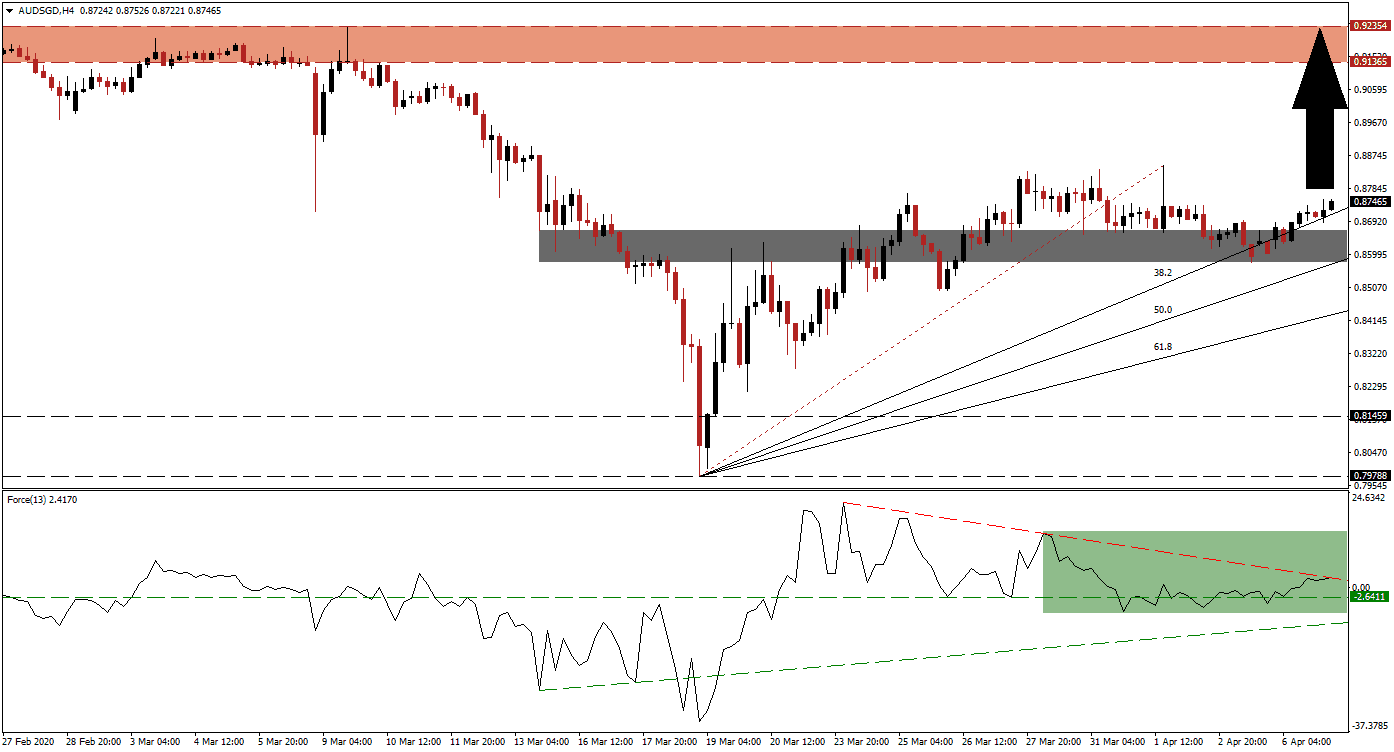

Australian job advertisements slumped for March while February exports and imports posted contractions. The service sector entered into deep recessionary conditions, joining other economies were data was released. It is the beginning of Convid-19 related disruptions, anticipated to dominate headlines moving forward. Despite the grim outlook, the majority remains overly optimistic about the long-lasting impact of this global pandemic. Singapore added S$5.1 billion in stimulus, which now totals S$59.9 billion or 12% of GDP. The AUD/SGD is following it's redrawn ascending 38.2 Fibonacci Retracement Fan Support Level higher, after completing a breakout above its short-term support zone.

The Force Index, a next-generation technical indicator, confirmed the breakout with stale bullish momentum. A temporary dip below its horizontal support level was reversed, with upside pressure provided by its ascending support level. The Force Index is now challenging its descending resistance level, as marked by the green rectangle. This technical indicator remains above the 0 center-line, allowing bulls to retain control of the AUD/SGD.

Governments continue to announce unprecedented amounts of stimuli, surpassing those in response to the 2008 global financial crisis. It suggests the economic fallout, and therefore the recession will be more severe. The attention will shift to long-term costs of government reactions to the virus. Debt-to-GDP ratios are set to spike while budget deficits will expand. Following the breakout in the AUD/SGD above its short-term support zone located between 0.85781 and 0.86663, as marked by the grey rectangle, bullish momentum is accumulating.

Forex traders are advised to monitor the intra-day high of 0.88479, the peak of the existing breakout, and the end-point of its Fibonacci Retracement Fan sequence. A sustained move higher is expected to attract new net buy positions in the AUD/SGD. It will provide the required volume to pressure this currency pair into its resistance zone located between 0.91365 and 0.92354, as identified by the red rectangle.

AUD/SGD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 0.87450

Take Profit @ 0.91850

Stop Loss @ 0.86000

Upside Potential: 440 pips

Downside Risk: 145 pips

Risk/Reward Ratio: 3.04

In the event of a contraction in the Force Index below its ascending support level, the AUD/SGD may enter a corrective phase. Singapore is adding to stimulus measures in an attempt to remain ahead of the pending global recession. Australia has not faced one since 1990, adding a moderately long-term bearish bias to this currency pair, due to inexperience as evident in its economic outlook and planning published in the budget papers. A breakdown can extend into its support zone located between 0.79788 and 0.81459.

AUD/SGD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 0.84850

Take Profit @ 0.81450

Stop Loss @ 0.86000

Downside Potential: 340 pips

Upside Risk: 115 pips

Risk/Reward Ratio: 2.96