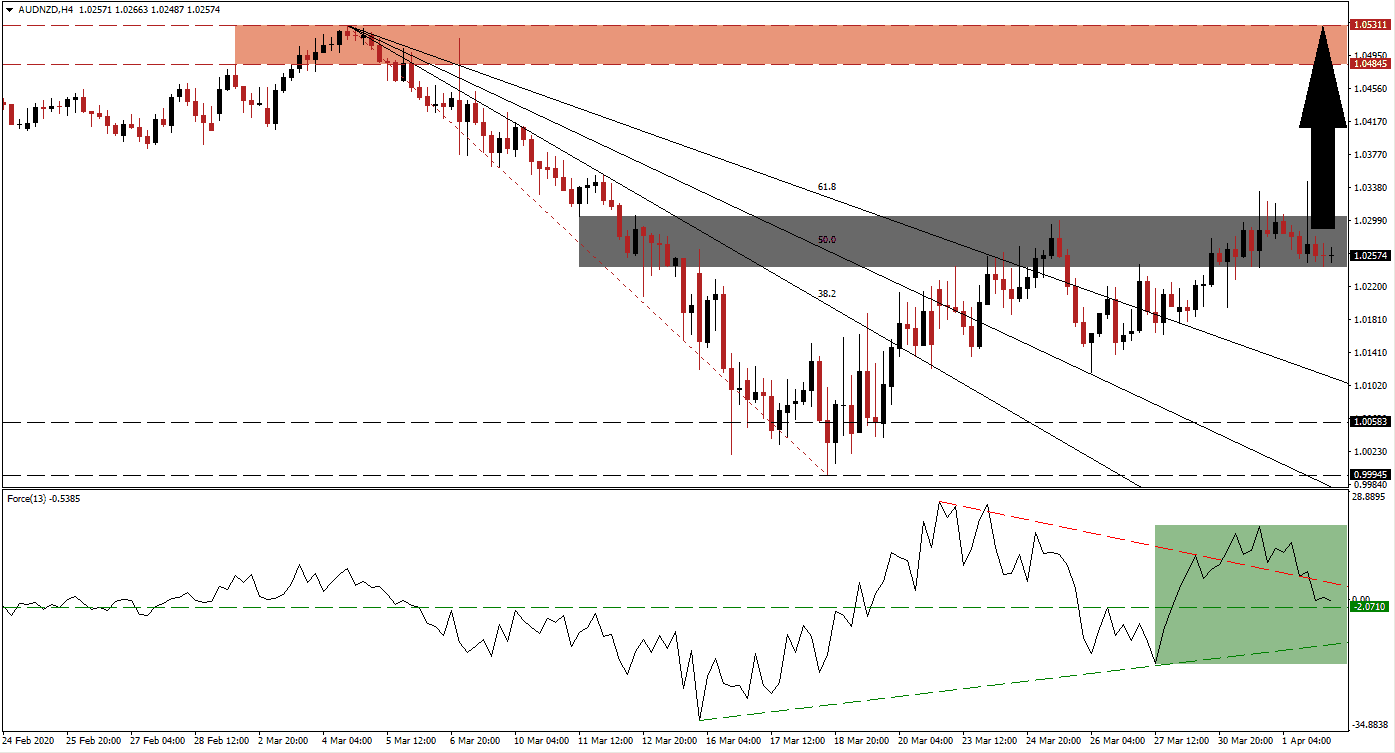

Wartime measures are required to combat Covid-19, according to the International Monetary Fund (IMF). It further notes governments will need to supply the health industry as the pandemic is threatening to collapse the existing infrastructure. Banks started to issue warnings regarding their capital buffers, thought to be more massive than during the 2008 global financial crisis. The Reserve Bank of New Zealand's announcement forbidding local banks to redeem short-term corporate bonds or pay dividends to investors sent shockwaves throughout the industry. Limitations on the financial industry may add to overall economic woes, while traders will pay closer attention to debt levels. The AUD/NZD is pausing at its newly converted short-term support zone, pending a new breakout.

The Force Index, a next-generation technical indicator, points towards a gradual increase in bullish momentum after a higher low allowed the formation of an ascending support level. It is adding to upside pressure, while the Force Index is closing in on its horizontal support level, chased by its descending resistance level, as marked by the green rectangle. This technical indicator dipped into negative territory, but bulls remain in charge of the AUD/NZD with an enforced support level nearby.

Price action converted its short-term resistance zone into support, confirmed following a reversed breakdown. This zone is located between 1.24390 and 1.03030, as marked by the grey rectangle. Australia’s net debt is forecast to surge to over A$500 billion due to the A$213.7 billion worth of economic stimulus packages. The figure rises to A$318.7 billion, including the Reserve Bank of Australia’s measures or 16% of GDP. Chinese PMI data surprised with an unexpected expansion, adding a boost to the AUD/NZD. Both economies are heavily dependent on China, with Australia more exposed. You can learn more about a support and resistance zone here.

Adding to bullish momentum in the AUD/NZD was the recovery off of its descending 50.0 Fibonacci Retracement Fan Support Level, which kept the bullish trend intact. Forex traders are recommended to monitor the intra-day high of 1.03456, the peak of the current breakout sequence. A move higher is favored to attract new net buy orders, providing volume to extend the price action recovery. The next resistance zone is located between 1.04845 and 1.05311, as identified by the red rectangle.

AUD/NZD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 1.02550

Take Profit @ 1.05300

Stop Loss @ 1.01750

Upside Potential: 275 pips

Downside Risk: 80 pips

Risk/Reward Ratio: 3.44

A collapse in the Force Index below its ascending support level is anticipated to pressure the AUD/NZD to the downside. Given the existing fundamental conditions, supported by technical developments, any move lower from current levels should be considered a buying opportunity. The downside potential is limited to its support zone located between 0.99945 and 1.00583, which includes parity in this currency pair, an essential support level.

AUD/NZD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.01200

Take Profit @ 1.00600

Stop Loss @ 1.01600

Downside Potential: 80 pips

Upside Risk: 40 pips

Risk/Reward Ratio: 2.00