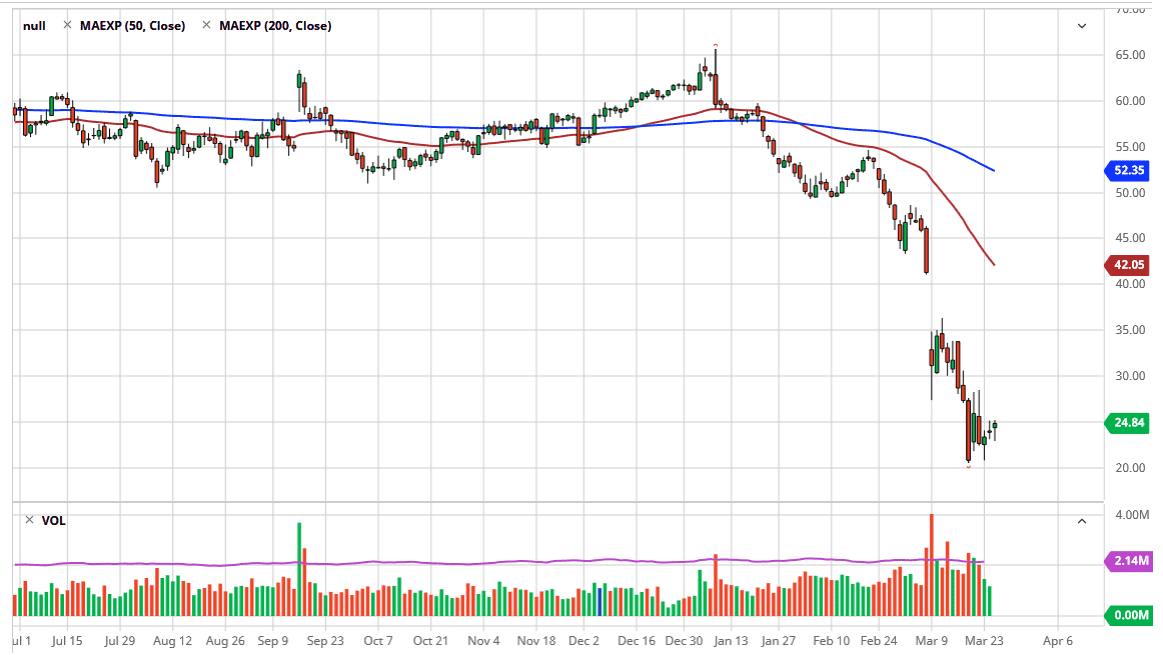

The West Texas Intermediate Crude Oil market initially fell during the trading session on Wednesday but turned around as inventory numbers were a bit better than anticipated. At this point in time though, we are still very much in a negative trend so it would make quite a bit of sense to see rallies sold into. The candlestick for the trading session does form a bit of a hammer, but I think at this point we are simply looking at an oversold condition more than anything else.

If the market were to break above the $25.00 level, then it will go looking towards the next resistance barrier near the $27.50 level. That’s an area where we have seen selling previously, and then of course I think there is plenty of selling near the $30.00 level as well. Ultimately, it’s only a matter of time before we can fade this rally and show signs of exhaustion. At this point, there is hope that the US Congress passing stimulus in such a large size should drive up asset prices, but quite frankly that’s going to do very little for demand in the short term. After all, the coronavirus infection is going to still drive down the demand and even if the demand does pick up just a bit, the price war between Saudi Arabia and Russia will continue to be a major problem. Furthermore, the fracking and other forms of oil extraction going on the United States continues to flood the market in general.

In this scenario I don’t have any interest in trying to buy this market, because it is so negative and rightfully so. It’s not until the price war ends that I think we get a serious move to the upside. The gap above could be filled at $42, but it’s going take a lot of good news in one shot to build up the type of momentum. Simply waiting for signs of exhaustion above will more than likely be the best way to play this market. Ultimately, I do believe that the volatility is going to be here for a while, and it’s not going take much to spook the market after a short-term rally. The $20.00 level underneath will be massive support, so if we were to break down below there, the oil markets would be in serious trouble.