Australian inflation data for the first quarter showed an increase while the Reserve Bank of Australia (RBA) slashed interest rates to an all-time low of 0.25% in response to the global Covid-19 pandemic. With the economy in a deep recession, inflation data will be closely monitored, as it may force central bank action if it continues to increase. A stagflationary environment, where economic output remains stagnant and inflation elevated, cannot be ruled out across developed economies. The AUD/CHF drifted to the top range of its resistance zone, but bullish momentum is weak, making this currency pair vulnerable to a profit-taking sell-off.

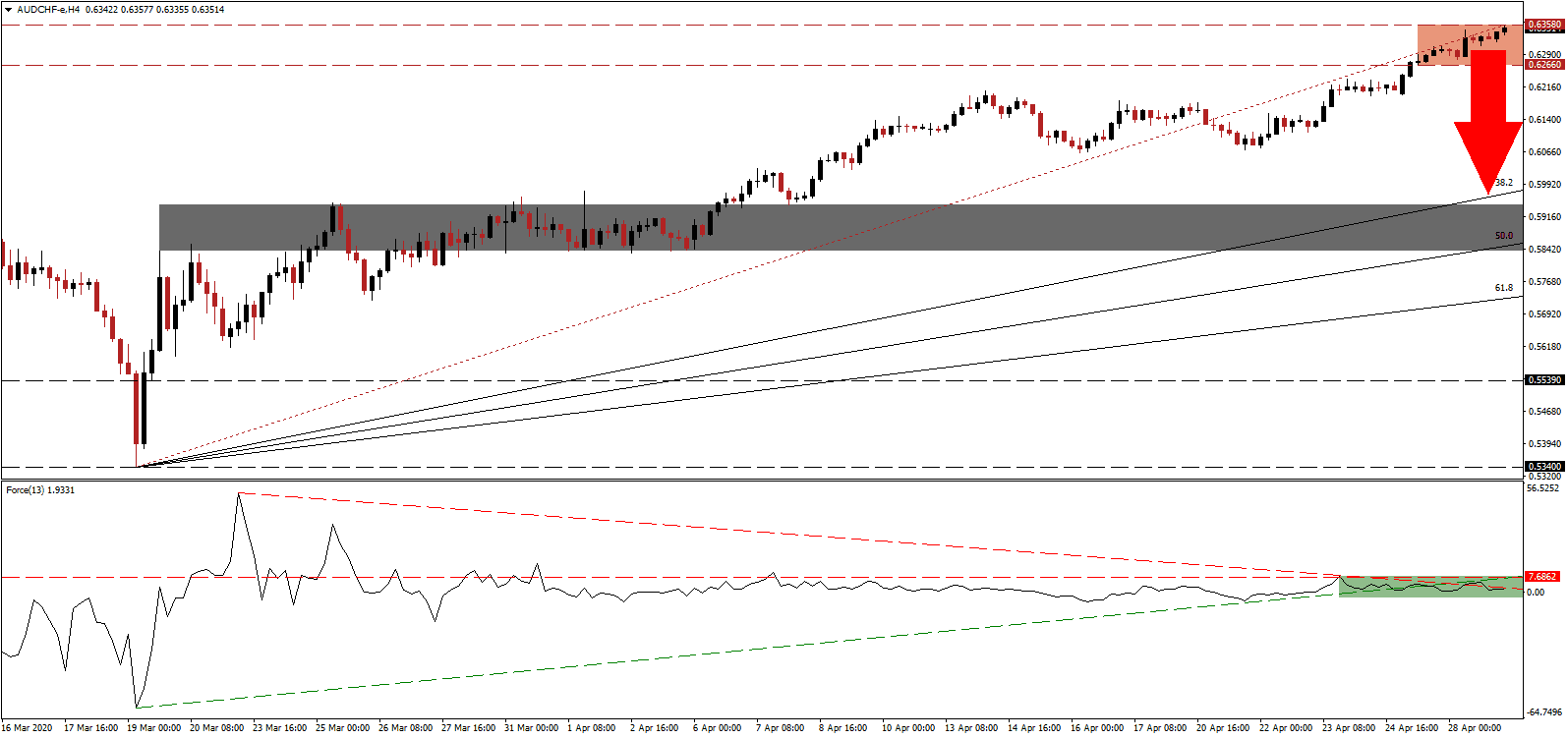

The Force Index, a next-generation technical indicator, presents an initial bearish signal with the emergence of a negative divergence. Price action advanced while the Force Index recorded a lower high, as marked by the green rectangle. The breakdown below its ascending support level increased breakdown pressures. With this technical indicator below its horizontal resistance level, the descending resistance level is expected to pressure it below the 0 center-line, ceding control of the AUD/CHF to bears.

Over 100 researchers from the Group of Eight universities in Australia conducted the most comprehensive analysis for a post-Covid-19 economic recovery plan. Two ideas dominated with one calling for an extension of the nationwide lockdown until the end of June, which is anticipated to deliver more robust growth and rise in consumer confidence. The other plan calls for a gradual easing of restrictions with slower economic growth. Border controls and travel restrictions will remain in place for at least six months. Adding to short-term bearish pressures on the AUD/CHF is the likelihood of a premature lifting of lockdown measures, positioning this currency pair the collapse below its resistance zone located between 0.6266 and 0.6358, as marked by the red rectangle.

A breakdown is favored to close the gap between the AUD/CHF and its ascending 38.2 Fibonacci Retracement Fan Support Level. It is located just above its short-term support zone located between 0.5838 and 0.5944, as identified by the red rectangle. The Swiss National Bank, known for its market manipulation to weaken the Swiss Franc, lost $39 billion in the first quarter due to market volatility. It is unlikely to deter it from meddling in the Forex market but is likely to keep it sidelined temporarily as its currency depreciated from 2020 highs. You can learn more about a breakdown here.

AUD/CHF Technical Trading Set-Up - Profit-Taking Scenario

- Short Entry @ 0.6355

- Take Profit @ 0.6000

- Stop Loss @ 0.6455

- Downside Potential: 355 pips

- Upside Risk: 100 pips

- Risk/Reward Ratio: 3.55

In case the Force Index spikes above its ascending support level, the AUD/CHF could be pressured into a breakout. The next resistance zone is located between 0.6577 and 0.6613, offering Forex traders a second short-selling opportunity. Financial markets are not priced for extended lockdowns or a second infection wave. Germany witnessed a rise in infections after easing restrictions, and economic activity remained depressed, a pattern favored to repeat itself across developed economies. It adds a bearish catalyst to price action on the back of the safe-haven status of the Swiss Franc.

AUD/CHF Technical Trading Set-Up - Breakout Scenario

- Long Entry @ 0.6490

- Take Profit @ 0.6600

- Stop Loss @ 0.6440

- Upside Potential: 110 pips

- Downside Risk: 50 pips

- Risk/Reward Ratio: 2.20