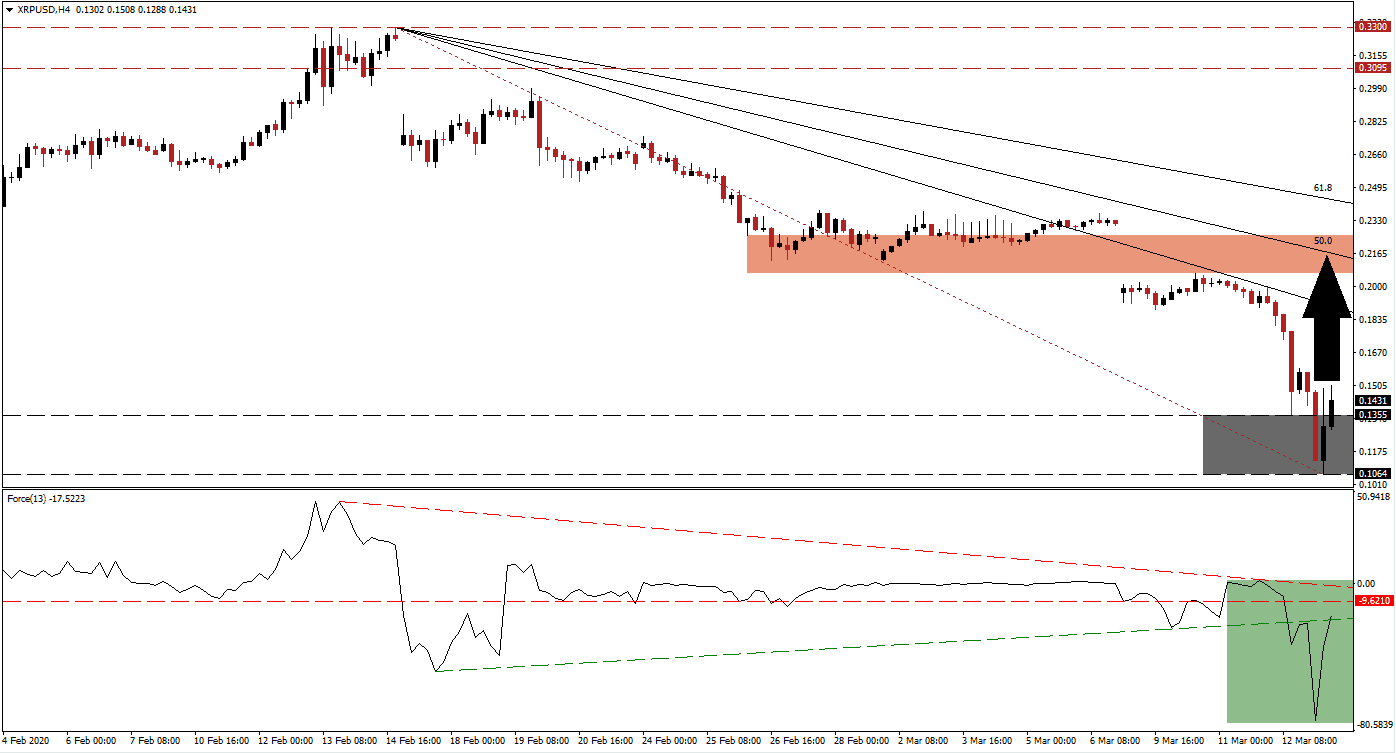

Since the Crypto Winter of 2018, a significant inflow of institutional capital inflamed a strong rally. As the Covid-19 pandemic and collapse in oil prices ignited a bear market in many global equity markets, portfolio managers were unprepared for its magnitude. It resulted in margin calls and forced selling in secondary assets like the cryptocurrency market. Bitcoin dropped over 60% from its 2020 peak, and the XRP/USD tumbled almost 70%, before selling pressure eased inside of its support zone dating back to March 2017.

The Force Index, a next-generation technical indicator, plunged to a new 2020 low and confirmed the massive price collapse in this digital asset. It has now spiked higher and reclaimed its ascending support level, as marked by the green rectangle. The Force Index is expected to push through its horizontal resistance level, converting it into support, before challenging its descending resistance level. A crossover in this technical indicator above the 0 center-line will place bulls in charge of the XRP/USD. You can learn more about the Force Index here.

Following the breakout in price action above its support zone located between 0.1064 and 0.1355, as marked by the grey rectangle, the downside potential remains limited. A short-covering rally is pending, favored to close the gap to its descending 38.2 Fibonacci Retracement Fan Resistance Level. XRP/USD fundamentals continue to support long-term gains in this digital asset. Despite the sell-off, Ripple remains the third most valuable digital asset behind Bitcoin and Ethereum. You can learn more about a short-covering rally here.

Unlike cryptocurrencies, Ripple is a centralized digital asset controlled by the Ripple Foundation, with XRP the primary token. Speculation about potential interference by CEO Brad Garlinghouse flared up, especially since an IPO was noted. The current breakout is likely to pressure the XRP/USD into its short-term resistance zone located between 0.2067 and 0.2256, as marked by the red rectangle. It includes a previous price gap to the downside and is enforced by its 50.0 Fibonacci Retracement Fan Resistance Level.

XRP/USD Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 0.1425

Take Profit @ 0.2100

Stop Loss @ 0.1200

Upside Potential: 675 pips

Downside Risk: 225 pips

Risk/Reward Ratio: 3.00

In the event of a renewed collapse in the Force Index, inspired by its descending resistance level, the XRP/USD will face more downside pressure. The long-term outlook remains bullish, and traders should cautiously take advantage of an extension of this sell-off with new buy orders. The next support zone is located between 0.0923 and 0.1091, with the 0.1000 level representing a significant level to monitor.

XRP/USD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 0.1125

Take Profit @ 0.0975

Stop Loss @ 0.1200

Downside Potential: 150 pips

Upside Risk: 75 pips

Risk/Reward Ratio: 2.00