Australian post-Covid-19 planning for the economy to prepare the country for future crises began. The Treasury will evaluate supply chains with a focus on implementing sovereign capabilities and less dependence on essential items. The primary focus remains on fuel, energy, and pharmaceuticals. It is the latest example of how the global pandemic will change existing systems where globalization was at the core. After the AUD/JPY concerted its short-term resistance zone into support, the rise in bullish momentum is favored to spark the next breakout.

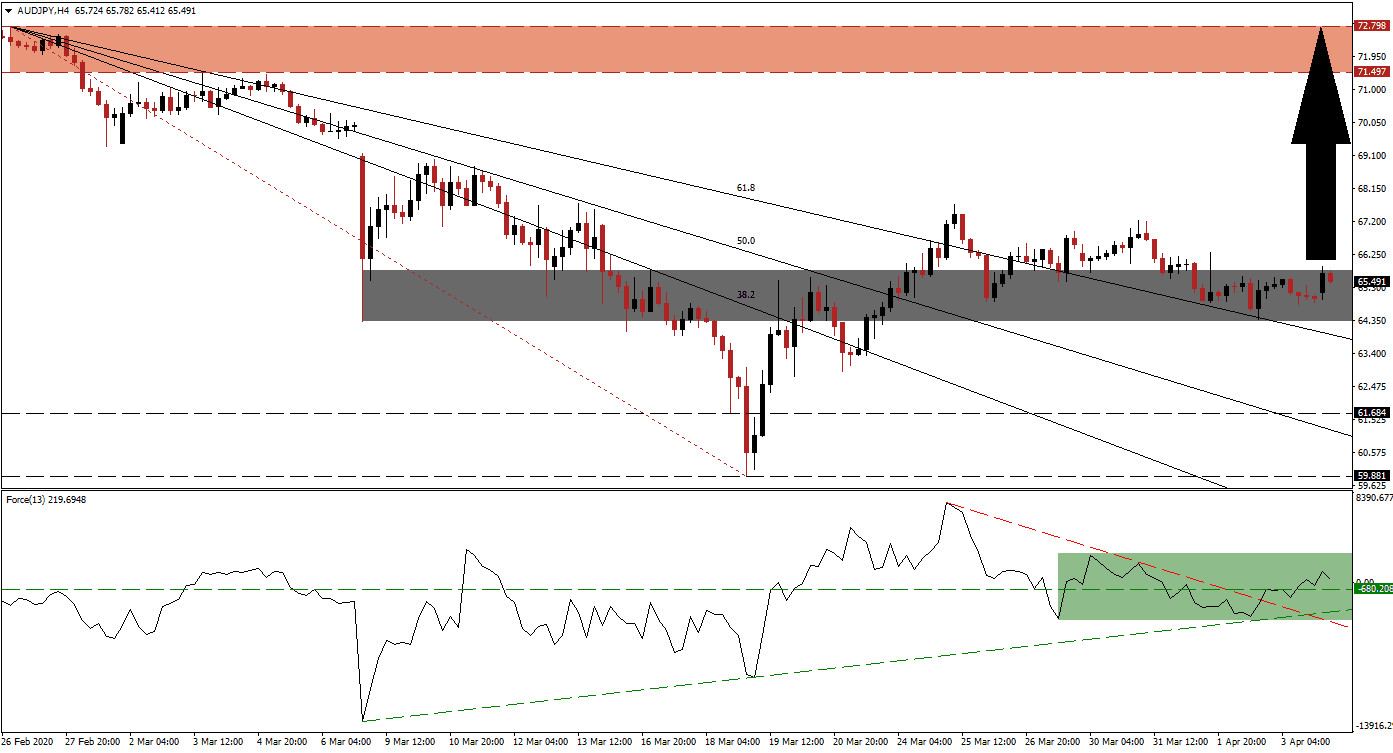

The Force Index, a next-generation technical indicator, points towards the gradual increase in upside pressure. A series of three higher lows allowed for the emergence of an ascending support level, as marked by the green rectangle. It pushed the Force Index above its descending resistance level and then converted its horizontal resistance level into support. Bulls have taken control of the AUD/JPY following this technical indicator’s advance into positive territory. You can learn more about the Force Index here.

Adding to bullish momentum was the breakout in this currency pair above its descending 61.8 Fibonacci Retracement Fan Resistance Level, turning it into support. It confirmed the conversion of its short-term resistance zone into support, located between 64.329 and 65.808, as identified by the grey rectangle. With Australia adopting an economic hibernation strategy, Japan so far was able to avoid a lockdown. Prime Minister Abe has cautioned that it may be forced to take measures if the virus continues to spread. News of a worsening situation in the already fragile Japanese economy is likely to spike the AUD/JPY higher.

Forex traders are recommended to monitor the intra-day high of 67.241, the peak of the previous breakout, which resulted in a lower high before reversing. A sustained push higher is anticipated to initiate the next wave of net buy orders. It will provide the catalyst for the AUD/JPY to accelerate into its resistance zone located between 71.497 and 72.798, as marked by the red rectangle. Volatility is expected to remain elevated and data-dependent. You can learn more about a resistance zone here.

AUD/JPY Technical Trading Set-Up - Breakout Scenario

Long Entry @ 65.500

Take Profit @ 72.750

Stop Loss @ 63.250

Upside Potential: 725 pips

Downside Risk: 225 pips

Risk/Reward Ratio: 3.22

In case of a breakdown in the Force Index below its descending resistance level, acting as temporary support, the AUD/JPY will be pressured to the downside. The downside potential appears limited to its long-term support zone located between 59.881 and 61.684. Any sell-off from current levels will provide Forex traders with an excellent buying opportunity on the back of an increasingly bullish outlook for this currency pair.

AUD/JPY Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 62.750

Take Profit @ 60.750

Stop Loss @ 63.500

Downside Potential: 200 pips

Upside Risk: 75 pips

Risk/Reward Ratio: 2.67