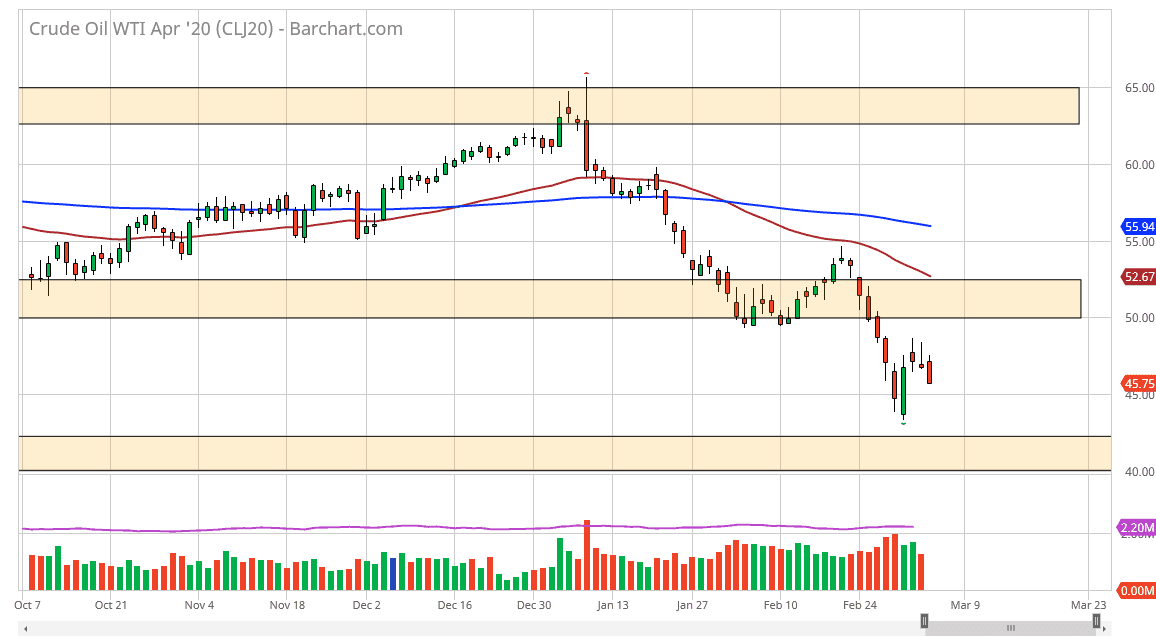

The West Texas Intermediate Crude Oil market initially tried to rally during the trading session on Thursday but gave back the gains to show signs of extreme exhaustion. This is particularly telling, considering that OPEC has promised to cut 1.5 million barrels worth of supply from the market daily. If that’s the case and oil can’t rally in that scenario, it’s almost impossible to imagine a scenario where crude oil suddenly takes out to the upside. I believe that rallies at this point will continue to show exhaustion, especially near the $47.50 level, and then eventually the $50.00 level. Either one of those levels looks like a perfect selling opportunity to be on signs of exhaustion.

That being said though, it should be noted that the candlestick is starting to close towards the bottom of the session and that is a very negative sign indeed. That should continue to attract a lot of sellers on short-term charts, as it shows real conviction of the negativity when it comes to this market.

Hourly chart shows continued break down

The hourly chart looks very likely to continue dropping from here, as the $46.00 level has been broken. The 50 hour EMA is starting to turn lower and it has of course offered a significant amount of resistance on the hourly chart during the previous day or so. Furthermore, the 200 hourly EMA is sitting above the highs, so it does in fact show just how much negativity there is out there and above current pricing.

Looking at this chart, it’s obvious that the market still has further to go, with perhaps an eye on the $44 level. The jobs number comes out on Friday and that of course will have a major influence on what happens in the marketplace, as it could give us an idea as to global demand for crude oil. If the jobs number is very loose, that will more than likely show that the economy in the United States is starting to drop, and it would make the idea of demand for crude oil to be all but impossible. However, if we were to break above the 200 hourly EMA then I think we make a charge towards the $50.00 level where we rolled right back over. It’s hard to imagine a scenario where this market can rally for any significant amount of time as demand has clearly shown that it’s lacking.