Australian Finance Minister Cormann echoes the sentiment of other leaders across the developed world that the economy will face a steep second-quarter contraction, followed by an equally powerful reversal in the second half of 2020. The stimulus of A$320 billion represents the most massive in the countries history, similar to record-breaking aid packages announced by essential economies, and long-term costs are colossal. Global leaders fail to account for changes to supply-chains and readjustments of existing business models, creating excessive downside risk. The AUD/USD is favored to extend its breakout sequence farther to the upside, with Australia in a more stable financial situation than the US.

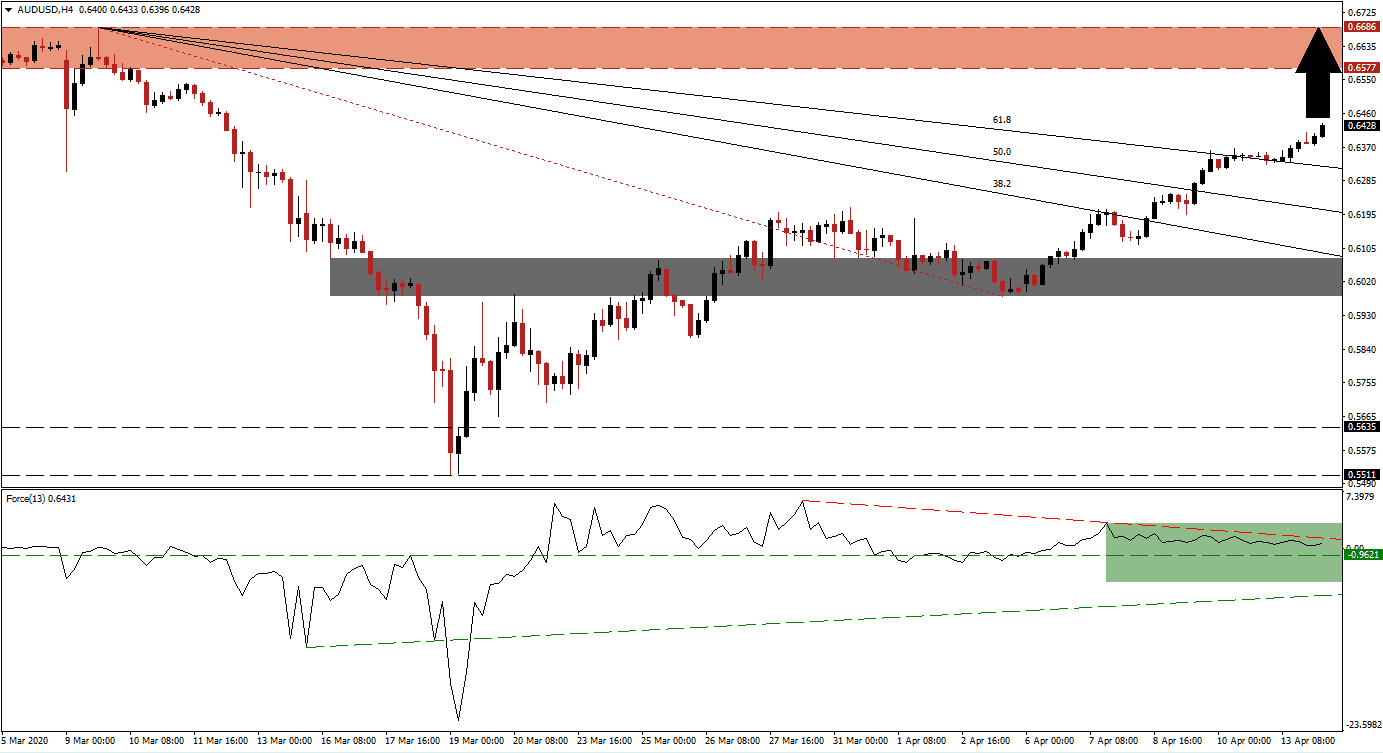

The Force Index, a next-generation technical indicator, drifted higher after briefly dipping below its horizontal support level. It then recorded a lower high, and the descending resistance level rejected an extension of the recovery. The Force Index is expected to attempt a second breakout on the back of stable bullish momentum. Limiting the downside potential is the ascending support level, as marked by the green rectangle. This technical indicator remains above the 0 center-line, and bulls are in control of the AUD/USD. You can learn more about the Force Index here.

A distinct bullish chart pattern is present, confirmed after this currency pair completed a breakout above its short-term support zone located between 0.5981 and 0.6080, as marked by the grey rectangle. Adding to bullish pressures was the push in price action above its descending 61.8 Fibonacci Retracement Fan Resistance Level, converting it into support. The AUD/USD may retest this level before extending its advance, as the series of higher highs and higher lows is well-positioned to continue, assisted by fundamental factors and technical developments.

Failure by global leaders to properly recognize or communicate long-term economic impacts of the Covid-19 pandemic, inspired by hopes to keep consumer spirits elevated, positions markets for more turmoil ahead. Debt levels spiked over 10% while the same amount of the workforce has been lost. Full lockdowns are unsustainable, but healthcare professionals warn against lifting them prematurely. Secondary infections are on the rise, adding uncertainty over how to combat the virus. The AUD/USD is favored to challenge its resistance zone located between 0.6577 and 0.6686, as identified by the red rectangle. Negative US data is anticipated to add bullish momentum to this currency pair.

AUD/USD Technical Trading Set-Up - Breakout Extension Scenario

- Long Entry @ 0.6425

- Take Profit @ 0.6685

- Stop Loss @ 0.6350

- Upside Potential: 260 pips

- Downside Risk: 75 pips

- Risk/Reward Ratio: 3.47

In the event the Force Index collapsed below its ascending support level, the AUD/USD is likely to enter a temporary correction. Given developing fundamental conditions, the downside potential remains limited to its 38.2 Fibonacci Retracement Fan Support Level, which has reached the top range of its short-term support zone. Forex traders are advised to consider this an excellent buying opportunity.

AUD/USD Technical Trading Set-Up - Limited Correction Scenario

- Short Entry @ 0.6280

- Take Profit @ 0.6080

- Stop Loss @ 0.6350

- Downside Potential: 200 pips

- Upside Risk: 70 pips

- Risk/Reward Ratio: 2.86