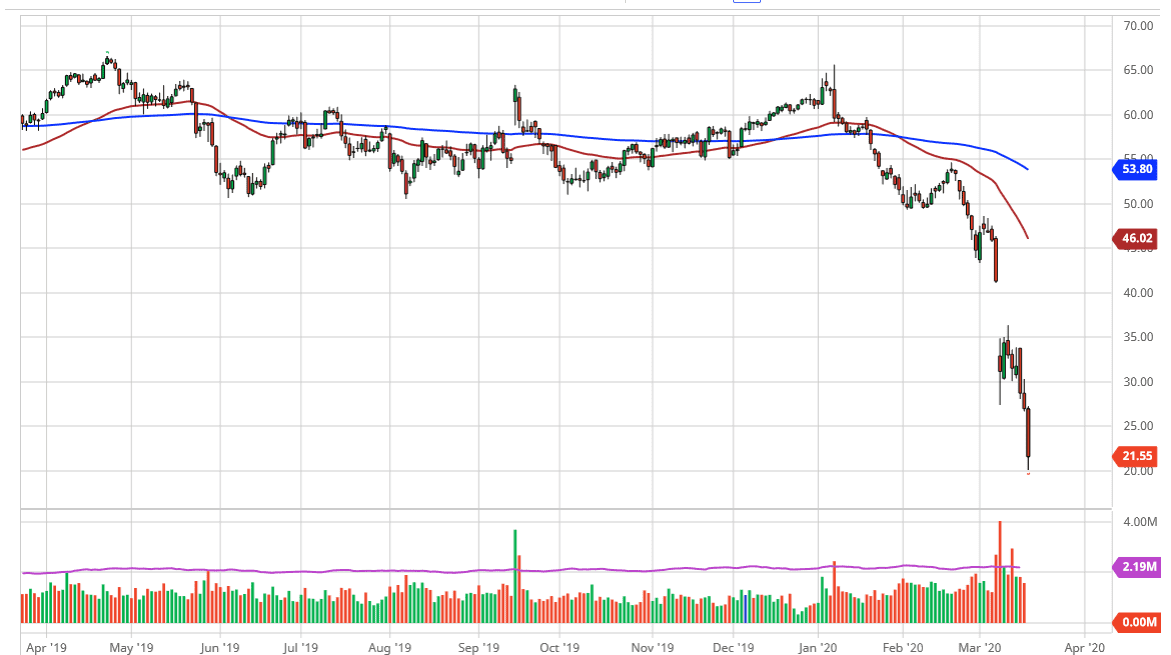

The West Texas Intermediate Crude Oil market has fallen rather precipitously during the trading session on Wednesday to reach all the way down to the $20 level. This is quite remarkable, and as a result it should not be a surprise that we have bounced from there. The market bounce at least $1.50 after that, and it now looks as if we are trying to find some type of stabilizing force in this region. I think that any bounce at this point is probably a nice selling opportunity, especially near the $25 level, possibly even the $27.50 level after that. All things being equal it’s very likely that the market will continue to find plenty of reasons to sell as the market continues to weigh the oversupply of crude oil against the lack of demand.

Looking at the candlestick, it does seem like a bit of a washout, but I think it’s only a matter of time before any relief rally gets pushed against. The $25 level above is going to be crucial from a psychological standpoint, as it is a major figure. Ultimately, if the market was to break above there it could increase the buying pressure, but I can still see plenty of reasons where the market would selloff. Granted, there is a gap above that has yet to be filled, which extends all the way to the $42 level. That is something to think about from a longer-term standpoint, but not anytime soon.

If we can break down below the $20 level, the market will more than likely go looking towards the $17.50 level, possibly even the $15 level. Granted, we are oversold at this point so any bounce will more than likely invite more selling based upon the market be in overextension. All things being equal though, it will be interesting to see how low we can go, and it’s probably going to be based upon the economy and whether or not we can get back to work relatively soon and then of course the whole massive output increase from Saudi Arabia perhaps slows down. That seems to be unlikely so regardless of how quick the economy can bounce back from the coronavirus, there will be a bit of a lid on how far we can go, that may very well end up being the gap above. In the meantime, I like fading those short-term rallies that show signs of exhaustion.