Australia’s and New Zealand’s Covid-19 response is being hailed by many in the international community. Both countries share other similarities like being major commodity exporters and their heavy reliance on China. Calls from Australia into inquiries of wet markets in China, where the virus is thought to have originated, outraged China, which voiced its concern via its ambassador. The diplomatic row could have a significant impact on the Australian economy as it attempts to position for recovery out of the first recession in thirty years. Bearish pressures have intensified in the AUD/NZD following an extensive price action reversal. This currency pair is vulnerable to a profit-taking sell-off.

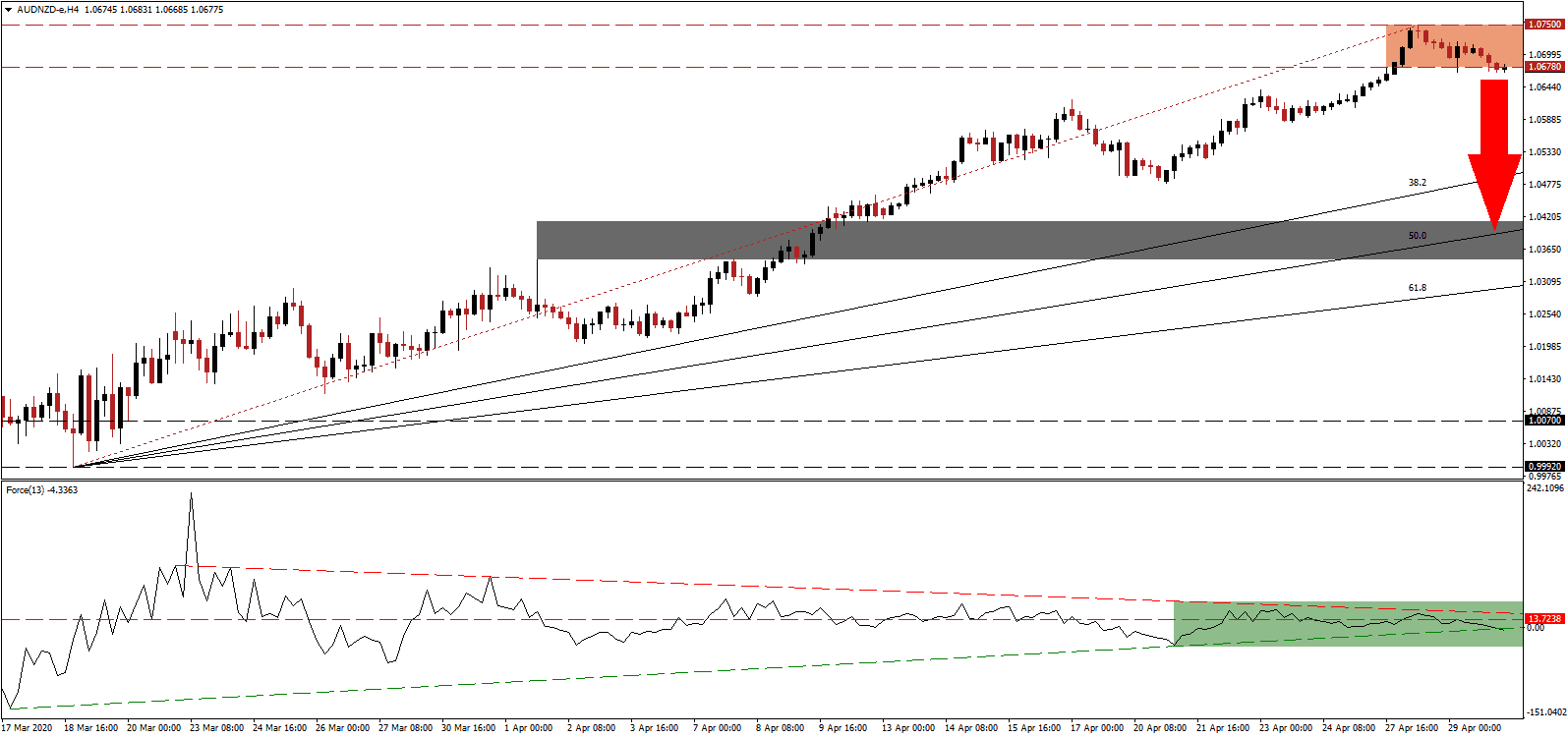

The Force Index, a next-generation technical indicator, confirms the build-up in bearish momentum after being rejected by its descending resistance level. It resulted in a conversion of its horizontal support level into resistance. The Force Index is now pushing below its ascending support level, as marked by the green rectangle. Bears have gained control of the AUD/NZD after this technical indicator slid into negative territory with more downside anticipated.

Chinese PMI data for April came in mixed, Australian private sector credit remained resilient, and New Zealand's business confidence extended its slump. The combination of data sufficed to pressures the AUD/NZD to the bottom range of its resistance zone located between 1.0678 and 1.0750, as marked by the red rectangle. Financial markets started to focus away from Covid-19 headlines and to the cost of stimuli and bailouts, debt levels, and signs of permanent changes in the supply change. Souring diplomatic relations between Australia and China are the latest developments for which markets are unprepared.

A sustained breakdown in this currency pair is favored to close the gap to its ascending 38.2 Fibonacci Retracement Fan Support Level. One essential level to monitor is the intra-day high of 1.0639, the peak of a previous advance. A contraction below it is expected to attract new net sell orders, further fueling the pending corrective phase. The AUD/NZD is positioned to descend into its 50.0 Fibonacci Retracement Fan Support Level, currently passing through its short-term support zone. This zone is located between 1.0347 and 1.0413, as identified by the grey rectangle. More downside is possible but will require a fundamental catalyst.

AUD/NZD Technical Trading Set-Up - Profit-Taking Scenario

- Short Entry @ 1.0675

- Take Profit @ 1.0400

- Stop Loss @ 1.0750

- Downside Potential: 275 pips

- Upside Risk: 75 pips

- Risk/Reward Ratio: 3.67

In the event the Force Index spikes above its descending resistance level, the AUD/NZD may attempt a breakout and extension of its advance. Changing fundamental dynamics limit the upside until more clarity materializes. Failure to enter a correction now will cause a more significant sell-off in the future, as technical indicators suggest present levels are unsustainable. The next resistance zone is located between 1.0840 and 1.0864.

AUD/NZD Technical Trading Set-Up - Breakout Scenario

- Long Entry @ 1.0780

- Take Profit @ 1.0850

- Stop Loss @ 1.0750

- Upside Potential: 70 pips

- Downside Risk: 30 pips

- Risk/Reward Ratio: 2.33