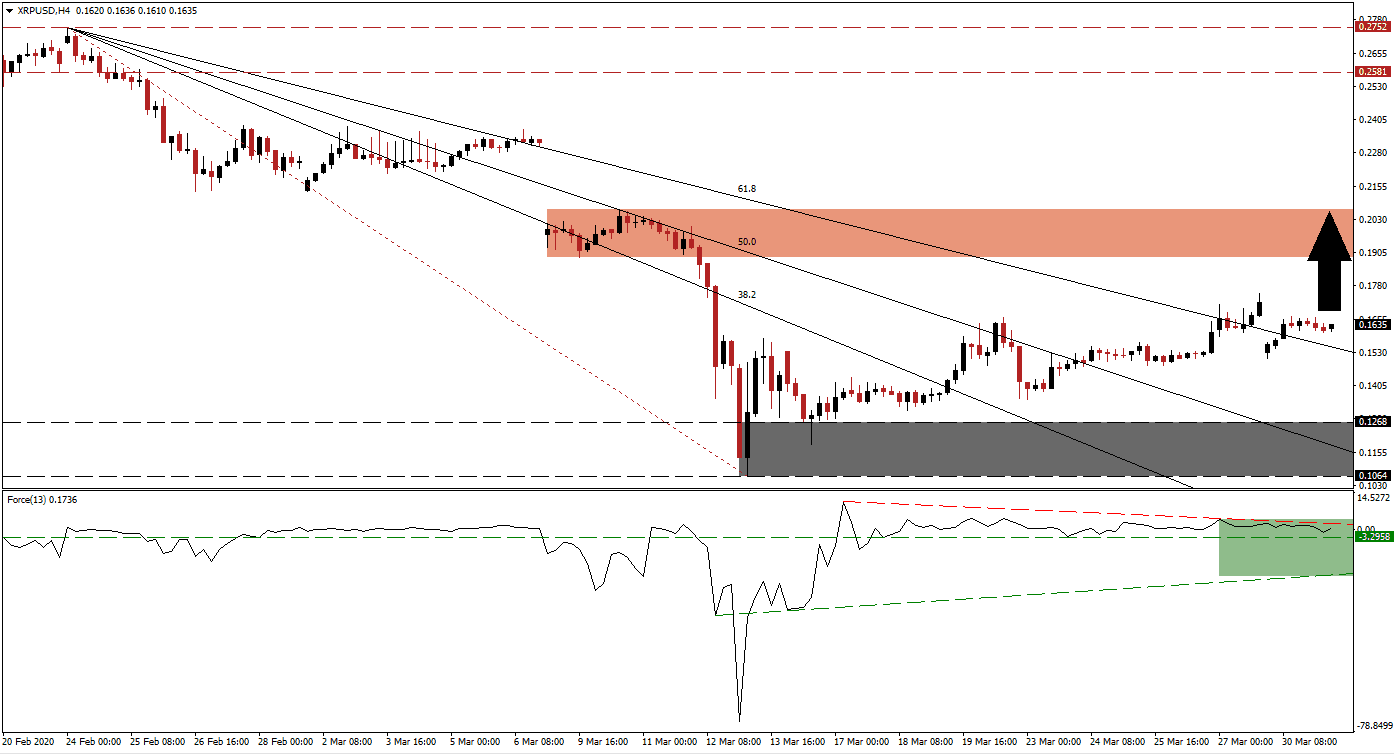

After the first wave of selling pressure collapsed the cryptocurrency sector to multi-year lows, price action recovered amid a period of relative calm. Margin calls forced selling across the board with portfolio managers closing non-essential positions to raise capital. A potential second wave of selling cannot be ruled out, but it may be less severe in the cryptocurrency market due to already depressed levels. The XRP/USD has completed a breakout above its support zone, and its entire Fibonacci Retracement Fan sequence.

The Force Index, a next-generation technical indicator, reversed from a multi-year low, reclaiming its ascending support level. Bullish momentum sufficed to convert its horizontal resistance level into support, as marked by the green rectangle. While its descending resistance level is limiting the upside, bulls remain in control of the XRP/USD with this technical indicator above the 0 center-line. You can learn more about the Force Index here.

Ripple continues to expand partnerships with banks and other traditional financial institutions, providing a distinct bullish fundamental catalyst. Unlike most assets part of the cryptocurrency sector, the XRP/USD resembles a centralized digital token, controlled by the Ripple Foundation. The breakout sequence originating from the support zone located between 0.1064 and 0.1268, as marked by the grey rectangle, has broken the preceding downtrend. A series of higher highs and higher lows created a short-term bullish chart pattern expected to lead to more gains.

Price action may dip into its descending 61.8 Fibonacci Retracement Fan Support Level before accelerating into its short-term resistance zone located between 0.1887 and 0.2067, as identified by the red rectangle. The range includes the bottom of a preceding price gap to the downside. Long-term fundamentals suggest more upside is possible in the XRP/USD, including a next-generation trading platform. Short-term risks remain to the downside due to economic lockdowns across many countries in response to Covid-19. You can learn more about a price gap here.

XRP/USD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 0.1635

Take Profit @ 0.2035

Stop Loss @ 0.1510

Upside Potential: 400 pips

Downside Risk: 125 pips

Risk/Reward Ratio: 3.20

In case the Force Index collapses below its ascending support level, the XRP/USD is likely to challenge its support zone once again. Traders are advised to consider any sell-off as an excellent long-term buying opportunity. This digital asset is well-positioned to appreciate as the global economy continues to evolve into a digital space. Ripple offers traditional finance a bridge into the digital world and is open to regulation. It disqualifies it from the accepted cryptocurrency approach while boosting long-term institutional demand.

XRP/USD Technical Trading Set-Up - Limited Reversal Scenario

Short Entry @ 0.1350

Take Profit @ 0.1100

Stop Loss @ 0.1470

Downside Potential: 250 pips

Upside Risk: 120 pips

Risk/Reward Ratio: 2.08