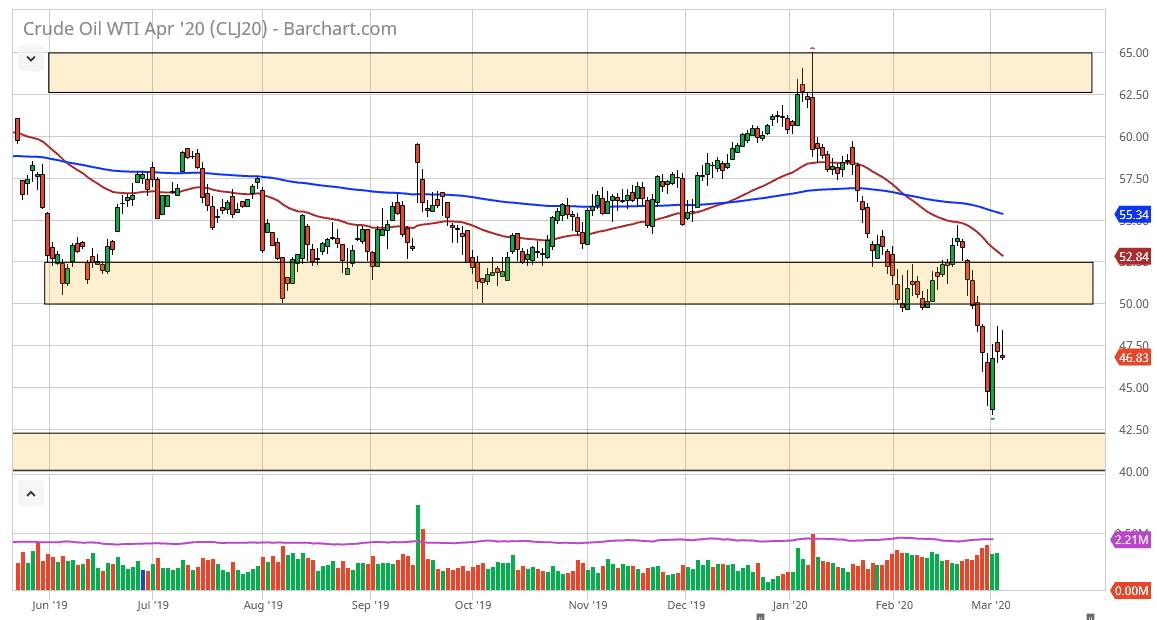

The West Texas Intermediate Crude Oil market has initially tried to rally during the trading session on Wednesday but failed to keep gains above the $47.50 level. There are talks about OPEC perhaps cutting production by 1 million barrels a day, but at this point it isn’t necessarily a supply concern as much as it is a demand concerned, something that is out of the hands of producers to fix. As long as there are a lot of concerns with the coronavirus out there, and of course industrial centers slowing down, there is going to be less in the way of demand when it comes to crude oil.

The daily candlestick ended up forming a nasty looking shooting star, and could even get to my next resistance barrier of $50. I still think that a move towards the $50 level is most certainly a sellable event, but I also recognize we may not be able to get there in the short term. Because of this, I am more than willing to fade rallies as they occur, especially on short-term charts. Be aware the fact that the inventory number will come out but that will be a temporary reprieve at best. It is hard to imagine that oil demand has suddenly spiked.

At this point, the market looks as if it is more than likely going to revisit the lows, perhaps down to the $42.50 level. Beyond that, then the market will more than likely target $40 where I would anticipate a lot of psychological and structural support based upon longer-term charts. I don’t necessarily think that we can get there in short order, but it does seem to be the target. Based upon the previous parish flag, the target was actually $35, but that might be a bit of a stretch at this point.

If the market does break above the highs from the last two candles, then it’s likely that a test of the $50 level will be in store. I believe that there is a significant amount of resistance just above that handle, and I would not hesitate to sell in that area either. OPEC really can’t do much about the lack of demand, so I think any cut they do will be felt in the market, but on a temporary basis at best as their hands are completely tied at this point.