle. The ascending 38.2 Fibonacci Retracement Fan Support Level enforces this zone. Given the massive recovery in the AUD/USD, a pause is necessary to ensure the longevity of the bullish chart pattern. Economic data out of the US continues to surprise to the downside, highlighting a severe disconnect between reality and price action, which provides upside pressure on this currency pair.

AUD/USD Technical Trading Set-Up - Short-Term Breakdown Scenario

- Short Entry @ 0.6445

- Take Profit @ 0.6130

- Stop Loss @ 0.6515

- Downside Potential: 315 pips

- Upside Risk: 70 pips

- Risk/Reward Ratio: 4.50

In case the Force Index utilizes its descending resistance level as a platform for an accelerated push through double resistance, the AUD/USD is likely to attempt a breakout. Failure to correct from current levels may jeopardize the strength of the next advance, positioning this currency pair for a more violent sell-off in the future. The next resistance zone awaits price action between 0.6645 and 0.6684.

AUD/USD Technical Trading Set-Up - Breakout Scenario

- Long Entry @ 0.6545

- Take Profit @ 0.6685

- Stop Loss @ 0.6485

- Upside Potential: 140 pips

- Downside Risk: 60 pips

- Risk/Reward Ratio: 2.33